Form 14039

What is Form 14039?

Form 14039 is how a taxpayer can inform the IRS of a fraudulent tax return filed with their SSN. Form 14039, or the Identity Theft Affidavit let the IRS know of this issue, and prompts an investigation to resolve the tax issue.

Neglecting to address a case of tax-related identity theft can result in a lost tax return, additional taxes owed by the taxpayer, or even new lines of credit opened under the victim’s SSN. If you suspect you’re a victim of tax-related identity theft, you will need to follow the IRS identity theft process to avoid penalty and fix the issue.

How Do I Know If I’m A Victim?

You may be unaware that you’ve become a victim until you file your tax return and discover that two returns have been filed using your Social Security number (SSN). Criminals tend to file forged returns early on in the filing season to try to beat you to the punch — so if you’re a victim, you may have been alerted after you attempted to file your legitimate return.

Per the IRS, you may be a victim of identity theft if you receive an IRS notice or letter that states that:

- More than one tax return for you was filed

- You have a balance due, refund offset or have had collection actions taken against you for a year you did not file a tax return

- IRS records indicate you received wages from an employer unknown to you

When to File Form 14039

Taxpayers who suspect they may be a victim of tax-related identity theft may wonder when to file Form 14039. One of the few occasions a taxpayer would need to fill out Form 14039 is if the taxpayer attempts to file their tax return online, and the IRS rejects the return because a return has already been filed under their SSN. File Form 14039 with the IRS if you receive this message, or a notice from the IRS that instructs you to do so.

The IRS notes that with processing filters, they are able to identify most suspicious tax returns, and they will notify the taxpayer if they encounter an issue with their return. If the IRS does find suspicious activity associated with your SSN, they will give you instructions with Letter 5071C.

If you are unsure if your tax information has been compromised, consult a professional tax services company like Community Tax to help you identify any issues with your tax return, and help you resolve them.

How to Fill Out Form 14039

Once you have confirmed with the IRS that your identity has been stolen – based on a rejected duplicate tax return, or notice from the IRS, you’ll want to get started on your Form 14039.

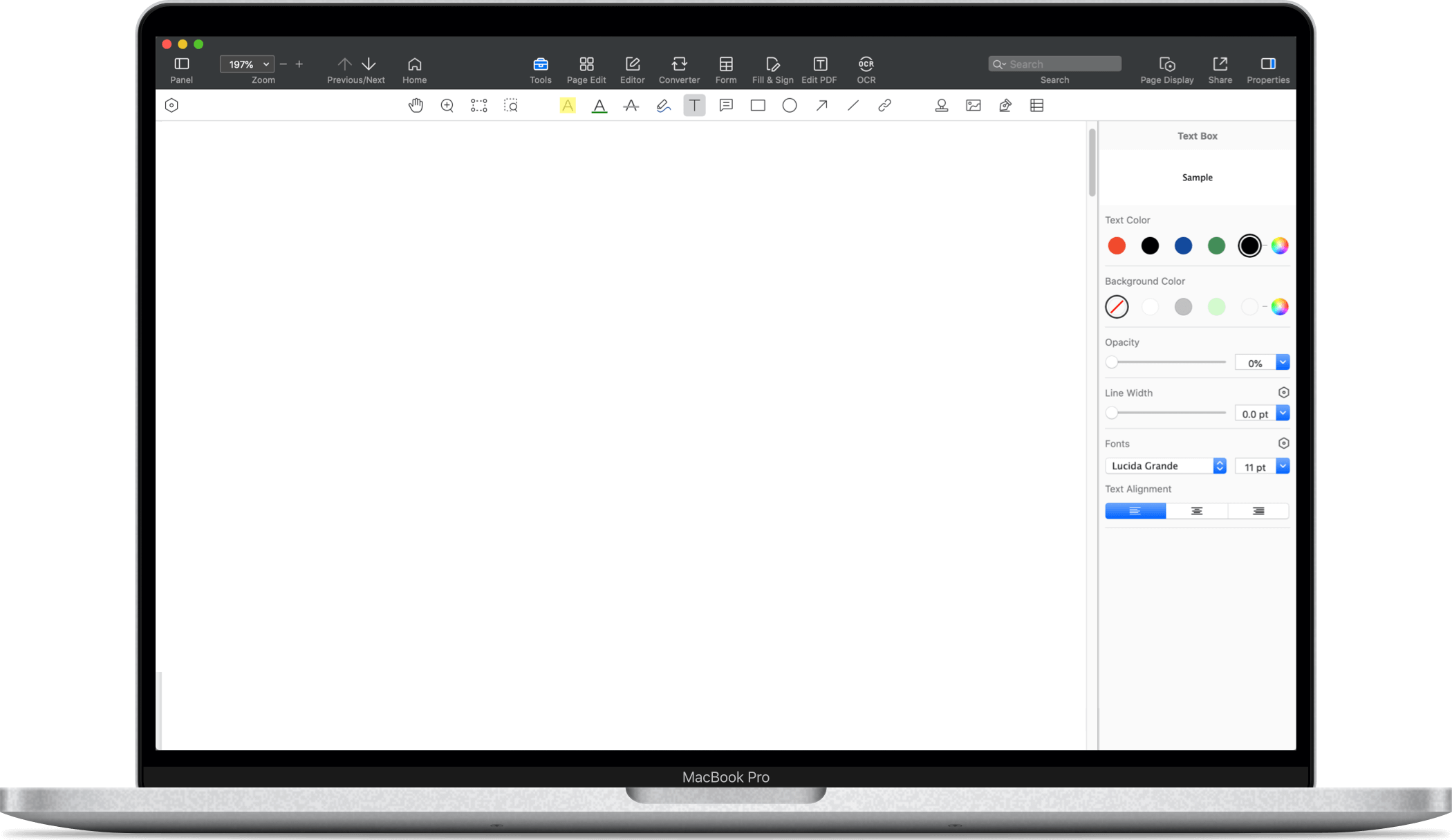

Download Form 14039 from PDF Reader Pro website and use a secure PDF filler like PDF Reader Pro to complete the form.

Form 14039: Section A

Check the box that best describes who you are filing the form for.

Form 14039: Section B

Check one of the following boxes:

1. Someone Used My Information to File Taxes

2. I don’t know if someone used my information to file taxes, but I’m a victim of identity theft

Provide an explanation of how you became aware of the situation with relevant dates and documentation attached, if applicable. For example, if you tried to file an electronic tax return but it was rejected by the IRS, try to include the date and a written confirmation that your return was rejected.

Form 14039: Section C

Fill in your contact and tax information. Wondering how to check if your tax return was filed? To get your tax record (transcript) directly from the IRS for the most accurate data on your last tax returns and filing information. You can access your record online or get your transcript by mail.

Form 14039: Section D

Sign and date the form, indicating that you have provided accurate information.

Form 14039: Section E

Section E will only need to be filled out if you are filing Form 14039 for someone else in the event of their death, if they are a dependent, or if you are the appointed conservator for the affected taxpayer.

Where To Send Form 14039

You can either mail or fax your form once completed. The IRS suggests only choosing one method to submit your form in order to avoid IRS delays.

Mailing Form 14039

If you received a notice from the IRS (Box 1, Section B), send your form and a copy of the notice received to the IRS address on the notice.

If you were not able to file your tax return electronically because a false return was already filed under your SSN (Box 1, Section B), attach the form to the back of your paper tax return and submit to the IRS location where you normally file your tax return.

If you have already filed your paper tax return, send this form to the IRS location where you file your tax return.

If you checked Box 2, Section B and have no known tax-related issues at this time, mail your form to:

- Department of the Treasury

- Internal Revenue Service

- Fresno, CA 93888-0025

Faxing Form 14039

If you are responding to a notice from the IRS (Box 1, Section B), you should send this form to the fax number provided on the letter. If there is not a fax number, follow the mailing instructions provided on the letter.

If you checked Box 2, Section B and have no known tax-related issues at this time, Fax your form toll-free to: 855-807-5720

A fillable Form 14039 PDF is available on PDF Reader Pro. It can be free downloaded and filled out using PDF Reader Pro, printed and attached to a paper tax return for mailing to the IRS. Click the button "Free Download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master