IRS Form 1099-G

What Is Form 1099-G?

Form 1099-G, Certain Government Payments, is one of a series of "1099" forms used by the Internal Revenue Service (IRS) to report different payments from and financial transactions with a government, not including employee wages.

Who Needs Form 1099-G?

You should be sent Form 1099-G if you received certain payments from a federal, state, or local government. The most common uses of the 1099-G are to report unemployment compensation and state and local income tax refunds. If you receive a 1099-G, you may need to report some of the information when you file your income tax return.

What Is Form 1099-G Used For?

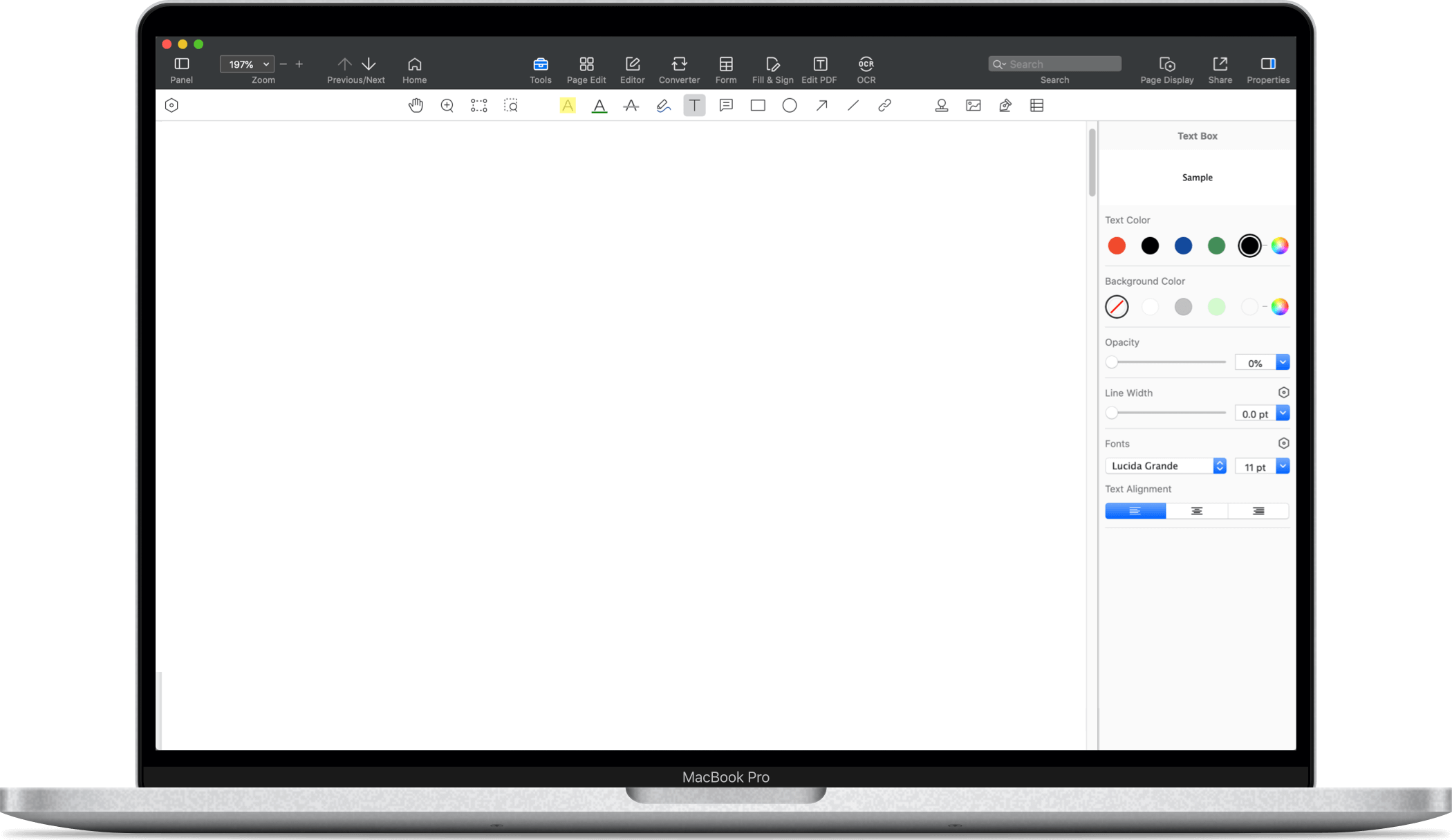

Federal, state, or local governments should file Form 1099-G to report if they received payments on a Commodity Credit Corporation (CCC) loan, or if they paid out: 1. Unemployment compensation 2. State or local income tax refunds, credits, or offsets 3. Reemployment trade adjustment assistance (RTAA) 4. Taxable grants 5. Agricultural payments How to Read Form 1099-G? The left side of the form includes details about the payer (the government that made the payment) and the recipient (you, the taxpayer), including names, addresses, tax identification numbers, and any associated account number. The right side of the form has 11 boxes. Box 1: Unemployment compensation. Box 1 shows the total unemployment compensation (including Railroad Retirement Board payments) you received this year. If you receive more than one 1099-G, combine the Box 1 amounts and report the total as income on the unemployment compensation line of your tax return. Box 2: State or local income tax refunds, credits, or offsets. Box 2 shows refunds, credits, or offsets of state or local income tax you received. This amount might be taxable if you deducted the state or local income tax paid on Schedule A. Box 3: Box 2 amount is for tax year. Box 3 shows the tax year for which the refunds, credits, or offsets in Box 2 were made. The box may be left blank if the refund, credit, or offset is for the current tax year. Box 4: Federal income tax withheld. Box 4 shows backup withholding or withholding you requested on unemployment compensation, Commodity Credit Corporation (CCC) loans, or certain crop disaster payments. Box 5: RTAA payments. Box 5 shows reemployment trade adjustment assistance (RTAA) payments you received. Include this amount on the "Other income" line of Schedule 1. Box 6: Taxable grants. Box 6 shows taxable grants you received from government agencies. Box 7: Agriculture payments. Box 7 shows taxable payments you received from the U.S. Department of Agriculture (USDA). See IRS Pub. 225 and the Schedule F instructions to learn where to report this income. Box 8: Check if box 2 is trade or business income. Box 8 shows if the amount in Box 2 is related to an income tax that applies exclusively to income from a trade or business. If taxable, report the amount in Box 2 of Schedule C or F. Box 9: Market gain. Box 9 shows any market gain associated with the repayment of a Commodity Credit Corporation (CCC) loan (available only to farmers). Box 10a: State. Box 10 a shows the abbreviated name of the state. Box 10b: State identification no. Box 10b shows the state’s identification number. Box 11: State income tax withheld. Box 11 shows the amount of state income tax withheld. After downloading the free Form 1099-G template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "free download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master