Form 843

What Is Form 843?

Form 843 is a multipurpose tax document issued by the Internal Revenue Service (IRS) used by taxpayers to make a claim for refund of certain assessed taxes or to request abatement of interest or penalties applied in error.

What Form 843 Is Used For?

Form 843 can be used to ask the IRS for an abatement of certain taxes other than income including: 1.Estate or gift taxes 2.Interest or penalties due to IRS error or delays, or incorrect written advice from the IRS 3.To seek a refund of Social Security or Medicare taxes that were withheld in error, and for which the employer will not adjust the over-collection. The 843 form cannot be used to amend a previously filed income or employment tax return to: 1.Claim a refund of agreement, offer-in-compromise fees, or lien fees 2.Request an abatement of gift or estate taxes 3.Claim a refund or abatement of Federal Insurance Contributions Act (FICA) tax 4.Claim a refund or abatement of Railroad Retirement Tax Act tax 5.Claim a refund or abatement of income tax withholding.

Who Can File Form 843?

There are several reasons a taxpayer can file Form 843. This includes if a taxpayer's employer withholds too much income, Social Security, or Medicare tax from a paycheck and will not make any adjustments. This form can also be filed by a taxpayer's authorized representative. Another reason to file this form may be as a result of IRS error or delay. This happens when a taxpayer is wrongly assessed interest, penalties, or additions to tax that are not owed. On these occasions, a taxpayer can request that the IRS fix the error(s) by filing a claim for refund or abatement. A separate Form 843 must generally be filed for each type of tax or fee, and for each tax year.

How to File Form 843

Form 843 requires basic information such as name, address, Social Security number, tax period, tax type, and return type. It requires a statement of the facts and issues as to why you are entitled to a refund or abatement. Penalty abatement requests require you to write the Internal Revenue Code (IRC) section number of the penalty on Line 4. You can find this section number on the IRS notice you received. Then, you must choose a reason for your request in Section 5a. The choices are: 1.Interest was assessed as a result of IRS errors or delays 2.Erroneous written information from the IRS 3.Reasonable cause or another reason other than erroneous written advice You can write an explanation of your request in Section 7. Remember to support your reasons with evidence and computations. The IRS allows you to attach additional pages if you need more space. The form must be filed within two years from the date you paid the taxes or three years from the date the return was filed, whichever is later.

Special Considerations for Form 843

If the IRS denies your claim by sending a statutory notice of claim disallowance—or if six months pass without any action—you can petition the U.S. District Court or the U.S. Court of Federal Claims.5 6 You can also file a protective claim before the expiration of the statute of limitations to preserve your right to make a claim for refund.7 Protective claims and real claims have the same legal effect.

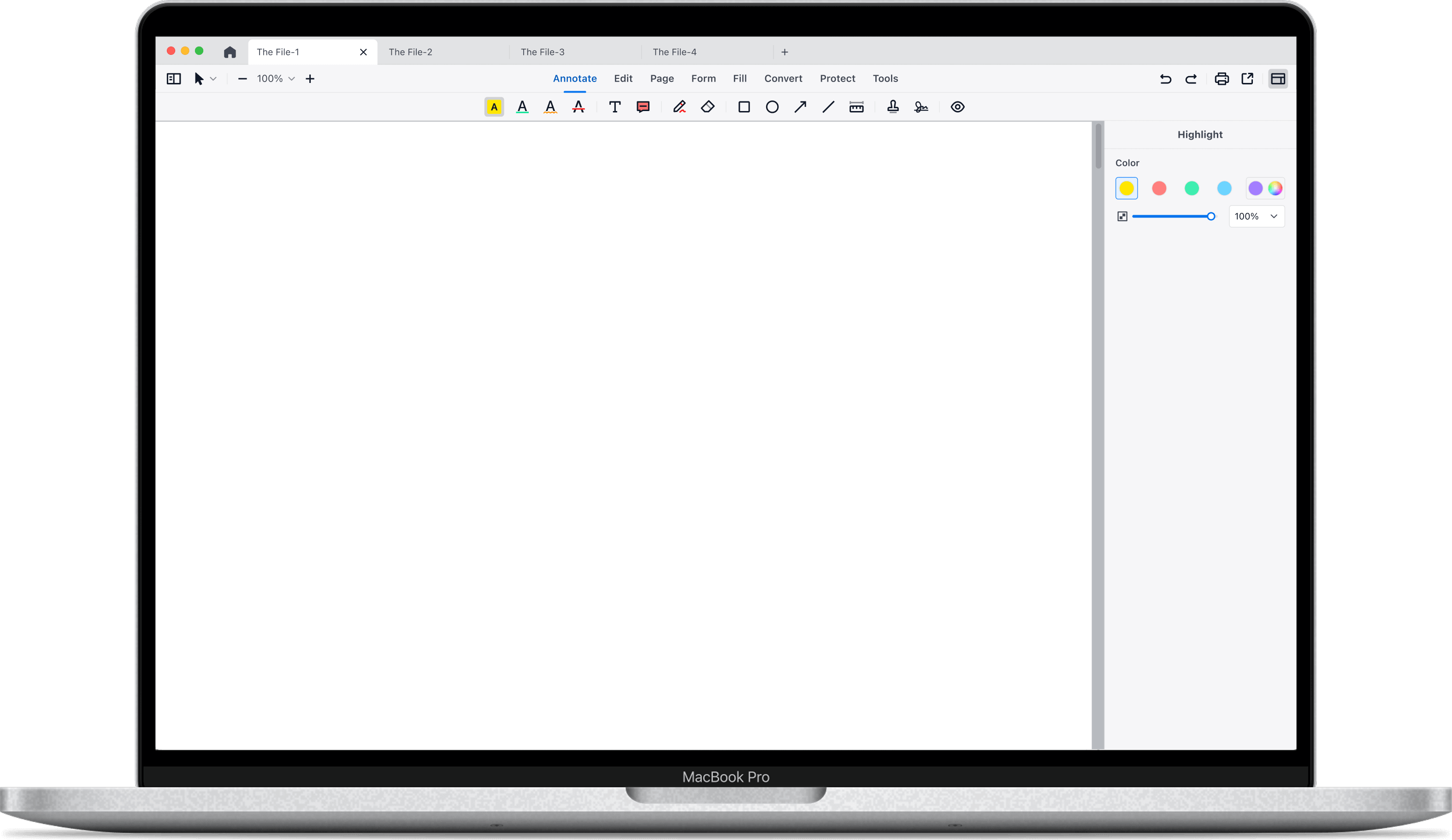

* The free templates above are provided for reference only, for all legal matters, you should always talk to a professional. After downloading the free template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

Support Chat

Support Chat