With the year winding down, the time is ripe to gear up for the forthcoming tax season.

As advised by industry specialists, organizing your paperwork early and establishing a comprehensive checklist of the necessary tax forms can significantly streamline the filing process.

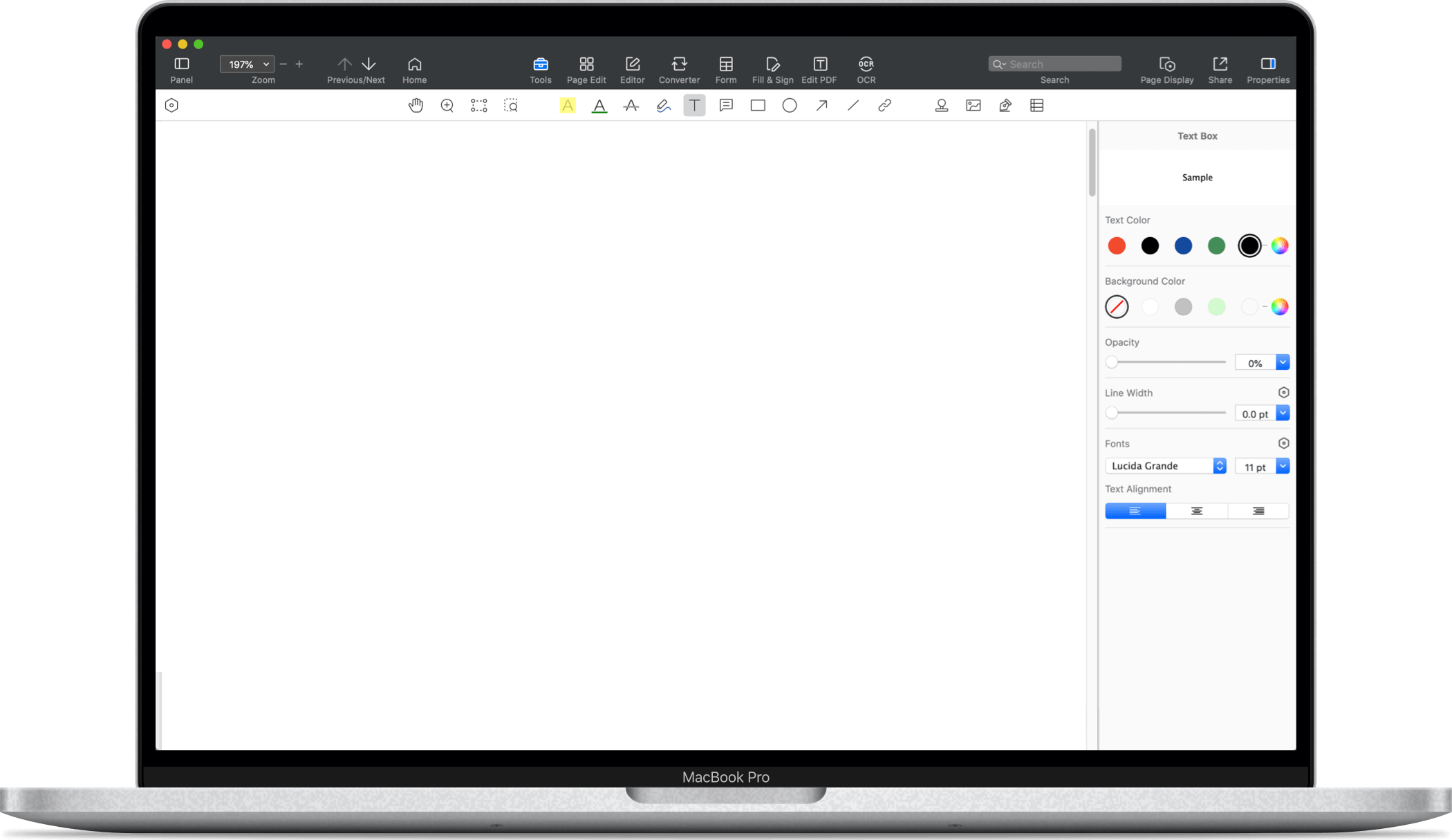

We also provide a selection of vital tax-related PDF templates courtesy of PDF Reader Pro.

- Tax Season 2023: The Most Significant Considerations

- Key Insights from the Financial Arena

- Understanding the 2023 Tax Bracket Adjustments

- Unpacking the Bigger Standard Deduction

- Use an IRS Form W-2 PDF Template

- 2023 Tax Season: Best Practices

- 2023 Tax Season: FAQ

Tax Season 2023: The Most Significant Considerations

When is the 2023 Tax Return Deadline?

- The clock is ticking, and it's crucial to keep an eye on the deadline for filing your 2023 tax return.

- Mark your calendar for Monday, April 15, 2024, as the standard due date.

- However, residents of Maine or Massachusetts get a brief respite, with their deadline extended to April 17, owing to the observance of national holidays on April 15 and 16.

- If you need more time, don't fret; an automatic six-month extension is within reach by filing Form 4868, the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Deciding Between a Tax Preparer and Tax Software

- Navigating the tax seas can be daunting, and whether to hire a professional tax preparer or opt for tax software is a decision that weighs heavily on many.

- While the scales tip slightly towards professional services in the U.S., tax software's user-friendly nature and cost-effectiveness are compelling.

- Your choice should hinge on several factors: the complexity of your tax situation, your comfort with tax matters, and the value of your time.

- Remember, a seasoned tax professional might unlock more savings than the cost of their services.

Understanding the Constant Evolution of Tax Changes

- Why the annual shuffle in tax provisions?

- The IRS routinely adjusts tax rates and income brackets to align with inflation, tweaking more than 60 tax provisions yearly, though not all see changes annually.

- For instance, the Lifetime Learning Credit has stood unchanged since 2020.

The Bottom Line: Staying Informed and Prepared

The IRS's inflation adjustments aim to harmonize federal taxes with the ever-shifting economic landscape:

- With inflation reaching heights unseen in recent decades, understanding these adjustments is more crucial than ever.

- Keep abreast of not just inflation-related shifts but also other tax law changes.

- This proactive approach will not only streamline your tax planning for 2023 but also keep you ahead of the curve for future tax years.

Stay vigilant, stay informed, and navigate the 2023 tax season with confidence and strategic foresight.

Edward Jastrem, a certified financial planner and the chief planning officer at Heritage Financial Services in Westwood, Massachusetts, emphasizes the importance of proactive involvement. "You really need to be your own advocate," he advises.

Key Insights from the Financial Arena

- The IRS recently announced a waiver of over $1 billion in penalties. Understanding eligibility criteria and potential benefits for taxpayers is crucial.

- As the year concludes, implementing strategic investment tax tips from top financial advisors can optimize your fiscal outcomes.

- The housing market anticipates shifts in 2024. Staying informed about expert projections can guide your real estate decisions.

Setting up an effective record-keeping system is pivotal. Not only does it place you in an optimal position to submit a precise tax return, but it also mitigates the risk of processing hiccups or delays in receiving refunds, as highlighted by the IRS.

As you embark on this journey, be mindful of the recent alterations that could impact your tax filing experience. Stay informed, stay prepared, and navigate the 2023 tax season with confidence and clarity.

Understanding the 2023 Tax Bracket Adjustments

For the tax year 2023, a notable shift occurred in the federal income tax brackets, although the rates themselves remained unchanged.

Experts highlight a significant adjustment - an approximate 7% expansion in the brackets.

This change increases the range of taxable income permissible in each bracket, offering a bit more breathing room for taxpayers.

Taxable income is determined by subtracting the greater of your standard or itemized deductions from your adjusted gross income.

This expansion means you may fall into a lower bracket than you would have in the previous year, potentially reducing your tax liability.

Kyle Pomerleau, a senior fellow and esteemed federal tax expert at the American Enterprise Institute, shed light on this development.

"That was a larger increase than usual,” he remarked in a discussion with CNBC. The reason behind this adjustment?

Inflation rates have soared beyond the norm, prompting a corresponding expansion in the tax brackets to mitigate the impact on taxpayers.

Unpacking the Bigger Standard Deduction

Inflation also boosted the standard deduction for 2023, which reduces your taxable income, but makes it harder to claim itemized tax breaks for charitable giving or medical expenses.

For 2023, the standard deduction increased to $27,700 for married couples filing jointly, up from $25,900 in 2022.

Single filers may claim $13,850 for 2023, an increase from $12,950.

Enacted via the Tax Cuts and Jobs Act of 2017, the higher standard deduction is slated to sunset in 2026, along with lower tax rates.

Some filers may have tax planning opportunities in the meantime, such as accelerating income or making Roth individual retirement account conversions, said CFP Nicholas Gertsema, CEO and wealth advisor at Gertsema Wealth Advisors in St. Joseph, Missouri.

Form 1099-K reporting changes are delayed

The IRS in November delayed a 2023 reporting change for business payments made via apps such as PayPal or Venmo.

Prior to the change, even a single payment of $600 would have triggered Form 1099-K, which reports business payments to the IRS.

However, business income is still taxable, warned Tommy Lucas, an Orlando, Florida-based CFP and enrolled agent at Moisand Fitzgerald Tamayo. “If you want to follow the law, you [have] still got to report it, even if a third party is not.”

Use an IRS Form W-2 PDF Template

PDF Reader Pro simplifies the tax filing process by offering a wide range of IRS form templates, including the critical IRS Form W-2 PDF Template.

This template is essential for employers who need to report their employees' annual wages and the amount of taxes withheld from their paychecks.

With PDF Reader Pro's IRS Form W-2 PDF Template, you can effortlessly fill out and manage your W-2 forms.

The template ensures that all necessary information is captured accurately, reducing the risk of errors and ensuring compliance with IRS requirements.

Plus, with the ability to save, print, or share the completed forms directly from the platform, managing your tax documents has never been more efficient.

Explore a Comprehensive Range of Tax-Related PDF Templates

PDF Reader Pro offers a vast selection of tax-related PDF templates, catering to various needs and ensuring that you're well-equipped for the tax season.

Here's a list of available templates:

- IRS Form 941: Employers use this form to report quarterly federal tax returns, covering withheld income taxes, and social security and Medicare taxes.

- IRS Form 1099-C: This form is used by financial institutions to report canceled debts of $600 or more.

- IRS Form 5329: Taxpayers use this form to report additional taxes on IRAs and other qualified retirement plans.

- IRS Form 1099-G: This form is used to report certain government payments, like state tax refunds and unemployment compensation.

- IRS Form W2: Essential for employers to report wages paid and taxes withheld for their employees.

- IRS Form 1040: The standard IRS form for individual tax filers to report their income.

- IRS Tax Form W4: Employees use this form to inform employers how much tax to withhold from their paycheck.

- IRS Form 1099-MISC: Used to report miscellaneous income, such as payments to independent contractors.

PDF Reader Pro's comprehensive library of tax-related PDF templates ensures you have all the resources you need at your fingertips, making tax preparation and filing more manageable and less time-consuming.

2023 Tax Season: Best Practices

As we approach the 2023 tax season, it's crucial to be well-prepared and informed about the best practices that can make the process smoother and potentially more beneficial for you.

Based on insights from multiple sources, here are some essential tips and strategies:

-

Organize Your Documents Early: Gather all necessary tax documents, including W-2 forms, investment income statements, and other relevant financial records. Early preparation can help avoid last-minute rushes and ensure you don't miss any crucial information.

-

Understand Your Filing Status: Your filing status significantly impacts your tax rates and bracket. Ensure you understand the categories you fall into, whether it's single, married filing jointly, or another status, as this determines your standard deduction and eligibility for certain credits.

-

Maximize Deductions and Credits: Be aware of the tax deductions and credits available to you. The standard deduction has increased significantly, which might make it more beneficial than itemizing deductions. Also, consider energy tax credits, education credits, and other deductions specific to your situation.

-

Leverage IRS Free File: For eligible taxpayers, the IRS Free File program offers access to free tax preparation software. This can be a cost-effective way to file your federal tax return, especially if your tax situation is relatively straightforward.

-

Opt for Direct Deposit: If you're expecting a refund, choosing direct deposit is the quickest way to receive your money. It's more secure and faster than waiting for a check in the mail.

-

Be Aware of Tax Brackets and Rates: Though the tax brackets have widened due to inflation adjustments, it's important to know which bracket you fall into. This knowledge can help you make strategic decisions, such as whether to defer income or accelerate deductions.

-

Consider Professional Help: If your tax situation is complex — perhaps you own a business, had significant life changes, or want to itemize deductions — it might be wise to consult a professional tax preparer. They can provide tailored advice and ensure you benefit from all the deductions and credits you're entitled to.

-

Plan for the Tax Deadline: Be mindful of the tax return deadline, which is April 15, 2024, for most taxpayers, and April 17, 2024, for residents of Maine and Massachusetts. If you need more time, remember to file Form 4868 for an automatic six-month extension.

-

Stay Informed About Changes: Tax laws and provisions can change annually. Stay informed about any new changes, such as the adjustments in the tax brackets and standard deductions, and how they might affect your filing.

-

Secure Your Data: Protect your personal and financial information throughout the tax filing process. Use secure networks when filing electronically and be vigilant about tax scams and phishing attempts.

By following these best practices, you can navigate the 2023 tax season more confidently, ensuring compliance, maximizing potential benefits, and minimizing stress.

2023 Tax Season: FAQ

What are the important considerations for individual tax returns in 2023?

For 2023, individual tax returns should focus on updated tax brackets, increased standard deductions, and the potential eligibility for various tax credits. Ensure that all income sources, including unemployment compensation if applicable, are accurately reported. Review the tax documents required for your specific situation, especially if there have been significant life changes.

How can I ensure I receive all eligible income tax credits?

To maximize income tax credits, such as the Additional Child Tax Credit, ensure your tax return is accurate and complete. Understand the eligibility criteria for each credit and maintain proper documentation to support your claims. Consult a tax professional if you need clarification on complex credits.

What are the key points to remember when filing federal income tax returns?

When filing federal income tax returns, ensure that all income is reported, including earnings from gig economy work or freelance activities. Double-check your filing status, especially if there have been changes in your household composition. Be aware of the tax filing deadline to avoid penalties.

How does filing status affect tax returns?

Your filing status, whether single, married filing jointly, or head of household, can significantly impact your tax rates, standard deductions, and eligibility for certain tax credits. It's essential to choose the correct filing status to optimize your tax situation.

What can taxpayers expect in the upcoming filing season?

Taxpayers should prepare for the upcoming filing season by organizing their tax documents early, understanding the implications of any new tax laws, and considering professional advice for complex situations. Expect advanced security measures to protect taxpayers' information.

What is the average refund, and how can I calculate mine?

The average refund varies each year based on numerous factors. To estimate your refund, consider your income, the taxes already paid throughout the year, applicable tax credits, and deductions. Online calculators or tax software can provide a preliminary estimate.

How can I ensure a timely tax refund?

To ensure a timely tax refund, file your tax return accurately and as early as possible. Opt for electronic filing with direct deposit to expedite the process. Double-check your return for errors and provide all necessary documentation.

Should I itemize deductions or take the standard deduction?

The decision to itemize deductions or take the standard deduction depends on your specific financial situation. Compare the total itemized deductions to the standard deduction for your filing status. If itemized deductions exceed the standard deduction, itemizing may save you more on taxes.

What options are available if I can't pay my tax bill immediately?

If you can't pay your tax bill immediately, consider applying for a payment plan with the IRS. This can provide a manageable way to settle your tax debt over time. Ensure you understand the terms and any interest or penalties associated with the plan.

How does Jackson Hewitt assist with tax preparation?

Jackson Hewitt offers professional tax preparation services, providing assistance with filing individual and business tax returns. Their customer service representatives can help navigate complex tax situations and ensure an accurate return.

What tax documents are essential for filing?

Essential tax documents for filing include W-2 forms from employers, 1099 forms for other income, records of any estimated tax payments, and documentation for deductions or credits. Ensure you have all necessary documents to support your income, deductions, and credits claimed.

By addressing these frequently asked questions, taxpayers can navigate the 2023 tax season with confidence, ensuring compliance and optimizing potential refunds or credits.

Sources

-

Edward Jastrem, Chief Planning Officer at Heritage Financial Services in Westwood, Massachusetts. His advice highlights the importance of being proactive and organized in tax planning.

-

Kyle Pomerleau, Senior Fellow and Federal Tax Expert at the American Enterprise Institute. His insights shed light on the adjustments in tax brackets and the influence of inflation on these changes.

-

Nicholas Gertsema, CEO and Wealth Advisor at Gertsema Wealth Advisors in St. Joseph, Missouri. He provides strategies for tax planning opportunities, especially considering the upcoming sunset of certain tax provisions.

-

Tommy Lucas, CFP and Enrolled Agent at Moisand Fitzgerald Tamayo in Orlando, Florida. He warns about the importance of reporting business income accurately, regardless of changes in form 1099-K reporting.

-

Internal Revenue Service (IRS): The article references several key pieces of information and guidelines issued by the IRS, particularly regarding tax brackets, standard deductions, energy tax credits, and reporting requirements.

-

Tax Cuts and Jobs Act of 2017: This legislation is mentioned in relation to the increased standard deduction and its scheduled expiration in 2026.

-

CNBC: Provided statements, stats, and analysis from financial experts Kyle Pomerleau and others, offering a broader perspective on the tax changes and their implications.

- Investopedia: Provided general information on the biggest changes in the 2023 tax season.