W8

The official document title of W-8BEN-E is Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). It is an important tax document which allows businesses operating outside of the U.S. to claim tax exemption on U.S.-sourced income.

According to U.S. tax regulations, any company paying a foreign entity conducting business within the U.S must withhold a mandatory amount of 30%. If the foreign company is based in a country which has a tax treaty with the U.S., 30% withholding will be exempted if company fills out and submits a W-8BEN-E. It is highly incentivized that foreign businesses fill out W-8BEN-E accurately and submit it. If it fails to submit, or submits an inaccurate document, the foreign company must automatically pay the full 30% tax rate.

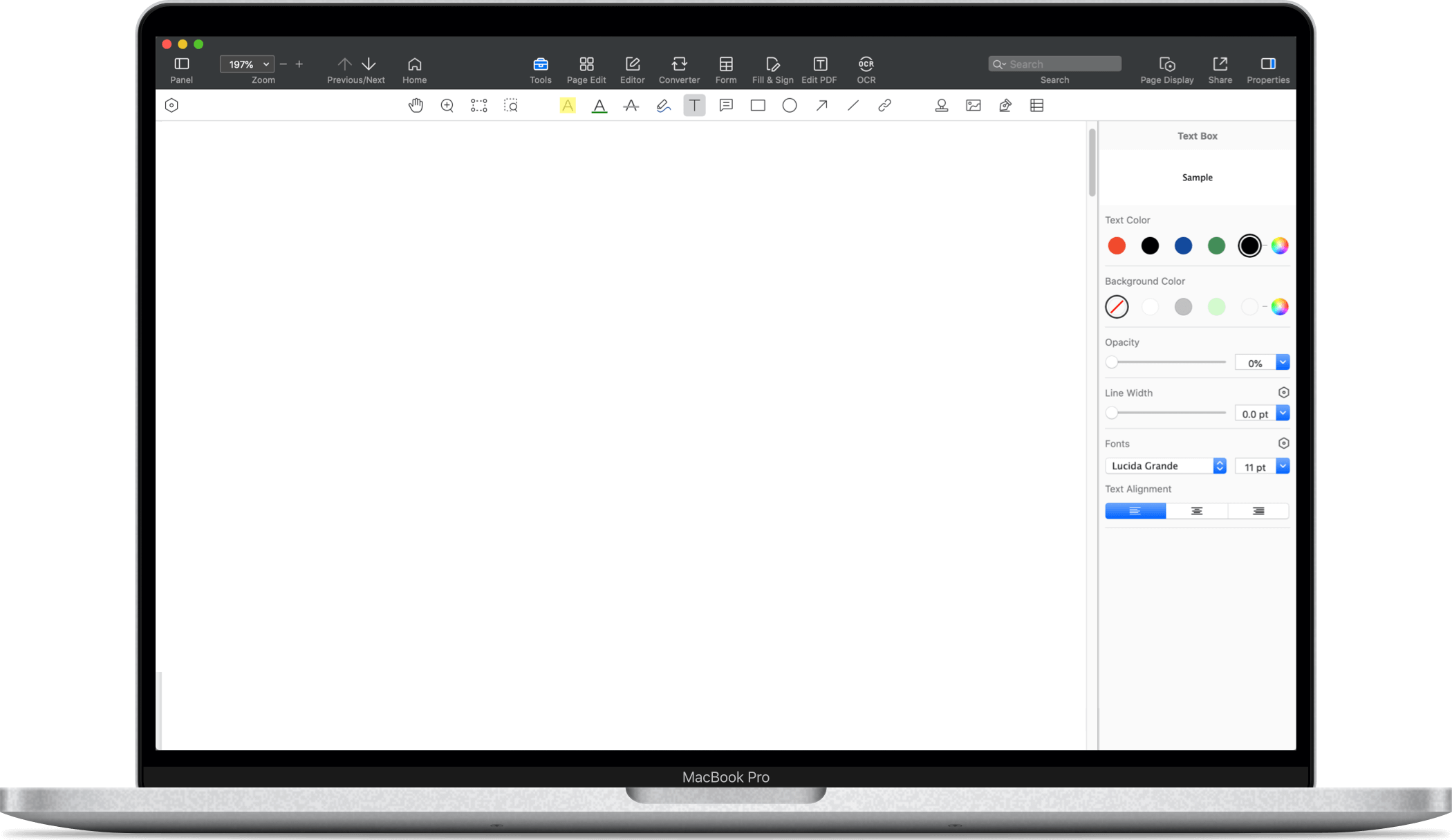

* The free templates above are provided for reference only, for all legal matters, you should always talk to a professional. After downloading the free invoice template, if you need to fill in it or modify the content of invoice on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this invoice template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "free download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master