Form 1099-B

What Is Form 1099-B?

Form 1099-B: Proceeds from Broker and Barter Exchange is a federal tax form used by brokerages and barter exchanges to record customers' gains and losses during a tax year. Individual taxpayers will receive the form from their brokers or barter exchange already filled out. Taxpayers transfer the information from a 1099-B to Form 8949 to calculate their preliminary gains and losses.

Who Can File Form 1099-B?

Brokers must submit a 1099-B form to the IRS as well as sending a copy directly to every customer who sold stocks, options, commodities, or other securities during the tax year. The IRS requires submission of the form to serve as a record of a taxpayer’s gains or losses.

A broker or barter exchange must file this form for each person: 1.For whom, they sold stocks, commodities, regulated futures contracts, foreign currency contracts, forward contracts, debt instruments, options, securities futures contracts, etc., for cash, 2.Who received cash, stock, or other property from a corporation that the broker knows or has reason to know has had its stock acquired in an acquisition of control or had a substantial change in capital structure reportable on Form 8806, or 3.Who exchanged property or services through a barter exchange.Assume, for example, you sold several stocks last year. The proceeds of the sale were $10,000. That figure will be reported to the IRS from two sources: One from the brokerage on a 1099-B and the second from you as a report of a taxable capital gain.

What Is a 1099-B Used For?

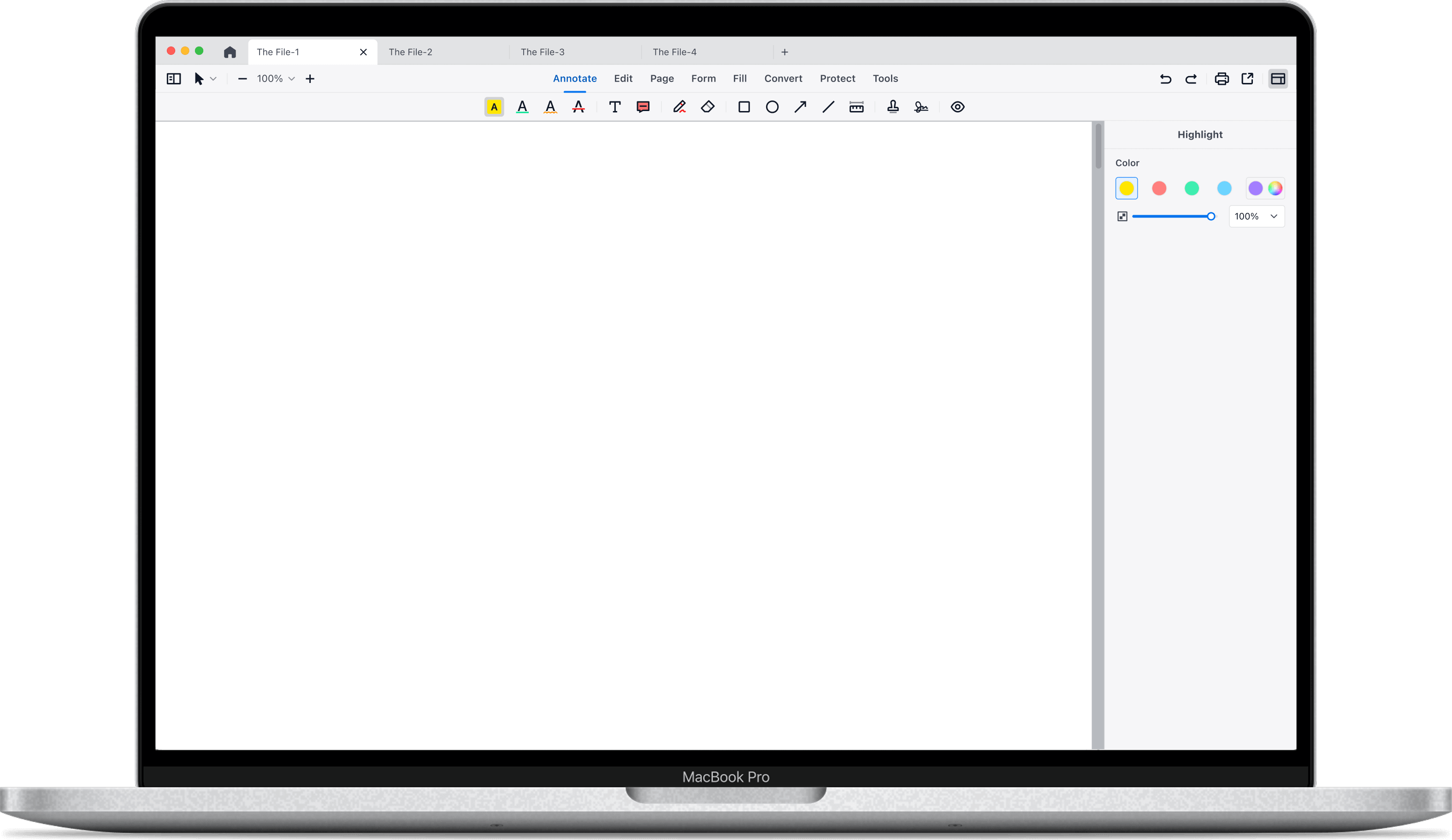

Information on a 1099-B includes a description of each investment, the purchase date and price, the sale date and price, and the resulting gain or loss. Commissions for these transactions are excluded. As a taxpayer, your capital losses are subtracted from any capital gains and may be used to reduce the taxable income you report. There are limits to the amount of capital loss that can be deducted each tax year. However, if the capital loss exceeds the limit, the difference may be carried over to the following tax year (or years). The broker or barter exchange must mail a copy of a 1099-B form to all clients by Jan. 31 of the year following the tax year. After downloading the free Form 1099-B template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.