Form 2848

What Is Form 2848?

Form 2848: Power of Attorney and Declaration of Representative is an Internal Revenue Service (IRS) document that authorizes an individual or organization to represent a taxpayer by appearing before the IRS—at an audit, for example. Federal law requires the IRS to keep confidential all of the information that you supply on your tax return. So, you must file a Form 2848 with the IRS before anyone other than yourself may receive and inspect your tax information, and represent you to the IRS.

What Is the Purpose of Form 2848?

Form 2848 is similar, but not identical, to a power of attorney (POA). It does not, however, relieve the taxpayer of any tax liability. When you sign Form 2848, you authorize a certified public accountant (CPA), attorney, or other person designated as your agent to take certain actions on your behalf including: 1. Receive confidential tax information 2. Sign an agreement with the IRS regarding taxes, on tax returns specified on Form 2848 3. Sign documents requesting additional time to assess the tax obligation, as well as extra time in order to agree to a tax adjustment 4. Sign a tax return in limited situations A limited situation, for example, could be if you are suffering from a disease or injury, or you are outside of the United States continuously for at least 60 days before the date that a return is required to be filed. In any other circumstance—let's say, you’re on vacation before and after your return has been prepared and must be filed—you must submit a request in writing to the IRS for permission for someone, such as a tax preparer, to sign your return. However, Form 2848 is not a blanket grant of authority to do everything connected with taxes on your behalf. For instance, your agent cannot: 1. Endorse or negotiate a refund check, or direct that a refund be deposited electronically into the agent’s account 2. Substitute another agent for themselves (although you can specifically authorize this)

Who Can File Form 2848?

Anyone who wishes to be represented by an authorized power of attorney when meeting with the IRS may fill out and submit Form 2848. Authorized individuals or organizations include attorneys or law firms, CPAs, and enrolled agents. These agents can fully represent taxpayers to the IRS. The IRS also allows individuals who are related to the taxpayer, such as family members or fiduciaries, to act as third-party representatives. However, their access is limited and they may represent taxpayers only in the presence of customer-service agents, revenue agents, or similar IRS employees. They cannot execute closing agreements, waivers, or refunds. Moreover, they cannot sign documents for taxpayers.

Form 2848 vs. Form 8821

Whereas Form 2848 allows a power of attorney to represent a taxpayer before the IRS, Form 8821: Tax Information Authorization empowers someone to receive and inspect your confidential information without representing you to the IRS. In other words, you may use Form 8821 when you want someone merely to see your tax information—as when you're applying for a mortgage and need to share your tax information with your lender.

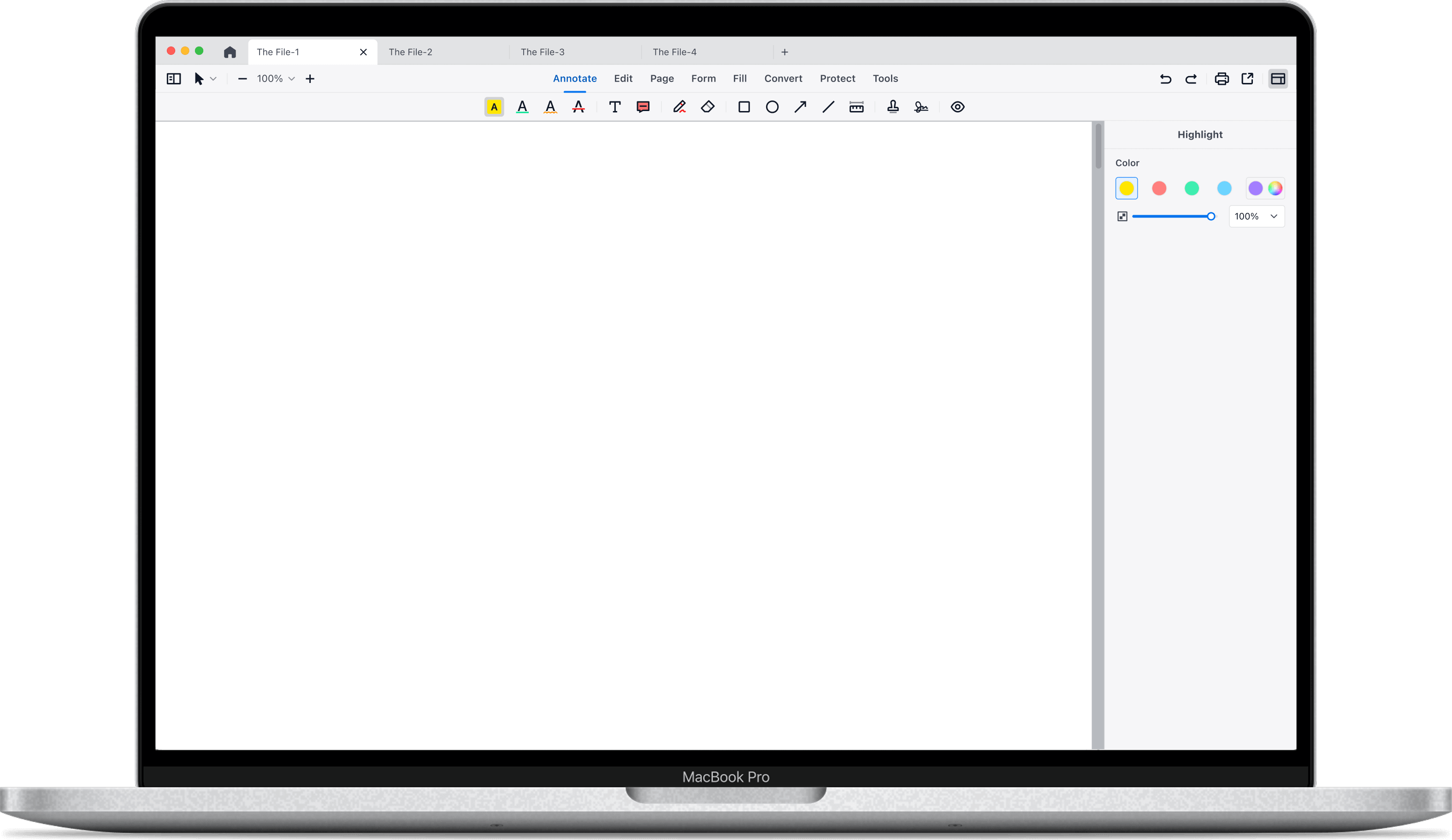

* The free templates above are provided for reference only, for all legal matters, you should always talk to a professional. After downloading the free template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

Support Chat

Support Chat