Understanding U.S. tax laws and forms can often feel like navigating a labyrinth. When it comes to investments and business structures, the Schedule K-1 form is one that often stumps taxpayers. Whether you're an investor in a partnership or a shareholder in an S corporation, a Schedule K-1 may land in your mailbox. But what is it, and what does it mean for your personal income tax return?

- What is Schedule K-1?

- The Role of Pass-Through Entities

- Types of Businesses That Use Schedule K-1s

- Who Receives a Schedule K-1?

- Is Schedule K-1 Income Earned or Unearned?

- How To Password Protect Your Tax Files on Windows

- How To Password Protect Your Tax Files on Mac

- K-1 Federal Tax Form Best Practices

- K-1 Federal Tax Form FAQ

What is Schedule K-1?

A Schedule K-1 is a federal tax document that provides a detailed account of a taxpayer's share of income, losses, tax deductions, and credits from certain types of business entities. Unlike a corporation that pays corporate taxes, businesses like partnerships, S-corporations, and certain trusts and estates are pass-through entities. This means they don't pay taxes at the entity level; instead, their earnings and losses pass directly to the individual partners, shareholders, or beneficiaries.

Business partnerships report financial activity on Form 1065 and attach the individual Schedule K-1s for each partner. Similarly, S-corporations use Form 1120-S and trusts and estates use Form 1041 to file their annual tax returns, incorporating the Schedule K-1 data.

The Role of Pass-Through Entities

The Internal Revenue Service (IRS) allows specific types of business structures to employ a "pass-through" taxation system. This means that tax liability is not shouldered by the business entity itself but passes through to individual owners or participants.

In simple terms, if you're part of a business or investment structure that operates as a pass-through entity, the Schedule K-1 form is your friend—or foe, depending on how well the business did that year.

Types of Businesses That Use Schedule K-1s

-

Partnerships: Both general and limited partners receive Schedule K-1s to report their share of income or losses. The partnership agreement outlines how these shares are divided among partners.

-

S-Corporations: Shareholders in S-Corporations also receive a K-1 form, which shows their percentage of ownership and the corresponding share of income, losses, and other tax items.

-

Trusts and Estates: Beneficiaries of trusts and estates also receive K-1 forms to report income distributions or losses.

-

Limited Liability Companies (LLCs) and Limited Liability Partnerships (LLPs): Though not corporations, these business structures can opt to be treated as partnerships for tax purposes, issuing K-1s to their members.

Components of Schedule K-1 Forms

-

Basis Calculation: One of the critical elements on a K-1 form is the calculation of a partner’s basis or ownership stake in the business entity. The basis increases with profits and capital contributions and decreases with losses and withdrawals.

-

Types of Income: A K-1 form can report several types of income, such as ordinary business income, real estate income, capital gains, and even income from bond interest and stock dividends.

-

Tax Credits: The K-1 form also highlights various tax credits that the shareholder, partner, or beneficiary is entitled to claim.

-

Deductions: The Schedule K-1 may report share of losses and deductions, which can offset other taxable income on an individual’s tax return.

Who Receives a Schedule K-1?

Typically, the following individuals or entities may receive a Schedule K-1:

- Business partners in partnerships or LLCs

- Shareholders of S-corporations

- Beneficiaries of trusts or estates

- Investors in certain specialized financial products like Master Limited Partnerships (MLPs) or certain Exchange-Traded Funds (ETFs)

Is Schedule K-1 Income Earned or Unearned?

The nature of income reported on Schedule K-1 varies. For active business partners and S-corporation shareholders, it's usually considered earned income, subject to self-employment tax. On the flip side, for limited partners, beneficiaries of trusts and estates, and passive investors, the income is generally treated as unearned.

Filing Deadlines and Delays

While Schedule K-1s should technically be sent out by March 15th, they're notorious for arriving late. That's because the entities that issue them often need more time to calculate the exact amounts and distributions. If you're a recipient, keep this in mind while planning your tax filing schedule. You may need to file an extension if your K-1 arrives late.

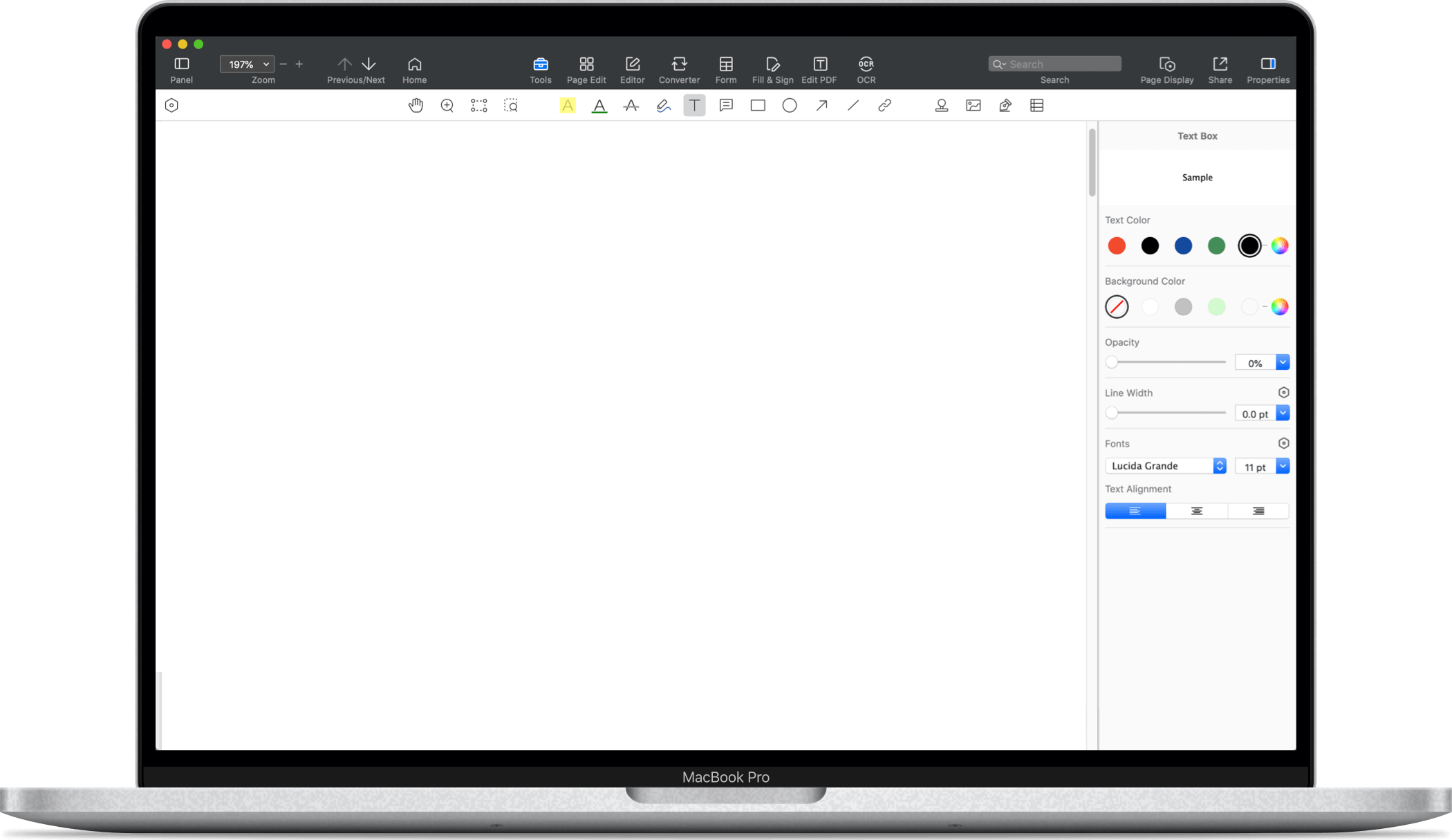

How To Password Protect Your Tax Files on Windows

You can never go wrong by adding password protection to your tax file PDFs. Find out how to do so for Windows.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

1. Open your tax form

Launch PDF Reader Pro and open the tax form PDF you need to secure.

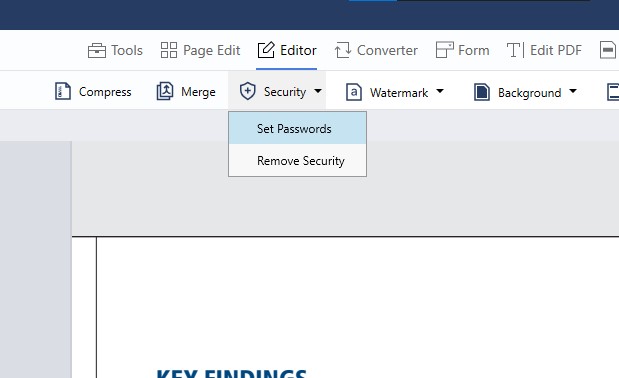

2. Open the Security Tools

Click on the 'Editor' option on the toolbar, then select 'Security' followed by 'Set Password'.

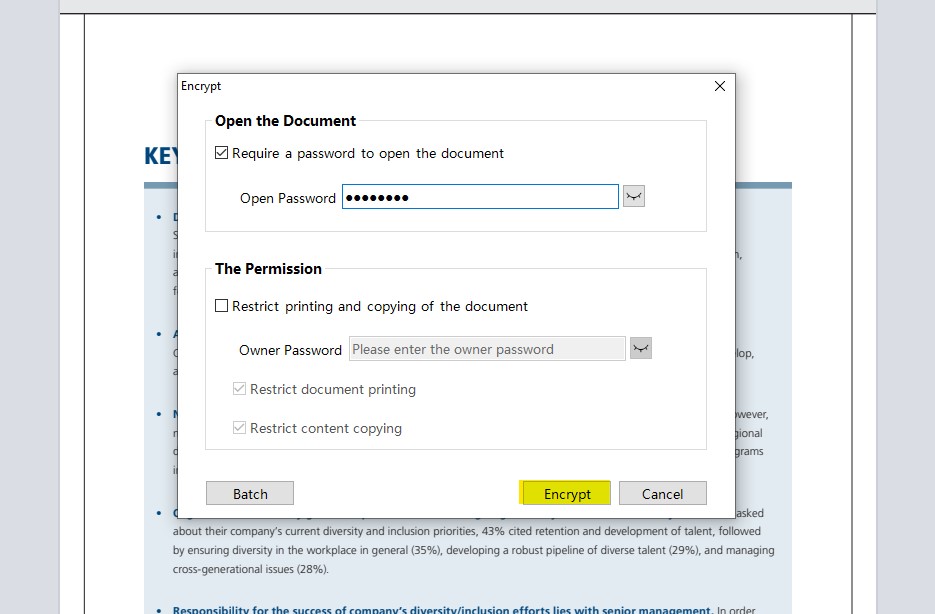

3. Implement File Content Security

Check the "Require a password to open the document" box and input a suitable password.

4. Finalize Password Security

Once you have established your password, click 'Encrypt'.

By following these steps, you limit unauthorized access to your document. Only individuals with the correct password will be able to see what's inside.

Additional Level of Protection

To further safeguard against unauthorized edits or copies:

- Redo the initial two steps mentioned earlier.

- Add an 'Open Password' to your document.

- Limit printing and copying by selecting the "Restrict printing and copying of the document" option and establish a distinct password for it.

- Complete the process by clicking on 'Encrypt'.

This level of security ensures that even if someone gains access to the document's format, they won't be able to modify or duplicate its content without the appropriate password.

How To Password Protect Your Tax Files on Mac

For Mac users, securing tax form PDFs with password protection is essential. Let's go ahead and fully encrypt your tax-related PDF files!

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

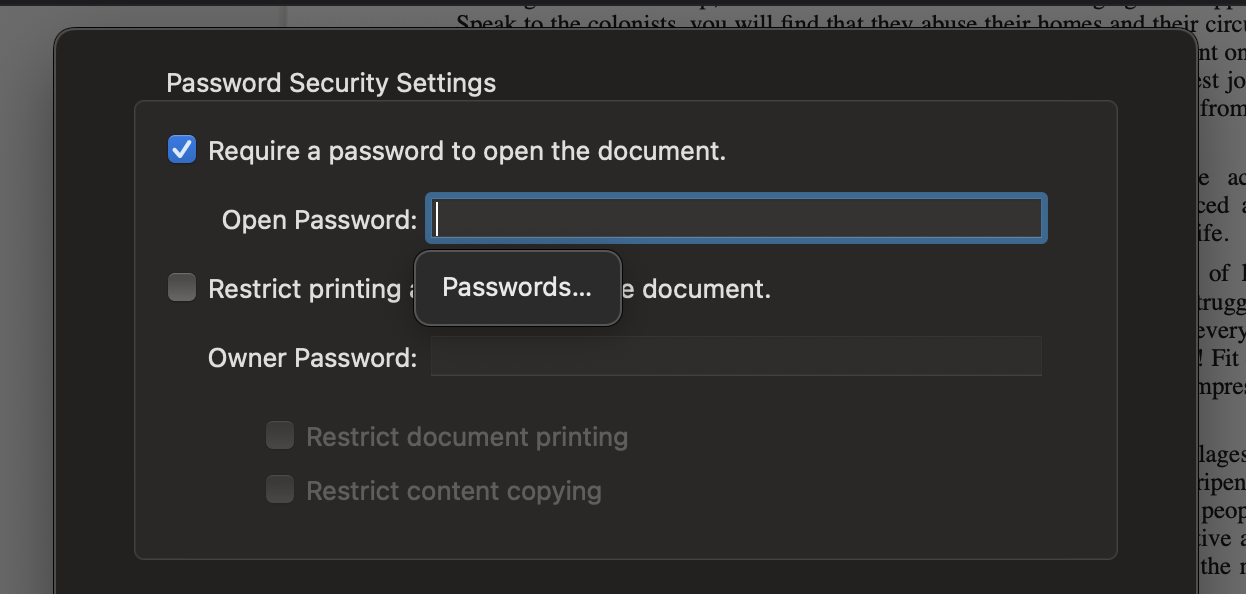

1. Navigate to the "Editor" section and select "Security," then choose the "Set Passwords" option.

2. Apply Security Measures to File Content

3. Select the option that says "Require a password to open the document" and enter a robust password.

4. After ensuring the password is strong, click on "Encrypt."

K-1 Federal Tax Form Best Practices

Handling your K-1 tax form correctly is crucial for complying with Internal Revenue Service (IRS) regulations and accurately reflecting your share of income, losses, and deductions. Below are some best practices for dealing with Schedule K-1s:

-

Check for Accuracy: As soon as you receive your K-1 form, review it meticulously for errors. Ensure that your share of income, capital gains, and tax deductions align with your understanding and the business agreements in place.

-

Don't Confuse It With Sole Proprietorship Income: Schedule K-1 income is not to be confused with the income of a sole proprietorship, which is usually reported on Schedule C. The IRS treats these forms of business income differently.

-

Be Aware of All Sources of Income: Schedule K-1 may list various types of income, such as ordinary income, real estate income, rental income, and capital gains. Understand the nature of each source to correctly report it on your personal income tax return.

-

Include in Your Personal Tax Return: The K-1 form details your share of income, deductions, and credits from business partnerships, trusts, or S-corporations. This information must be included when you file your personal income tax return.

-

Pay Attention to State Taxes: If the entity operates in more than one state, you may be required to file state income taxes based on the information in the K-1.

-

Consider Social Security and Medicare Taxes: Income from partnerships may be subject to Social Security and Medicare taxes. Make sure to consult a tax professional to clarify these obligations.

-

File a Six-Month Extension if Needed: If you don't receive your K-1 form in time or if you find errors that require correction, you might need to file a six-month extension for your individual return.

-

Consult a Tax Professional: Because K-1 forms can be complex, it's often advisable to seek the help of a tax advisor, especially if you have multiple sources of income or complex investments.

K-1 Federal Tax Form FAQ

How is a K-1 different from other tax return forms?

Unlike W-2 or 1099 forms, a K-1 reflects income from business partnerships, S-corporations, and beneficiaries of trusts or estates. It is specific to pass-through taxation entities.

Navigating Employment Eligibility: IRS Form I-9

Ensure compliance with our comprehensive guide.

Do I have to file a Schedule K-1 if I am part of a business partnership?

Yes. Business partners in partnerships, shareholders in S-corporations, and beneficiaries of trusts and estates must report K-1 income on their annual tax returns.

What types of income can be reported on a K-1?

A K-1 can report various types of income, including but not limited to ordinary income, real estate income, rental income, and capital gains.

How does K-1 income affect my personal income tax return?

The income or losses you report from a K-1 form get added to your other sources of income, like wages or investment income, and are reported on your individual return. They affect your overall taxable income and therefore your tax liability.

Can K-1 income be tax-exempt?

Generally, K-1 income is not tax-exempt and must be reported to the IRS. However, some tax deductions may be applicable based on the nature of the income or the specific expenses incurred by the business entity.

What do I do if my K-1 arrives late?

If your K-1 arrives after the filing deadline, you might need to amend your federal income tax return. Alternatively, if you anticipate a delay, you can file a six-month extension for your individual return.

How does K-1 income relate to Social Security and Medicare taxes?

If you are an active member of a partnership, your share of the business income may be subject to Social Security and Medicare taxes. Consult a tax professional for precise guidance.

Can I report K-1 income on a joint tax return?

Yes, if you are married and filing jointly, you can include K-1 income in the joint return. Both partners should be aware of the K-1 income and how it affects your joint taxable income.

By understanding these best practices and frequently asked questions, you'll be better equipped to handle the complexities of Schedule K-1 forms and pass-through taxation, ensuring accurate reporting of your income and deductions.

Understanding the Schedule K-1 form is essential for anyone involved in a pass-through entity or receiving income from such a business structure. Not only does it affect your personal tax liabilities, but it also provides insights into the financial health of the investment or business you are a part of. Always consult with a tax professional when dealing with complex tax documents like Schedule K-1 to ensure accurate filing and compliance with tax laws.