Form 1099-NEC

What is IRS Form 1099-NEC?

The Internal Revenue Service has reinstituted Form 1099-NEC as a new way to provide data on self-employment income instead of 1099-MISC, as it has done before. Companies will now have to use this template if they have made payments totaling $600 or more to a non in-house worker, such as an independent contractor.

If you are self-employed, you can expect to receive this new report from a business you have worked with by January 31st of each year (February 1, 2021, since January 31st falls on a Sunday) and use it to prepare your tax return.

Who needs to submit Nonemployee Compensation?

Any company that makes payments totaling $600 or more to at least one individual who is not an employee will now use this updated form to report that payment. Additionally, businesses will need to complete Form 1099-NEC when they pay any individual at least $10 in fees or when any federal income tax withheld, regardless of the amount paid for the year.

When is the 1099 NEC due date?

Taxpayers must file their forms no later than February 1, 2021, using paper or electronic methods. Electronic filing is mandatory for those companies that file 250 or more documents. The updated MISC form must be filed in paper form by March 1, 2021, and March 31, 2021, if filed electronically.

The complete guide to prepare the 1099-NEC report

The document itself is straightforward to prepare. You can quickly fill out the blanks online on our website. The main point is to know a few things:

The form consists of several copies, each of which has its own purpose

Copy A is for information only; the official form should be requested from the IRS

Copy B and the following pages can be filled in here online, emailed, or printed

Follow the quick steps on how to fill out the 1099 NEC in minutes:

1. Click Free Download to get the template and start completing it with PDF Reader Pro fill online;

2. Please note that Copy A is provided for informational purposes only;

3. Scroll down to start filling out Copy 1 for the State Tax Department and the following copies for the Recipient and Payer;

4. Navigate from one fillable field to another and complete them with the help of the pop-up tips;

5. Enter the required information carefully (text, numbers, checkmarks); follow the instructions in the pop-ups;

6. For your protection, show only the four last digits of your TIN/SSN. However, the issuer (Client) has already reported your complete TIN to the IRS;

7. Double-check the information provided to prevent penalties because of errors;

8. Click Done when finished;

9. Proceed to send out the report and save Copy B for your records.

FAQs about From 1099-NEC

Q1: What is nonemployee compensation?

These are payments for services provided for your trade or business by those who aren’t employees. Non-employee compensation can include fees, commissions, prizes, benefits, and awards for freelancers’ jobs.

Q2: Can I file 1099 NEC online?

You can submit Form 1099-NEC to the IRS by mail or online, using the Filing Information Returns Electronically (FIRE) system. Check details with the Internal Revenue Service before filing the report.

Q3: What if you don't file non-employee compensation on time?

If you fail to provide the right form to the right agency before the due date, you will be subject to penalties. The greater the delay in filing, the greater the penalty you will be assessed.

Q4: 1099-NEC vs. 1099-MISC: what’s the difference?

IRS Form 1099-NEC replaces 1099-MISC for non-employees starting in the 2020 tax year. Form 1099-MISC is still used for other purposes, but now, independent contractors have a separate form instead of Box 7 of the MISC-type report.

Q5: What form should I use 1099 MISC or 1099 NEC?

Use 1099-MISC to report different income such as rent, payments to attorneys, or royalties. Payments to non-in-house contractors made in 2020 and later will be reflected on the new Form 1099-NEC. If freelancers work for you, you must provide them this document by February 1, 2021. If you are a freelancer, you will get this version of the template from your client to prepare your tax return.

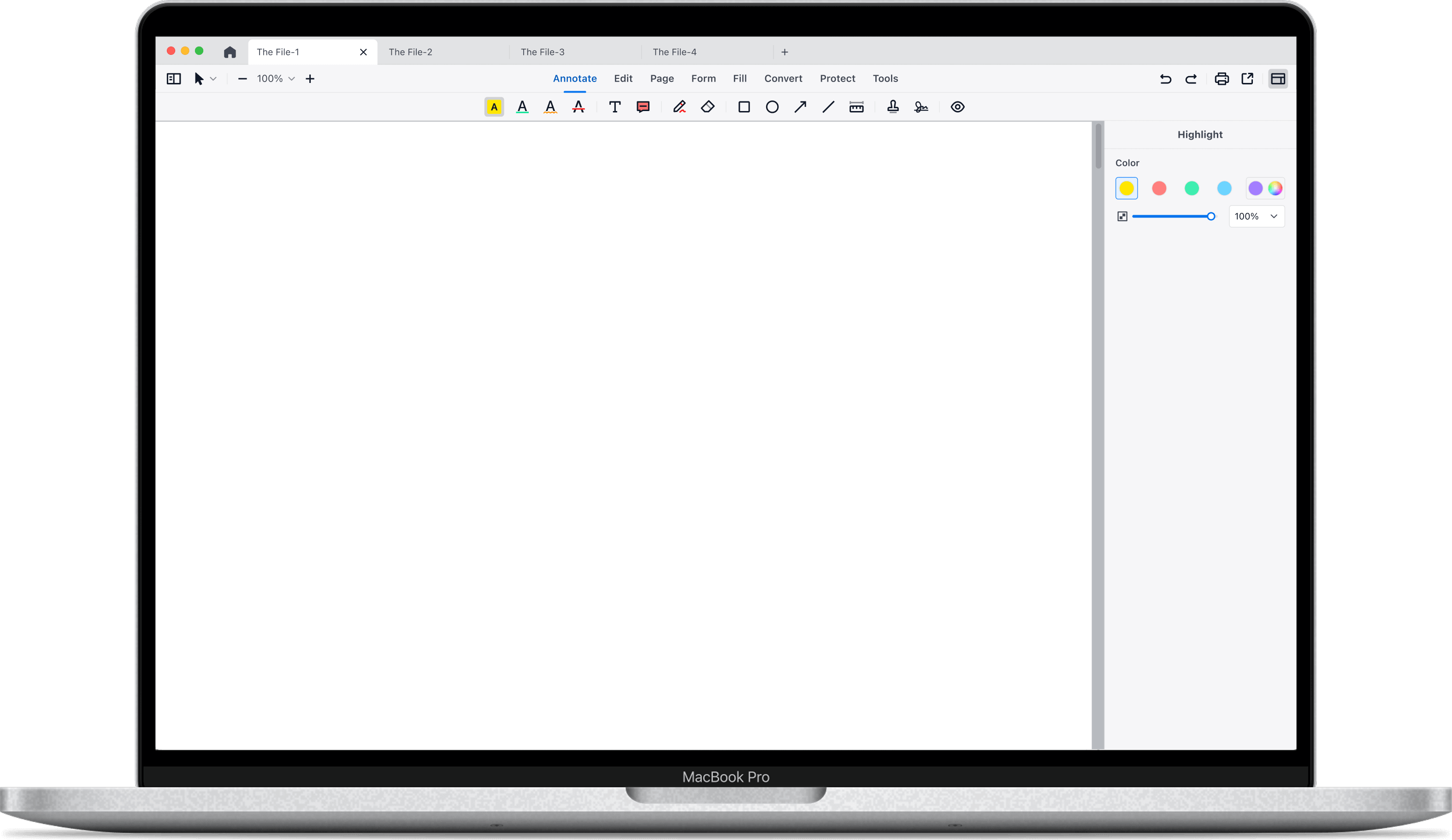

After downloading the free Form 1099-NEC template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

Support Chat

Support Chat