Ah, tax time. That period of the year that has many of us grappling with stacks of tax documents, calculator in hand, and perhaps even consulting a tax preparer for expert advice. For the majority of U.S. taxpayers, the 1040 form serves as the linchpin for filing federal income taxes. But what exactly is this form, and why is it so crucial?

The 1040 form is a comprehensive document that addresses a broad range of tax situations, from calculating tax payments to reconciling Premium Tax Credit Repayments. Whether you're a business owner or an employee, this form is the tool the IRS uses to determine your tax liability for the year. The form can encompass various aspects of your financial life, including Social Security Tax, retirement savings contributions, business credits, and even foreign tax credits.

For those who have more complex tax situations, additional forms and numbered schedules may be needed to report things like self-employment taxes, education credits, or loan interest deductions. If you're residing in special jurisdictions like Puerto Rico, or dealing with unusual situations like filing for a deceased person, additional forms and documentation may also be necessary.

- What is a 1040 Form?

- Types of 1040 Forms

- What Information is Required on the 1040?

- A Tool to Help You With Tax Filing

What is a 1040 Form?

The 1040 form is a key document for individual taxpayers in the United States when it comes to filing their annual income tax returns. This form is used to report various types of income, deductions, and credits that impact an individual's tax liability.

It is important for taxpayers to understand the purpose of the 1040 form and how it affects their tax situation. The form is named after its number in the Internal Revenue Service (IRS) tax code and is also known as the U.S. Individual Income Tax Return form. Whether you are an employee, self-employed individual, or have other sources of income, the 1040 form provides the IRS with a comprehensive snapshot of your financial situation for the year.

It is important to accurately complete the 1040 form to ensure compliance with tax laws and to maximize potential deductions and credits that can help reduce your tax liability or even result in a tax refund. Understanding the different sections and schedules of the 1040 form is essential to accurately report your income and claim any eligible deductions and credits.

You can also check our guide on How to Fill Out a 1040 Form.

Who Must File a 1040 Form?

The 1040 form is an annual income tax return form that must be filed by individuals who meet specific requirements set by the Internal Revenue Service (IRS). There are three general conditions that determine if someone needs to file a 1040 form: meeting specific income levels, being claimed as a dependent, or being in certain tax situations.

When it comes to income levels, the thresholds vary depending on filing status and age. For example, single individuals under the age of 65 must file a 1040 form if their income is at least $12,550, while those who are 65 or older must file if their income is at least $14,250. Married individuals filing jointly have a higher threshold of $25,100 for those under 65, and $27,400 for those 65 or older.

In addition to meeting income levels, individuals may need to file a 1040 form if they are claimed as a dependent on someone else's tax return, regardless of their income. Furthermore, certain tax situations such as owing additional special taxes or receiving distributions from a health account may require the filing of a 1040 form.

It is essential to determine whether or not you are required to file a 1040 form based on your income levels, dependent status, and specific tax situations. Failing to file when required may result in penalties and missed opportunities for tax credits and deductions.

Types of 1040 Forms

When it comes to filing taxes, there are several types of 1040 forms that individuals may need to use, depending on their specific tax situation. The standard 1040 form is known as the "U.S. Individual Income Tax Return" and is used by most taxpayers to report their annual income and claim various deductions and credits. However, there are also additional 1040 forms that may be required for certain circumstances.

For individuals who have self-employment income or own a small business, the 1040 Schedule C form is used to report business income and expenses. This form allows business owners to calculate their net profit or loss and report it on their individual tax return.

If you have income from rental properties or receive royalties, you may need to file a 1040 Schedule E form. This form is used to report income and expenses related to rental real estate, partnerships, S corporations, estates, and trusts.

Another common form is the 1040 Schedule D, which is used to report capital gains and losses from the sale of investments, such as stocks or real estate. This form is important for individuals who have received income from investments throughout the year.

Additionally, there are other numbered schedules that may be required depending on specific tax situations. Some examples include Schedule A for itemized deductions, Schedule B for reporting interest and dividend income, Schedule SE for self-employment taxes, and Schedule H for household employment taxes.

When filing taxes, it's important to understand which form(s) you need to use based on your unique circumstances. Utilizing the correct form ensures accuracy in reporting your income, deductions, and credits, leading to a more smooth and efficient tax filing process.

Form 1040

IRS Form 1040 is an essential document used by individuals to report their annual income and calculate their tax liability. The purpose of this form is to provide a comprehensive overview of an individual's financial situation for the given tax year.

When filling out Form 1040, individuals are required to report their gross income, which includes income from various sources such as wages, salaries, dividends, and interest. They must also account for any adjustments to income, such as educator expenses or contributions to retirement savings accounts.

To reduce their taxable income, taxpayers can claim deductions, either by taking the standard deduction or by itemizing their deductions on Schedule A. Some common deductions include mortgage interest, medical expenses, and state and local taxes paid.

In addition to deductions, individuals can also claim tax credits on Form 1040. Tax credits directly reduce the amount of tax owed. Examples of tax credits include the Child Tax Credit or the Earned Income Tax Credit.

Depending on their specific tax situation, individuals may need to attach additional schedules to Form 1040. These schedules provide more detailed information about specific types of income or deductions. For example, self-employed individuals would attach Schedule C to report their business income and expenses, while those who have capital gains or losses from investments would attach Schedule D.

Form 1040 serves as a comprehensive tax return that allows individuals to report their gross income, claim deductions, and calculate their tax liability accurately. It serves as a crucial document in the tax-filing process and ensures individuals fulfill their legal obligations to the IRS.

Decoding Tax Essentials: IRS Form 1040

Navigate the intricacies of income reporting with our comprehensive guide.

Form 1040-SR (for Seniors)

Form 1040-SR is a specialized version of Form 1040 that is designed specifically for individuals aged 65 and older. This form was introduced to make the process of filing taxes easier for seniors by providing a simple and more user-friendly format.

One of the cosmetic differences between Form 1040-SR and the regular Form 1040 is the color scheme. Form 1040-SR is printed in larger, bolder font and features a more prominent color scheme that is easier to read for individuals with visual impairments or those who prefer a clearer layout.

Additionally, Form 1040-SR includes an embedded standard deduction table on the form itself. This table displays the standard deduction amount for seniors, which is often a significant deduction for this age group. The inclusion of this table eliminates the need for seniors to reference separate publications or tables to determine their standard deduction.

Overall, Form 1040-SR offers seniors a simplified and more accessible way to file their taxes. With its larger font, distinct color scheme, and embedded standard deduction table, this form ensures that seniors can easily navigate their tax obligations and take advantage of the deductions and credits they are entitled to.

Form 1040-EZ (for Simple Returns)

Form 1040-EZ is a simplified version of the regular Form 1040 and is specifically designed for individuals with simple tax returns. This form is intended for those who have no dependents, no deductions, no credits, or any other complications in their tax situation.

The purpose of Form 1040-EZ is to provide a straightforward and easy-to-understand way to file taxes for individuals with straightforward financial circumstances. It is often used by single taxpayers or married couples filing jointly who have no dependents and have simple sources of income, such as wages, salaries, tips, and unemployment compensation.

Using Form 1040-EZ can significantly simplify the tax-filing process, as it eliminates the need to deal with more complex forms and calculations. This form is ideal for individuals whose taxable income is below a certain threshold and who do not have significant income from investments or business activities.

By using Form 1040-EZ, individuals can avoid the complexities of itemized deductions, additional forms, and various tax credits. It streamlines the process and makes it quicker and easier to file annual income tax returns.

In conclusion, Form 1040-EZ is a simplified tax form designed for individuals with simple returns, no dependents, no deductions, and no credits. It provides a straightforward way to file taxes for those who meet the criteria and have uncomplicated financial situations.

Form 1040-NR (for Nonresident Aliens)

Form 1040-NR is specifically designed for nonresident aliens who need to file their annual income tax return in the United States. Nonresident aliens are individuals who do not meet the criteria for being considered U.S. residents for tax purposes.

The purpose of Form 1040-NR is to report income earned from U.S. sources, including wages, salaries, tips, and investment income. It is also used to calculate any additional taxes owed or claim any applicable tax credits or deductions.

To be eligible to use Form 1040-NR, individuals must be nonresident aliens with U.S. income that is subject to taxation. This form cannot be used by U.S. citizens, resident aliens, or individuals who are claimed as dependents on someone else's tax return.

Filing requirements for Form 1040-NR vary depending on an individual's income and tax situation. In general, nonresident aliens must file Form 1040-NR if their income from U.S. sources exceeds a certain threshold. However, there are some exceptions and special rules that may apply.

Additionally, nonresident aliens may need to attach additional forms or schedules to their Form 1040-NR. These could include forms for claiming certain tax credits or deductions, such as the foreign tax credit or the standard deduction for nonresident aliens.

Overall, Form 1040-NR serves as a comprehensive tool for nonresident aliens to accurately report their U.S. income and fulfill their tax obligations in the United States.

What Information is Required on the 1040?

When filling out the 1040 form, there is specific information that is required in order to accurately report your income and calculate your tax liability. This form serves as the main document for individual taxpayers to report their annual income and claim any applicable deductions or credits. Some of the key pieces of information that are required on the 1040 form include your filing status, such as single, married filing jointly, or head of household.

You will also need to provide your social security number and the social security numbers of any dependents you are claiming. In addition, you will need to report your income from various sources, such as wages, self-employment income, and investment income. It is also important to include any adjustments to income, such as deductible expenses or contributions to retirement accounts.

Finally, you will need to calculate your taxable income, which is your total income minus any deductions or exemptions. By providing all of this necessary information, you can accurately complete the 1040 form and ensure that you are meeting your tax obligations.

Personal and Household Information

Form 1040, also known as the U.S. Individual Income Tax Return, is a document that individual taxpayers use to report their annual income and calculate their tax liability. This form requires personal and household information to accurately identify the taxpayer and determine their tax obligation.

On the first page of Form 1040, taxpayers must provide their full name, Social Security number, and current address. This information is essential for the Internal Revenue Service (IRS) to identify and process the tax return. Taxpayers are also required to include details about their dependents, such as their names and Social Security numbers. This helps determine eligibility for certain tax credits and deductions.

In addition to personal and household information, Form 1040 requires taxpayers to report all sources of income. This includes wages, salaries, tips, and self-employment income. Taxpayers must also include income from investments, such as interest, dividends, and capital gains. Additionally, any retirement income, rental income, and unemployment compensation received during the tax year should be reported.

Accurately reporting all sources of income is crucial as it forms the basis for determining a taxpayer's taxable income and calculating their tax liability. Failure to include any income can result in penalties or legal consequences.

In summary, Form 1040 collects personal and household information, including the taxpayer's name, Social Security number, address, and details about their dependents. It also requires the reporting of all sources of income to accurately calculate the taxpayer's tax liability. Properly completing this form is essential for fulfilling tax obligations and avoiding potential penalties.

A Tool to Help You With Tax Filing

Whether you're planning to consult a tax professional or tackle your taxes independently, PDF Reader Pro offers an array of features to streamline your tax filing process. Its robust functionalities allow you to scan physical forms, documents, and images directly into PDF format on both iOS and Android platforms.

You can also merge multiple PDFs into a single, organized document for easier file management. Concerned about security? PDF Reader Pro has you covered. The software enables you to set passwords and permissions, safeguarding your sensitive financial information when shared with an accountant or tax preparer.

Additionally, in preparation for the 2021 tax season, PDF Reader Pro offers a curated collection of commonly used tax forms, complete with detailed descriptions. This makes it simpler for you to view, download, and complete the necessary paperwork. Experience a more efficient and hassle-free tax preparation process by choosing PDF Reader Pro as your go-to tool for the upcoming 2021 tax season.

How to Add Comments to 1040 Form PDF with Windows

Adding comments to a 1040 form PDF is a great way to ensure you've correctly answered every form. Here is how to do so for PDF Reader Pro's Windows version.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Open Your PDF Document

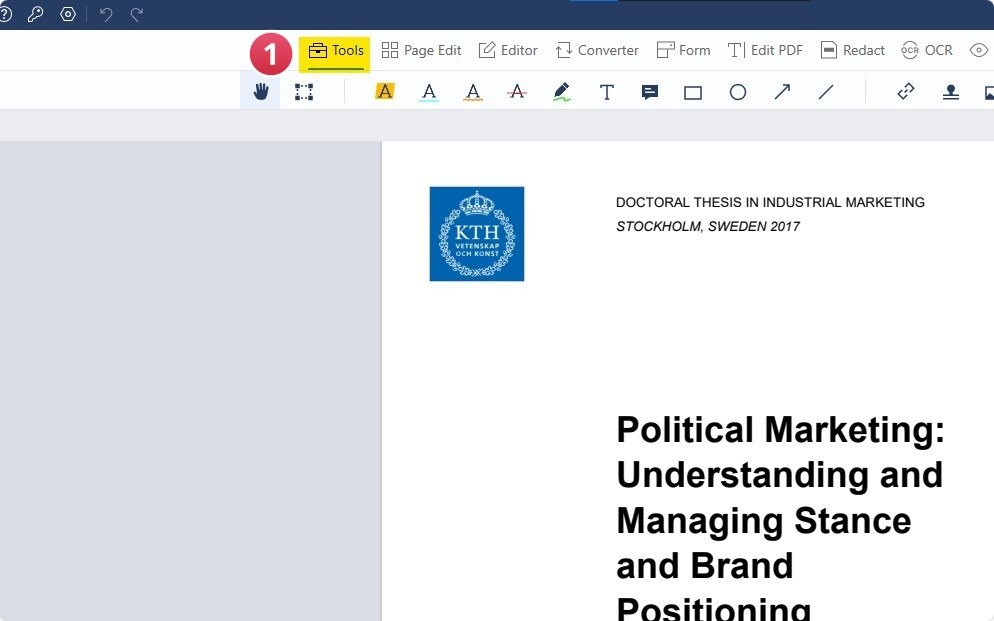

Step 2: Click "Tools" on the Menu Bar

Image Source: PDF Reader Pro

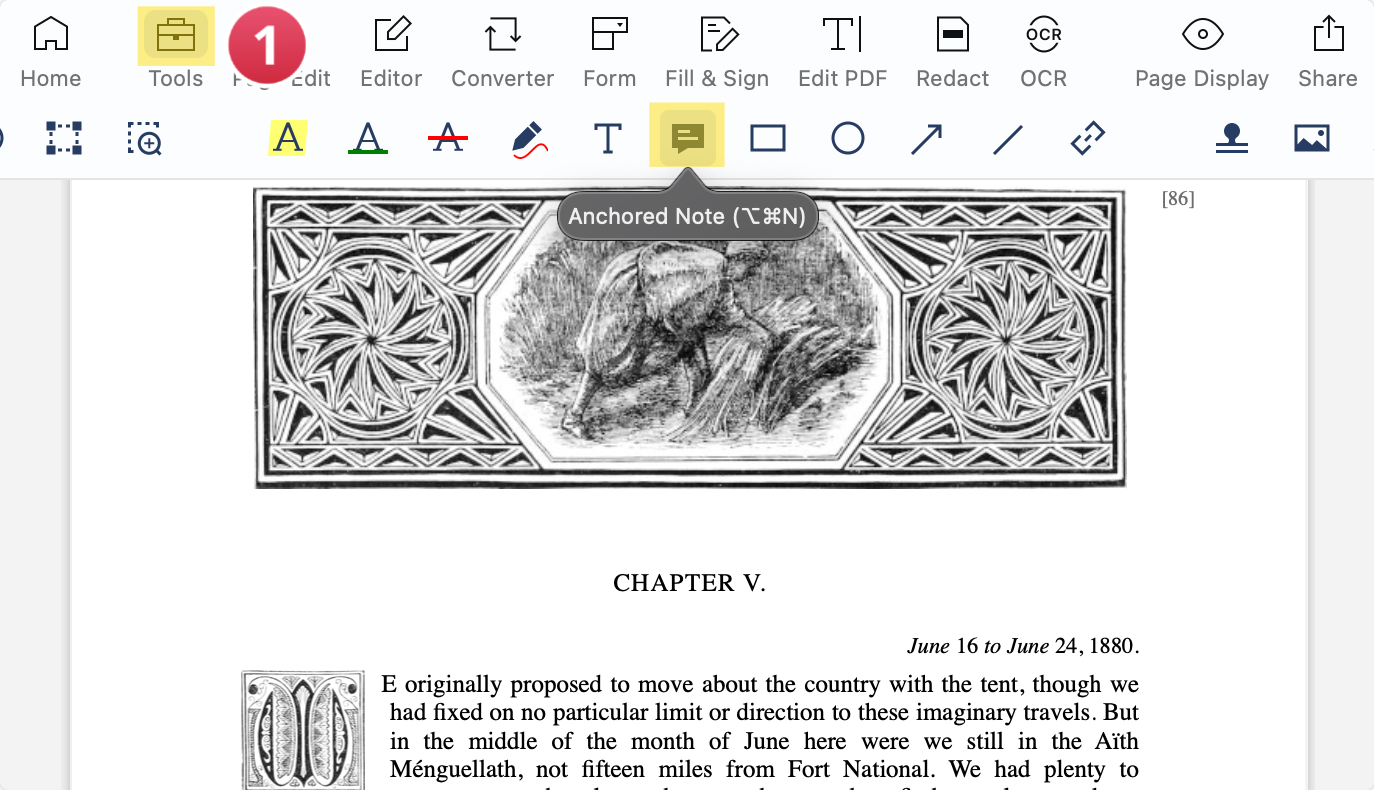

Step 3: Use the Anchored Note Function

Click on the spot where you want to leave your comment. Type the comment in the note section. If you want to bring attention to a specific part, you can also use the highlighter tool to select the text in question.

Image Source: PDF Reader Pro

Step 4: Alter the Colors

Choose the icon and highlight color of your note by clicking "Properties" on the top right hand corner.

Image Source: PDF Reader Pro

How to Add Comments to 1040 Form PDF with Mac

Mac users will also need to ensure they're completing and submitting their 1040 forms to the best of their abilities. Here is our guide for Mac users.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Open Your PDF Document

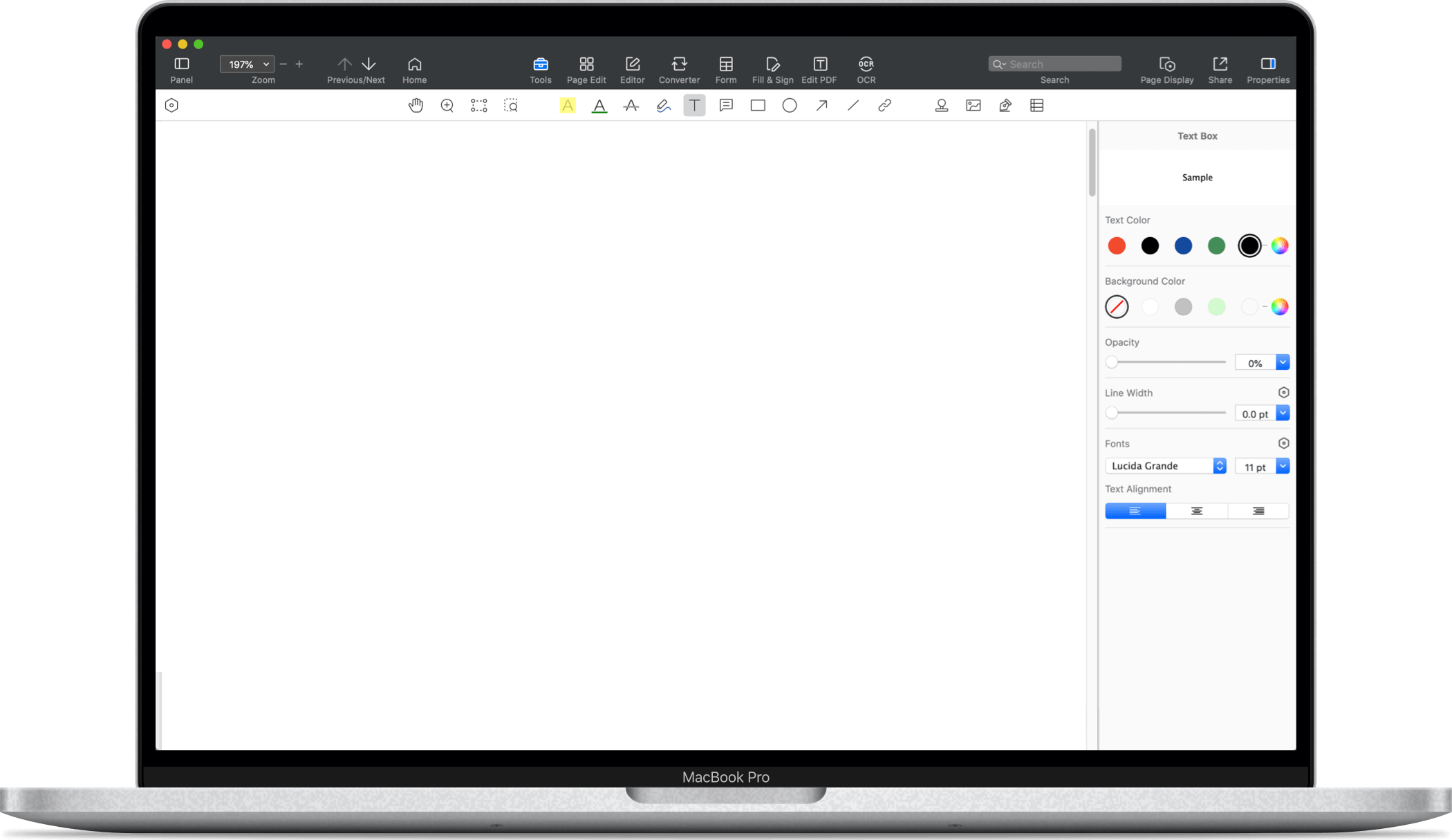

Step 2: Click "Tools" on the Menu Bar

Image Source: PDF Reader Pro

Step 3: Use the Anchored Note Function

Click the sticky note function on the tools menu. Click anywhere on the page to place it and write your comment. Consider highlighting it with the highlighter tool if you want to comment on a particular sentence.

Image Source: PDF Reader Pro

Step 4: Alter the Colors

Change the icon and color by clicking the "Properties" panel in the top right-hand corner.

Image Source: PDF Reader Pro