IRS Form 1099-DIV

What Is Form 1099-DIV: Dividends and Distributions?

Form 1099-DIV: Dividends and Distributions is an Internal Revenue Service (IRS) form sent by banks and other financial institutions to investors who receive dividends and distributions from any type of investment during a calendar year. Investors can receive multiple 1099-DIVs. Each 1099-DIV form should be reported on an investor’s tax filing. Certain types of investment accounts are exempt from issuing a Form 1099-DIV. Exempt accounts include individual retirement accounts (IRAs), money purchase pension plans, profit-sharing plans, and various retirement accounts. Investors typically will not receive a 1099-DIV form if cumulative dividends are not greater than $10.

Who Can File Form 1099-DIV: Dividends and Distributions?

Banks, investment companies, and other financial institutions are required to provide taxpayers with a 1099-DIV by Jan. 31 each year. Companies provide a copy of the Form 1099-DIV to the investor and to the IRS. Most investors who receive a Form 1099-DIV will have ordinary dividends, qualified dividends, or total capital gains. Other categories for investors include unrecaptured section 1250 gain, section 1202 gain, collectibles gain, non-dividend distributions, federal income tax withheld, investment expenses, foreign tax paid, foreign country or U.S. possession, cash liquidation distributions, non-cash liquidation distributions, exempt-interest dividends, specified private activity bond interest dividends, and state tax withheld. Investors may also be subject to Foreign Account Tax Compliance Act (FATCA) filing requirements for foreign accounts. This is a law that requires U.S. citizens, both in the country and abroad, to file reports on foreign account holdings.

How to File Form 1099-DIV: Dividends and Distributions

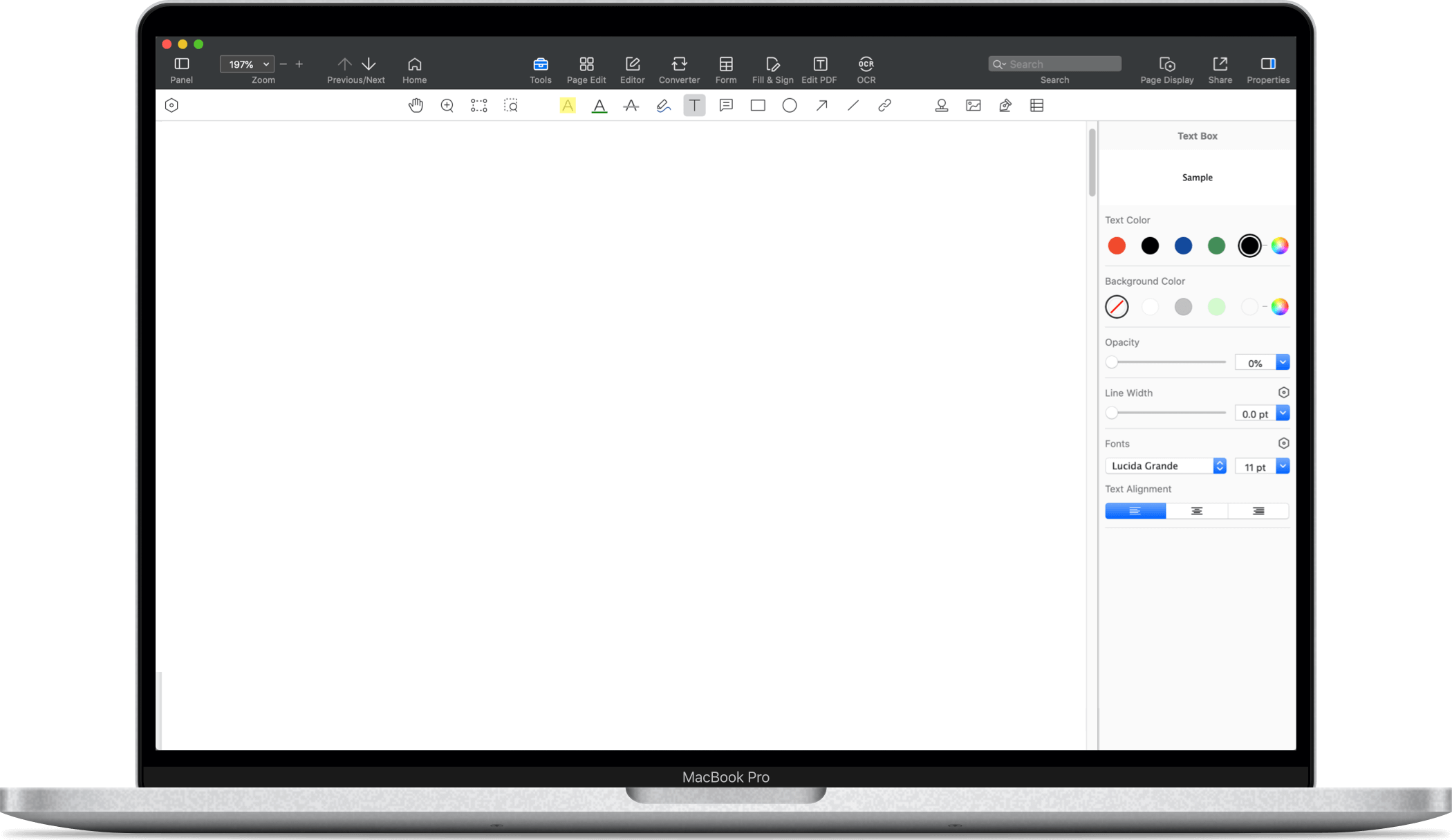

Taxpayers are required to file the information on each Form 1099-DIV they receive on their annual tax form. This can be done on a Schedule B form or directly on Form 1040. Taxpayers who receive more than $1,500 in taxable interest and/or ordinary dividends during the year are required to fill out Schedule B, which accompanies a 1040 form. Dividends are taxed at an investor’s income tax rate with a few exceptions. Qualified dividends are the primary exception. Qualified dividends have met certain criteria that allow them to be taxed at a lower capital gains tax rate. The tax rate on capital gains may also vary from the ordinary income tax rate. Short-term capital gains are taxed at the ordinary income tax rate, but taxes on long-term capital gains are lower. After downloading the free Form 1099-DIV template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "free download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master