IRS Form 4868

Understanding Form 4868

If you are required to file a federal income tax return and for any reason want more time beyond the April filing deadline, you can get an extension just by asking for it. The request is made by filling out an Internal Revenue Service (IRS) extension form, known officially as Form 4868: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Form 4868 gives you an automatic six-month extension to file your federal income tax return. The extension for 2019 federal income tax returns that are due on April 15, 2020, gives you until Oct. 15, 2020. You may want an extension if you have not yet received all the necessary information to prepare your return—for example, you haven't received a Schedule K-1 from a trust in which you are a beneficiary or because the chaos of the COVID-19 crisis is making it difficult to organize your taxes. If you are self-employed, there is an added benefit to obtaining a filing extension. It gives you until the extended due date to set up and fund a simplified employee pension (SEP) retirement plan. By obtaining the extension, you avoid any late-filing penalties as long as you do file by the extended due date. If you don't, you face a late filing penalty of 5% of the amount due for each month or part of the month your return is late. If your return is more than 60 days late, the minimum penalty is $330 or the balance due, whichever is smaller. It's important to keep in mind that filing an extension does not generally mean you are off the hook for paying taxes due by the April deadline. You'll owe interest and potential penalties if you pay late, even if you file an IRS extension form. But 2019 tax payments have been given a 90-day extension, so you have more time to pay them. This more time, however, is 90 days, not Oct. 15, when your filed tax papers are due when you file for an extension.

Who Can File Form 4868?

Taxpayers who want more time for any reason to file federal income tax returns can use Form 4868. You can file the form when you need an extension for a variety of returns in the 1040 series including: Form 1040: U.S. Individual Tax Return Form 1040-SR: U.S. Tax Return for Seniors Form 1040NR: U.S. Nonresident Alien Income Tax Return Form 1040-NR-EZ: U.S. Income Tax Return for Certain Nonresident Aliens With No Dependents Form 1040-PR: Self-Employment Tax Return-Puerto Rico Form 1040-SS: U.S. Self-Employment Tax Return

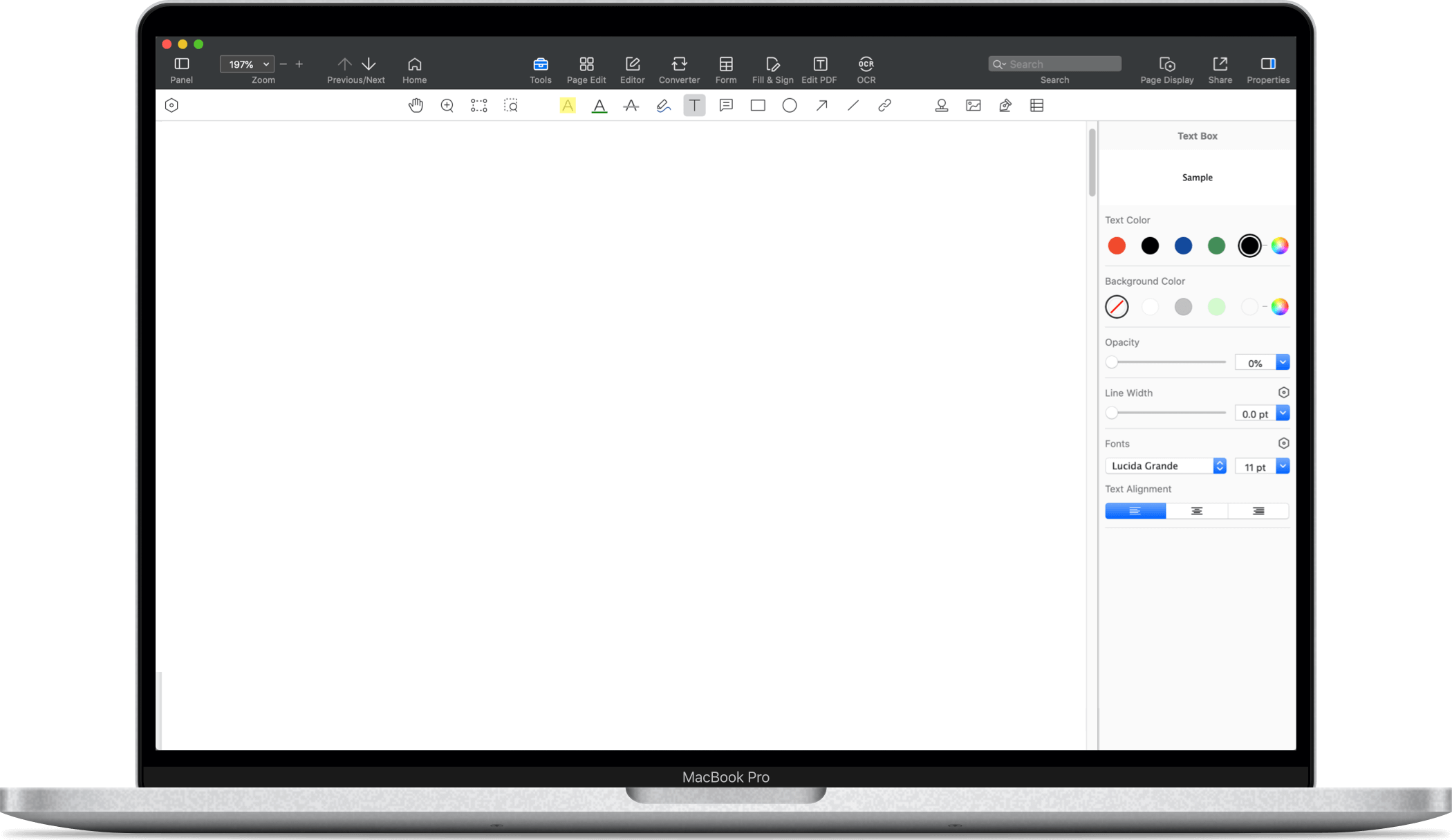

* The free templates above are provided for reference only, for all legal matters, you should always talk to a professional. After downloading the free template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

PDF Reader Pro

PDF Reader Pro

PDF Master

PDF Master