IRS Form 1099-INT

What Is Form 1099-INT: Interest Income?

Form 1099-INT is the IRS tax form used to report interest income. The form is issued by all payers of interest income to investors at year end. It includes a breakdown of all types of interest income and related expenses. Payers must issue a 1099-INT for any party to whom they paid at least $10 of interest during the year.

Who Files Form 1099-INT?

Brokerage firms, banks, mutual funds, and other financial institutions are required to file a 1099-INT on interest over $10 paid during the year. The form must be reported to the IRS and sent to each interest recipient by Jan. 31. When taxpayers borrow money, the lenders charge them interest on the loans. This interest represents a cost of borrowing to the borrower, who can be an individual, a business, or a government agency. Individuals and businesses can borrow money by taking out loans from a bank. Likewise, businesses and federal and municipal governments can borrow money by issuing bonds to investors. Financial institutions pay interest to account holders as compensation for the bank's use of the deposited funds. The interest received by the investors or lenders is taxable income and must be reported to the IRS.

What Is Form 1099-INT Used For?

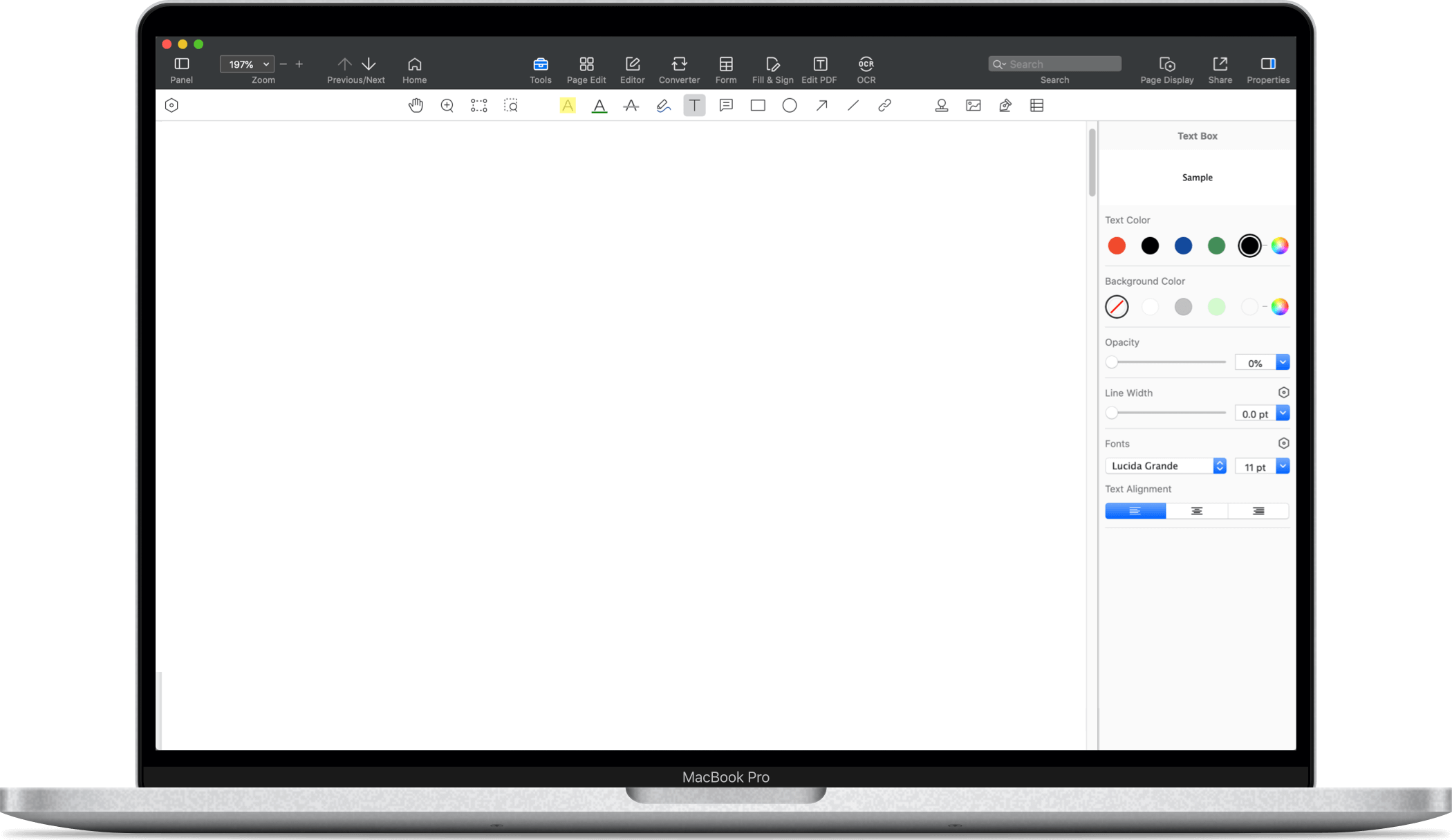

IRS Form 1099-INT must be filed for each person: 1. To whom a financial institution paid amounts reportable in Boxes 1, 3, and 8 of at least $10 (or at least $600 of interest paid in the course of your trade or business described in the instructions for Box 1, "Interest income"). 2. For whom a financial institution withheld and paid any foreign tax on interest. 3. From whom a financial institution withheld (and did not refund) any federal income tax under the backup withholding rules regardless of the amount of the payment. Interest paid that must be reported on a 1099-INT will include interest on bank deposits, accumulated dividends paid by a life insurance company, indebtedness (including bonds, debentures, notes, and certificates other than those of the U.S. Treasury) issued in registered form or of a type offered to the public, or amounts from which federal income tax or foreign tax was withheld. In addition, interest accrued by a real estate mortgage investment conduit (REMIC) or a financial asset securitization investment trust (FASIT) regular interest holder, or paid to a collateralized debt obligation (CDO) holder, will also be reported here. After downloading the free Form 1099-INT template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "free download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master