IRS Form 1099-OID

What Is Form 1099-OID?

Form 1099-OID, "Original Issue Discount," is the IRS form that you received if you must include an amount of OID in your taxable income. OID is the excess of an obligation’s stated redemption price at maturity over its issue price, and it is taxable as interest over the life of the obligation. Obligations generally exist for holdings issued after 1984. Those that may have OID include a bond, debenture, note, certificate, or other evidence of indebtedness having a term of more than one year. OID rules may apply to certificates of deposit, time deposits, bonus savings plans, and other deposit arrangements, especially if the payment of interest is deferred until maturity. The rules apply also to Treasury inflation-protected securities.

Who Needs Form 1099-OID?

You receive Form 1099-OID if the OID includable in your gross income was at least $10, the provider of the form withheld and paid any foreign tax on the OID for you, or you had withheld (and did not have refunded) any federal income tax under the backup withholding rules, even if the amount of the OID is less than $10 (withheld state taxes will also be shown).

What Is Form 1099-OID Used For?

Form 1099-OID is used to report original issue discount interest as part of your income. How the OID on a long-term debt instrument is figured depends on the date it was issued, as well as on the type of debt instrument. Rules differ for instruments issued after July 1, 1982, and before 1985; instruments issued after 1984; contingent payment debt instruments issued after Aug. 12, 1996; and inflation-indexed debt instruments issued after Jan. 5, 1997. A debt instrument you purchased after the date of its original issue may have premium, acquisition premium, or market discount. If it has premium or acquisition premium, the OID reported to you may have to be adjusted. The rules for including OID in income generally do not apply to U.S. savings bonds, tax-exempt obligations, and loans of $10,000 or less between individuals who are not in the business of lending money.

Why Is Form 1099-OID Important?

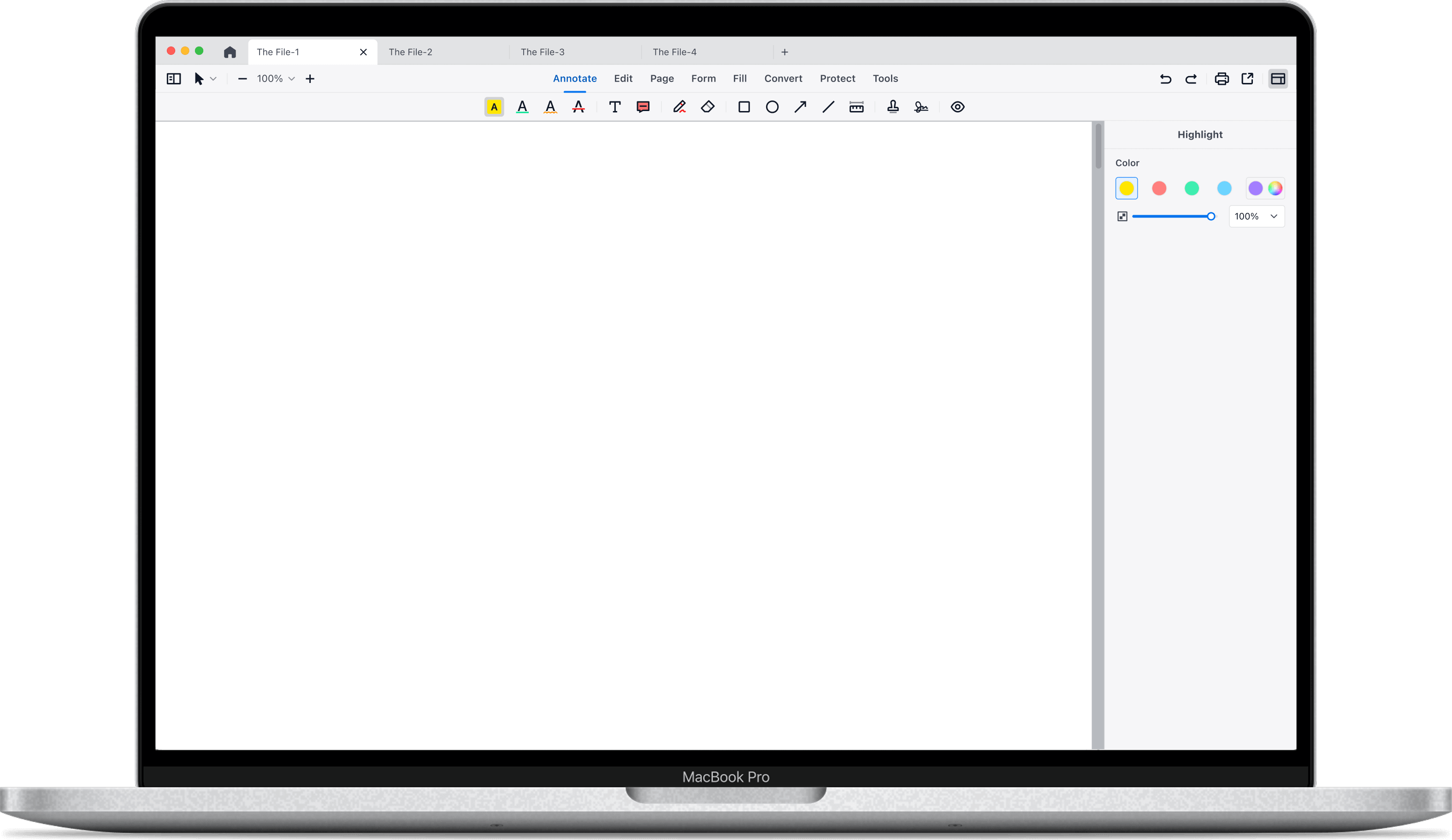

The 1099-OID is an important form when you report special kinds of interest and investment income on your tax return. The form gives you specific information that you need to report correctly and in the right tax categories. If you have questions—and these issues are complicated—work with a tax preparer or expert. After downloading the free Form 1099-OID template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "free download" to download the app.

Support Chat

Support Chat