Form 7200

What's the Form 7200?

Form 7200 was recently created by the IRS in response to the Covid-19 Pandemic. As a part of the tax relief effort for affected businesses. The official title of this form is the Advance Payment of Employer Credits Due to Covid-19. To learn more about this form and decide whether or not your business should file one, keep reading.

What Is The Purpose of Form 7200?

This form allows employers to request an advance payment on their tax credits for the following: - Qualified sick leave - Family leave wages - Employee retention credit Instead of filing Form 7200, you should first reduce your employment tax deposits to account for the credits. You can request the amount of the credit that exceeds your reduced deposits by filing Form 7200. Use Form 7200 to request an advance payment of the tax credits for qualified sick and qualified family leave wages and the employee retention credit that you will claim on the following federal forms. - Form 941, 941-PR, 941-SS - Form 943, 943-PR - Form 944, 944 (SP) - Form CT-1

How to File Form 7200?

When filing, you will need all of the information from your employment tax return. Basic Inofrmation Box 1– Basic business information (business name, address, third party payer details, EIN) Box 2– Choose the calendar quarter for which you are filing this form. This indicates when the wages were paid. Part I Here you will indicate which employment tax form you file and indicate whether you are a new business. You will also report the number of employees that you have. Lines A-D report the employment tax return information. Line A: Check the box to your employment tax return type you file for 2020 Employment tax return types are Form 941/PR/SS, Form 943/PR, Form 944/SP, and Form CT-1 Line B: Check the box if you are a new business that started on or after January 1, 2020 If yes, your business has not yet filed any employment tax return so skip Line C. If no, complete employment tax return information details on Line C. Line C: Amount reported on line 2 of your most recently filed Form 941 The IRS will verify this information with the employer that the credit is being paid to the correct or not. If your wages are reported on Schedule R (Form 941), enter the wages reported by your third-party payer for your EIN on its most recently filed Schedule R (Form 941), column (c). If your wages are reported on Schedule R (Form 943), enter the social security tax reported by your third-party payer for your EIN on its most recently filed Schedule R (Form 943), column (c). Form 941-PR, line 5a, Salarios sujetos a la contribución al Seguro Social. Enter the amount reported in column 1. Form 941-SS, line 5a, Taxable social security wages. Enter the amount reported in column 1. Form 943, line 2, Total wages subject to social security tax. Form 943-PR, line 2, Total de salarios sujetos a la contribución al Seguro Social. Form 944, line 1, Wages, tips, and other compensation. Form 944(SP), line 1, Salarios, propinas y otras remuneraciones. Form CT-1, line 1, Tier 1 employer tax—compensation (other than tips and sick pay). Enter the amount reported in the Compensation column. Line D: Enter the total number of employees you have In your business, if you have 500 or more employees, then you are not eligible to claim the credit for qualified paid sick and family leave wages and employee retention credit may be based on the number of employees you have. Please visit IRS official website to get more information about Coronavirus Tax Relief.

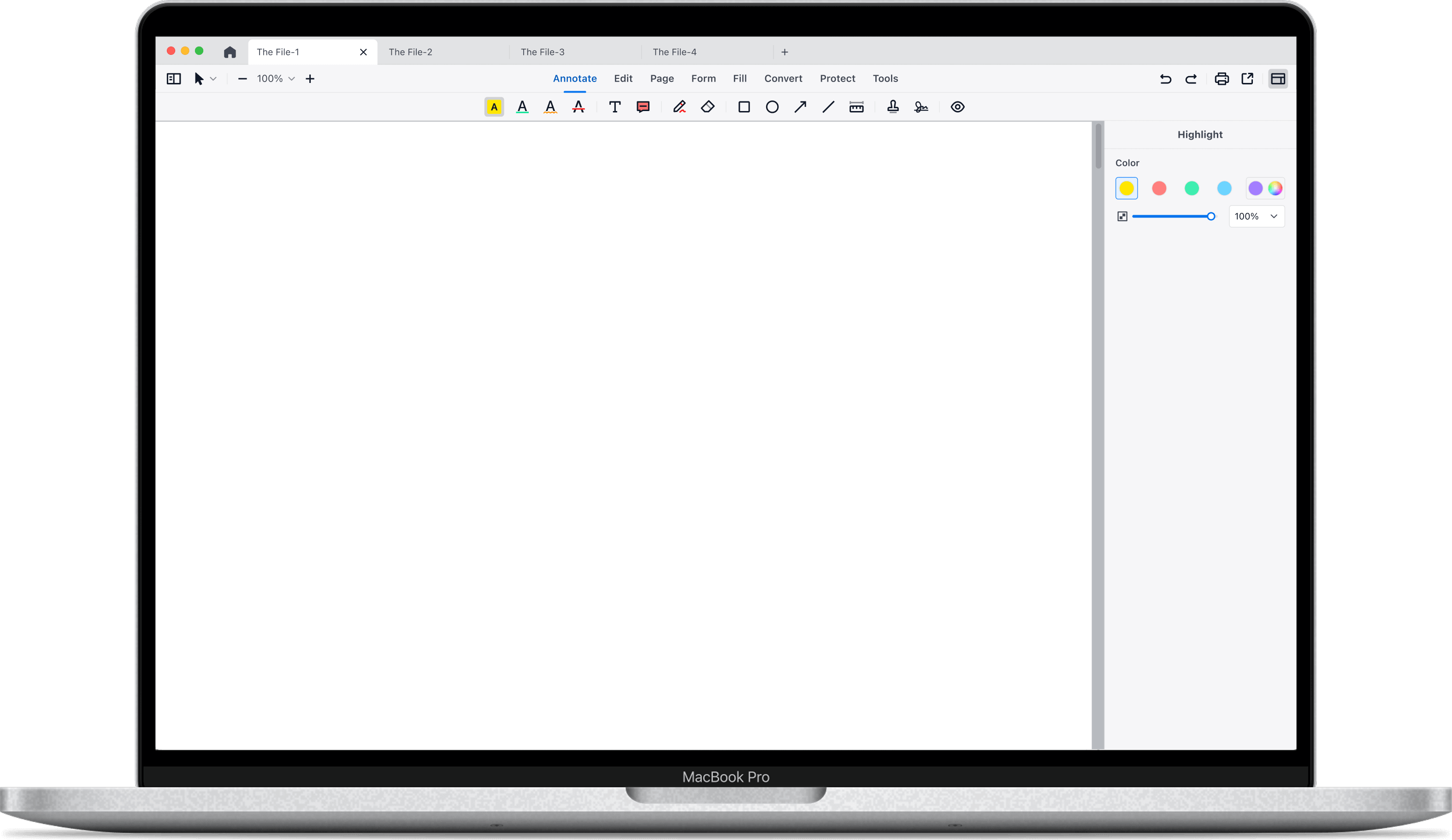

Part II This is the portion of the form where you will actually request an advance on your credits. This is done by completing lines 1-8. Line 1– Total employee retention credit for the quarterYou can enter up to 50% of the wages for the current quarter, qualified wages may not exceed 50% of $10,000 ($5,000) for any employee for all the quarters. If you paid any qualified wages between March 13, 2020, and March 31, 2020, including 50% of those wages together with 50% of any qualified wages paid during the second quarter for the second-quarter total to enter on line 1. Line 2– Total qualified sick leave wages eligible for the credit and paid this quarter Enter the sick leave wages paid as a result of Covid-19. Remember, the Emergency Paid Sick Leave Act (EPSLA) requires employers of 500 or less employees to provide paid sick leave to those affected by Covid-19. Line 3- Total qualified family leave wages eligible for credit paid this quarter Enter the wages paid for family sick leave related to Covid-19 for the current quarter. Line 4– The sum of line 1, 2, and 3 Line 5- Enter the total amount by which you have already reduced your federal employment tax deposits for the quarter. Line 6– The total advanced credits that you have already requested on previous filings of Form 7200 for the quarter. Line 7– The sum of lines 5 and 6. Line 8- Your Advance Payment Request This amount is calculated by subtracting line 7 from line 4. If the amount is less than zero, you are not eligible to file the IRS Form 7200. If you have any questions about the Form 7200, please don’t hesitate to reach out to the TaxBandits support team. This is a difficult time and many businesses are experiencing stress. We are here to help your business in any way possible. Third-Party Designee A Third-party designee is authorized by the employer to discuss their return with the IRS. Check “Yes”, If you wish to discuss this return with the IRS and provide the designee name and phone number. Also, enter the 5 digit pin to use while talking with the IRS. Check “No”, if you don’t wish to discuss it. After downloading the free Form 7200 template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

Support Chat

Support Chat