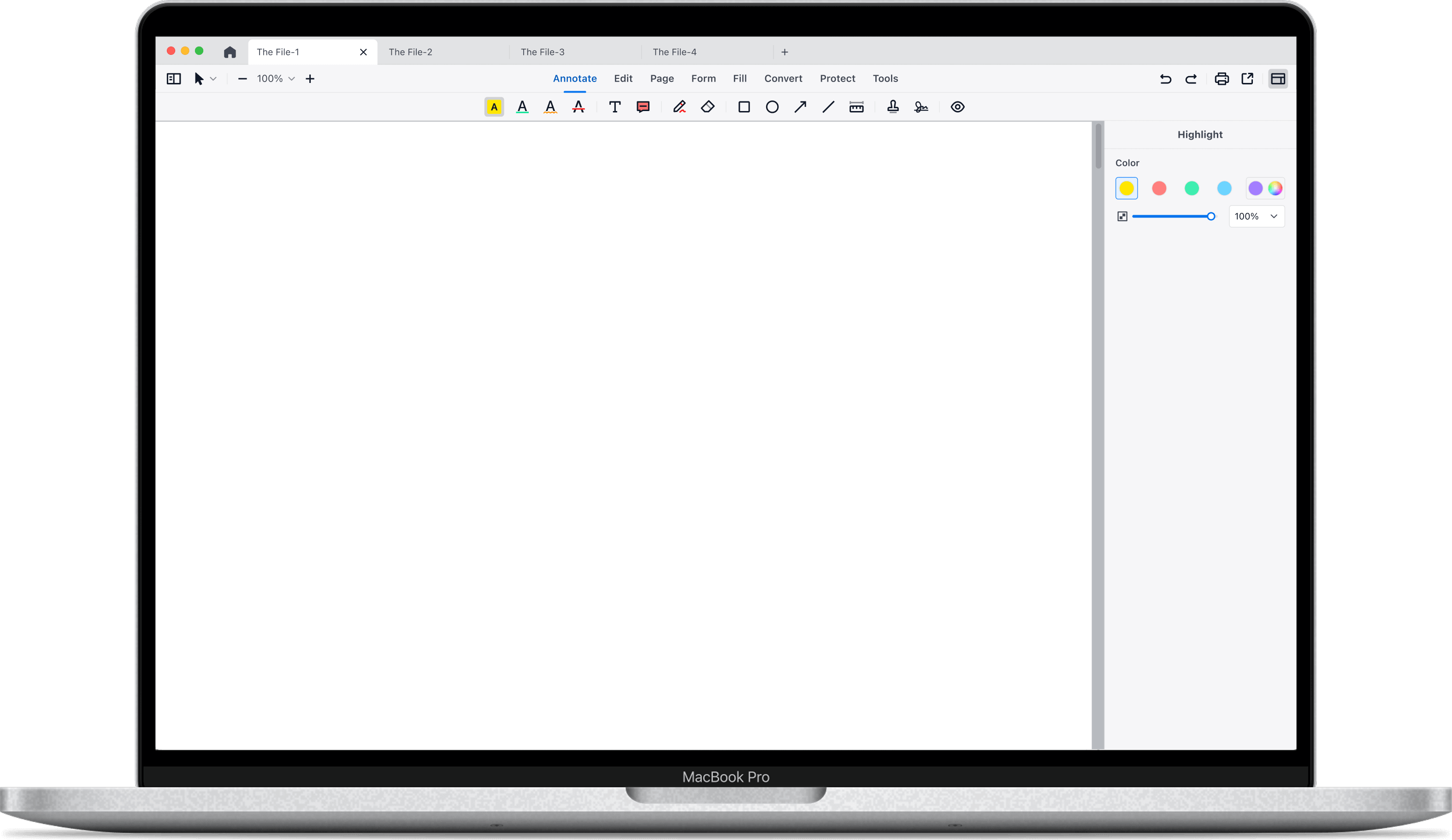

Schedule K-1 Form 8865 PDF Template

What is a Schedule K-1 Form 8865?

Schedule K-1 (Form 8865) is a tax document used by U.S. taxpayers to report their share of income, deductions, credits, and other financial items from a foreign partnership. This form is part of the Form 8865 package, which is required for U.S. persons who have certain interests in foreign partnerships. The Schedule K-1 provides detailed information necessary for partners to accurately report their share of the partnership's financial activities on their personal or corporate tax returns. This ensures compliance with U.S. tax laws and proper reporting of foreign income.

How to Fill in Our Schedule K-1 Form 8865 PDF Template

Follow these steps to fill in the Schedule K-1 Form 8865 template:

Part I: Information About the Partnership

A1: Enter the partnership’s employer identification number (EIN).

A2: Provide the reference ID number as per the instructions.

B: Fill in the partnership’s name, address, city, state, and ZIP code.

Part II: Information About the Partner

C: Enter the partner’s Social Security Number (SSN) or Taxpayer Identification Number (TIN), ensuring it is not the TIN of a disregarded entity.

D1: Provide the partner’s name, address, city, state, and ZIP code.

D2: If the partnership interest is owned through a disregarded entity (DE), enter the DE’s TIN and name.

E: Partner’s Share of Profit, Loss, Capital, and Deductions

Indicate the partner’s share percentages at the beginning and end of the tax year for:

Profit

Loss

Capital

Deductions

Check the box if the decrease is due to the sale or exchange of the partnership interest.

F: Partner’s Capital Account Analysis

Beginning capital account: Enter the value at the beginning of the year.

Capital contributed during the year: Enter any contributions made by the partner.

Current year net income (loss): Report the partner’s share of net income or loss.

Other increase (decrease): Attach an explanation for other changes.

Withdrawals & distributions: Enter the amount withdrawn or distributed to the partner.

Ending capital account: Calculate and enter the value at the end of the year.

G: Partner’s Share of Net Unrecognized Section 704(c) Gain or (Loss)

Report the values at the beginning and end of the year.

Part III: Partner’s Share of Current Year Income, Deductions, Credits, and Other Items

1: Report ordinary business income (loss).

2: Report net rental real estate income (loss).

3: Report other net rental income (loss).

4a: Enter guaranteed payments for services.

4b: Enter guaranteed payments for capital.

4c: Total guaranteed payments.

5: Report interest income.

6a: Report ordinary dividends.

6b: Report qualified dividends.

6c: Report dividend equivalents.

7: Report royalties.

8: Report net short-term capital gain (loss).

9a: Report net long-term capital gain (loss).

9b: Report collectibles (28%) gain (loss).

9c: Report unrecaptured section 1250 gain.

10: Report net section 1231 gain (loss).

11: Enter other income (loss).

12: Report section 179 deduction.

13: Enter other deductions.

14: Report self-employment earnings (loss).

15: Report credits.

16: Check if Schedule K-3 is attached.

17: Report alternative minimum tax (AMT) items.

18: Report tax-exempt income and nondeductible expenses.

19: Report distributions.

20: Enter other information.

21: Report foreign taxes paid or accrued.

Support Chat

Support Chat