Welcome to our 2023 tax season guide, where we will cover everything to do with paper returns, confirming your filing status, and ensuring your general tax payments are delivered on the correct business day.

Whether you're using your credit card or have specific payment plans in place, we'll make sure that this tax filing season is as smooth as possible for you. We'll also clue you up on your refund status, whether you've pursued mainstream employment or are part of the gig economy.

- Overview of the Tax Season

- Types of Tax Returns to File

- The Difference Between Standard Deduction vs. Itemized Deductions

- Tax Credits and Deductions Available

- Ensuring an Accurate Tax Return with PDF Reader Pro

Overview of the Tax Season

The tax season is a crucial time of the year when individuals and businesses are required to file their income tax returns with the IRS. It typically begins on January 1st and ends on the tax filing deadline, which is typically April 15th. However, depending on certain circumstances, such as natural disasters or other unforeseen events, the deadline may be extended.

During the tax season, millions of people across the country gather their financial documents and work to prepare and submit their tax returns. This includes individuals, married couples, independent contractors, and business owners. The tax returns provide information about their income, deductions, tax credits, and other relevant details that help determine their tax liability or any refund they may be entitled to.

Taxpayers have the option to file their returns electronically or by paper. Electronic filing is a popular choice as it offers several advantages, including faster processing times, more accurate returns, and the possibility of receiving tax refunds much sooner. Some individuals may also qualify to use the IRS Free File service, which allows eligible taxpayers to prepare and e-file their federal income tax returns for free.

Throughout the tax season, individuals should stay updated about any changes or new provisions that may impact their tax situation. This includes understanding the latest tax laws, deductions, and credits that may be available to them. Keeping track of important dates, such as the tax filing deadline and any applicable extensions, is also crucial to avoid penalties for late filing or paying taxes.

In summary, the tax season requires individuals and businesses to fulfill their tax obligations by filing accurate and timely tax returns. It is a period when taxpayers gather necessary documentation, navigate through tax forms, and utilize tax software or the assistance of tax professionals to ensure their taxes are filed correctly. By staying informed and organized, individuals can successfully navigate the tax season and effectively manage their tax situation.

Changes to Expect in 2023

The upcoming 2023 tax season is set to bring some significant changes that taxpayers should be aware of. With the potential impact of high inflation, stock market volatility, rising interest rates, and potential layoffs, understanding how these factors may affect your tax situation is crucial.

One notable announcement from the IRS is the increase in standard deductions for 2023. Standard deductions are a set amount that reduces your taxable income, and they typically increase each year due to inflation. Higher standard deductions mean that more taxpayers may choose to take the standard deduction instead of itemizing their deductions, simplifying the tax filing process for many.

In light of these changes, financial planning and forecasting will play a crucial role in helping individuals navigate the tax season effectively. Utilizing tax software or seeking professional help can provide invaluable assistance in understanding how these changes may impact your specific tax situation. Tax software allows individuals to input their financial information and receive accurate calculations and guidance on deductions, credits, and potential tax liabilities.

Professional help, such as consulting with a tax advisor or certified public accountant, can provide personalized advice tailored to your unique circumstances. They can offer insights into tax-saving strategies, opportunities for legitimate deductions, and guidance on how to maximize any potential benefits from the new tax laws.

In conclusion, the 2023 tax season brings changes that individuals need to stay informed about. Understanding the impact of inflation, stock market volatility, rising interest rates, and the potential for layoffs is crucial. Utilizing tax software or seeking professional help for financial planning and forecasting will help ensure accurate and optimized tax filing.

Tax Filing Deadline

An important date that taxpayers should mark on their calendars is the tax filing deadline. This is the last day for individuals to submit their federal income tax returns to the IRS. For the 2023 tax season, the deadline is expected to be on April 18th, as the usual deadline of April 15th falls on a Saturday. It is crucial for taxpayers to meet this deadline to avoid late filing penalties and interest charges.

Filing your tax return on time ensures that you comply with the IRS and allows you to claim any necessary deductions, credits, or refunds to which you are entitled. It is recommended to start preparing your tax documents well in advance to minimize stress and allow ample time for any potential questions or complications that may arise. Utilizing tax software or enlisting the help of a tax professional can help streamline the process and increase the likelihood of filing an accurate and complete return before the deadline.

Federal Deadline

The federal tax filing deadline for the 2023 tax season is an important date that taxpayers should note. In 2023, the deadline to file federal income tax returns is April 17th. It is crucial for taxpayers to meet this deadline to avoid penalties and interest.

Failing to file your taxes on time can have serious consequences. If you miss the deadline, you may be subject to penalties and interest charges. The penalty for filing late can be as high as 5% per month of the amount owed. Additionally, interest accrues on any unpaid taxes, further increasing your overall tax liability.

If you find yourself unable to file your taxes before the deadline, it is important to request an extension. This can be done by filing Form 4868 with the IRS. By filing an extension request, you can get an additional six months to file your tax return without incurring any penalties. However, keep in mind that an extension only applies to the filing deadline, not the payment of taxes owed. If you owe taxes, you must still make an estimated payment by the original deadline to avoid any potential penalties or interest charges.

In conclusion, meeting the federal tax filing deadline for the 2023 tax season is crucial to avoid penalties and interest charges. If you are unable to file your taxes on time, it is important to file an extension request to avoid unnecessary financial consequences.

State-Specific Deadlines

As the 2023 tax season approaches, it's important to be aware of the specific state deadlines for filing your tax returns. While the federal tax deadline is usually April 15th, each state has its own unique deadlines and extension options. Here are some key state-specific deadlines for the 2023 tax season:

- California: Taxpayers in California have until April 15th to file their state tax returns. However, an extension can be requested, giving you an additional six months to file until October 15th.

- New York: In New York, the state tax return deadline is also April 15th. Similar to California, taxpayers can request an extension, allowing them to file their returns by October 15th.

- Texas: Texas does not have a state income tax, so residents of the Lone Star State are only required to file their federal tax returns by the April 15th deadline.

- Florida: Similar to Texas, Florida also does not impose a state income tax. Therefore, residents of the Sunshine State only need to focus on filing their federal tax returns by April 15th.

- Pennsylvania: The state tax return deadline in Pennsylvania is typically April 15th. However, an extension can be requested, giving taxpayers until October 15th to file their returns.

Make sure to check with your state's tax authority for any additional requirements or considerations specific to your state.

Types of Tax Returns to File

When it comes to tax season, understanding the different types of tax returns that need to be filed is crucial. The type of tax return you file depends on your individual circumstances and sources of income. Here are some common types of tax returns to be aware of:

- Individual Tax Returns: This is the most common type of tax return filed by individuals to report their income, deductions, and credits. It is used by taxpayers who earn income from various sources, such as salaries, investments, and self-employment.

- Business Tax Returns: If you own a business, you will need to file a separate tax return for your business. The specific type of business tax return will depend on the legal structure of your business, such as a sole proprietorship, partnership, or corporation.

- Estate and Trust Tax Returns: When someone passes away, their estate may continue to generate income that needs to be reported and taxed. Estate and trust tax returns are used to report the income, deductions, and distributions of estates and trusts.

- Nonresident Alien Tax Returns: Nonresident aliens, who are individuals that are not U.S. citizens and do not have a green card, may still be required to file a tax return if they have income from U.S. sources.

- Gift Tax Returns: If you give a gift to someone that exceeds the annual gift tax exclusion amount, you may need to file a gift tax return to report the gift and potentially pay taxes on it.

Understanding the different types of tax returns will help ensure that you file the correct return and accurately report your income and deductions to the IRS.

Individual Tax Returns

Preparing and filing individual tax returns for the 2023 tax season is a crucial task that requires attention to detail and proper planning. The tax filing deadline for individual tax returns for the 2023 tax season is April 18, 2023, unless taxpayers file for an extension. It's important to note that taxpayers should stay updated on any changes or updates that may affect their tax filings for the current year.

To file individual tax returns, taxpayers need to gather and organize various forms and documents. These may include W-2 forms from employers, 1099 forms reporting income from other sources, and documentation supporting deductions and credits claimed. The most common form used for filing individual tax returns is the Form 1040, although there may be other forms and schedules depending on the taxpayer's specific circumstances.

When preparing individual tax returns, taxpayers should be aware of the deductions and credits they may be eligible for. Some popular deductions include the standard deduction, which is a set amount that reduces taxable income, and itemized deductions for expenses such as mortgage interest, medical expenses, and charitable donations. Tax credits, on the other hand, directly reduce the amount of tax owed and can be advantageous. Examples of tax credits include the child tax credit and the earned income tax credit.

In conclusion, individuals should be proactive in preparing and filing their tax returns for the 2023 tax season. By staying updated on any changes or updates, gathering the necessary forms and documents, and taking advantage of deductions and credits, taxpayers can ensure an accurate and timely filing.

Business Tax Returns

During the 2023 tax season, various types of business tax returns need to be filed. These include returns for sole proprietorships, partnerships, S corporations, and C corporations. It's important for business owners to understand the differences between these types of returns and the specific requirements for each.

A sole proprietorship is the simplest form of business entity, where the owner and the business are considered the same entity for tax purposes. The owner reports business income and expenses on Schedule C of their personal tax return, Form 1040.

Partnerships are formed when two or more individuals join together to conduct business. In a partnership, the business itself does not pay taxes. Instead, the partners report their share of the business's income and expenses on Form 1065, which is an informational return. Each partner then includes their share of the partnership's income or loss on their individual tax return.

S corporations are a type of business entity that provides limited liability to its shareholders. The income, deductions, and credits of an S corporation are passed through to the shareholders, who report their share on their individual tax returns using Form 1120-S.

C corporations, on the other hand, are separate legal entities from their owners. These corporations file their own tax returns using Form 1120. Shareholders of C corporations may also be subject to individual taxes on any dividends received.

It's crucial for business owners to understand the specific requirements and forms needed for each type of business tax return to ensure compliance during the 2023 tax season.

Required Forms and Documents

When it comes to filing your taxes for the 2023 tax season, it's important to gather all the necessary forms and documents to ensure a smooth and accurate process. One of the most commonly used forms is the Form 1040, also known as the U.S. Individual Income Tax Return.

This form is used by individuals who are reporting their income, deductions, and credits. Additionally, if you are a sole proprietorship or a partnership, you may need to fill out Schedule C or Form 1065, respectively, to report your business income and expenses.

S Corporation shareholders will need to use Form 1120-S, and C corporations will file their taxes using Form 1120. Other important documents to have on hand include W-2 forms from your employer, 1099 forms for any additional income, and any receipts or records of deductible expenses. By being organized and prepared with all the necessary forms and documents, you can make the tax filing process much easier and ensure that you are accurately reporting your income and deductions.

Federal Forms Needed for Filing

When it comes to filing taxes, individuals and businesses must be familiar with various federal forms required by the IRS. These forms serve different purposes and provide important information about income, deductions, and credits. Here are some key federal forms needed for tax filing:

- Form 1040: This is the main form for individual tax returns. It includes personal information, income, deductions, and credits. Most taxpayers can use the standard Form 1040, but those with more complex situations may need additional forms or schedules.

- Form 1120: This is the main form for filing business tax returns for corporations. It reports income and expenses and determines the tax liability of the corporation.

- Form 1065: This form is used for filing partnership tax returns. It reports the partnership's income, deductions, and credits, and determines the tax liability of the partnership.

- Form 990: Non-profit organizations use this form to report their financial information and activities to the IRS.

- Form 941: This form is used by employers to report and pay employment taxes, including income tax withholding, Social Security tax, and Medicare tax.

It's important to note that each form has specific requirements and guidelines associated with it. Filing accurate and complete federal forms is crucial to ensure compliance with tax laws. To learn more about these forms and their specific requirements, individuals and businesses can visit the IRS website or consult a tax professional. By understanding and properly completing the required federal forms, taxpayers can navigate the tax filing process smoothly and avoid any penalties or audits.

State Forms Needed for Filing

In addition to the federal forms required for filing taxes, individuals and businesses must also be aware of the state-specific forms needed to fulfill their state income tax obligations. Each state has its own tax laws and requirements, which means that different forms may be necessary depending on where you live.

State income tax due dates typically follow the federal tax deadline, which is usually on April 15th. However, it's important to note that there may be exceptions. Some states may have different due dates for filing state income taxes, so it's crucial to double-check the specific deadline for your state.

For example, states like South Carolina have a different state income tax due date of April 30th. Other states may even have earlier or later due dates. Additionally, rules for requesting a state tax extension can vary from state to state. Some states automatically grant an extension if you have already requested a federal extension, while others require a separate extension form to be filed.

To ensure you meet your state's tax obligations, it is highly recommended to check with your state's taxes and revenue authority. They will provide you with detailed information about state-specific forms, due dates, and any necessary extensions. By staying informed and submitting the correct forms on time, you can avoid penalties and ensure a smooth tax filing process.

The Difference Between Standard Deduction vs. Itemized Deductions

When it comes to filing your taxes, one important decision you'll need to make is whether to take the standard deduction or to itemize your deductions. The standard deduction is a predetermined amount that reduces your taxable income, while itemized deductions allow you to deduct specific expenses, such as mortgage interest, medical expenses, and charitable donations.

The choice between the two depends on your individual circumstances and which option will result in a lower tax liability. For the 2023 tax season, the standard deduction amounts are $12,900 for individuals filing as single or married filing separately, $25,800 for married couples filing jointly, and $19,350 for heads of household. It's important to note that the standard deduction has increased for the 2023 tax year due to inflation adjustments.

However, if your itemized deductions exceed the standard deduction amount, it may be more beneficial for you to itemize. It's essential to keep accurate records and consult with a tax professional to determine which deduction method is best for your tax situation.

Understanding the Difference Between Both Options

When it comes to filing your taxes, you have the option to take either the standard deduction or itemize your deductions. It's essential to understand the difference between the two and choose the option that benefits you the most.

The standard deduction is a fixed amount set by the government that reduces your taxable income. For the tax year 2023, the standard deduction for a single individual is $12,050, for married couples filing jointly, it is $24,100, and for head of household, it is $18,350. The advantage of taking the standard deduction is that it is simple and requires no itemization or tracking of expenses. However, it may not always maximize your tax savings.

On the other hand, itemized deductions allow you to deduct eligible expenses individually. Common deductible expenses include mortgage interest, state and local taxes, medical expenses exceeding a certain threshold, and charitable donations.

The advantage of itemizing is that it can potentially reduce your taxable income more than the standard deduction if you have significant eligible expenses. However, itemizing can be time-consuming as you need to gather documentation and calculate each deduction. Additionally, some itemized deductions have limitations and may not be available to everyone.

Before deciding whether to take the standard deduction or to itemize, it's crucial to evaluate your financial situation and calculate potential tax savings. Some individuals may find that the standard deduction is more beneficial, while others may benefit from itemizing their deductions. Consulting with a tax professional or using tax preparation software can help you determine which option is most advantageous for your specific circumstances.

In conclusion, understanding the difference between the standard deduction and itemized deductions is crucial for maximizing your tax savings. The standard deduction is a fixed amount that reduces your taxable income, while itemized deductions require you to calculate and deduct eligible expenses individually. Consider your financial situation and the potential advantages and disadvantages of each option to make an informed decision. By doing so, you can ensure you are optimizing your tax return and minimizing your tax liability.

Advantages and Disadvantages of Each Option

When it comes to filing your taxes, you have the option to either seek the assistance of a tax professional or tackle it yourself. Both options have their advantages and disadvantages, and it's important to consider your specific circumstances before making a decision.

Using a tax professional can provide a range of benefits. They have expert knowledge of tax laws and regulations and can ensure that your return is accurate and compliant with all applicable rules. This can help you avoid costly mistakes and potential audits. Additionally, a tax professional can help you navigate complex tax situations, such as self-employment income, rental property ownership, or income from multiple states. These situations often involve specific deductions and credits that can be difficult to navigate on your own.

However, there are also drawbacks to using a tax professional. The cost is one consideration, as hiring a professional can be more expensive than filing yourself. Additionally, you may have to rely on the availability and schedule of the tax professional, which can lead to delays in filing your return. Finally, some individuals enjoy the process of filing their taxes themselves and find it empowering to take control of their financial affairs.

On the other hand, filing taxes yourself can also have advantages. It can be cost-effective, particularly for individuals with straightforward tax situations. Platforms like TurboTax and H&R Block offer user-friendly tax software that guides you through the process step by step. For first-time filers or those with adjusted gross income of $73,000 or less, the IRS also offers free software through its Free File program. Filing yourself allows you to have a hands-on understanding of your financial situation and may provide a sense of accomplishment.

However, there are disadvantages to filing taxes independently as well. It can be time-consuming, especially if you have complex tax situations. The risk of making errors may be higher, which can lead to penalties or even audits. Additionally, you may miss out on potential deductions or credits if you are not aware of all available options.

Ultimately, the decision to use a tax professional or file taxes yourself depends on your unique circumstances. If you have a straightforward tax situation and feel confident in your ability to tackle the task, filing independently may be a good option. However, if you have complex income sources or want the peace of mind that comes with professional assistance, seeking the help of a tax professional is worth considering.

Tax Credits and Deductions Available

Tax credits and deductions can be valuable tools for reducing your tax liability during the 2022 and 2023 tax seasons. While both credits and deductions can lower your overall tax bill, they work in different ways.

Securing Financial Agreements: Loan Agreement

Navigate the terms of your loan with our customizable agreement template.

Tax deductions reduce the amount of your taxable income. They are subtracted from your total income before calculating your tax liability. Examples of common deductions include mortgage interest, student loan interest, and medical expenses.

Tax credits, on the other hand, directly reduce your tax liability dollar-for-dollar. They can be more valuable than deductions since they provide a greater tax savings. For example, if you owe $5,000 in taxes and qualify for a $1,000 tax credit, your tax bill would be reduced to $4,000.

One of the most significant credits available is the Earned Income Tax Credit (EITC). This credit is designed to benefit low to moderate-income workers and can result in a substantial refund, even if you owe no taxes. Other credits to consider include the Child Tax Credit, the Retirement Savings Contributions Credit, and the American Opportunity Credit for education expenses.

To take advantage of these credits and deductions, it's important to keep accurate records and consult with a tax professional or utilize tax software. They can help ensure you claim all eligible credits and deductions and maximize your tax savings. Be sure to explore these options during the 2022 and 2023 tax seasons to reduce your tax burden.

Ensuring an Accurate Tax Return with PDF Reader Pro

As you can tell by now, commercial tax filing companies are quite strict regarding everything from the 1099-K form to late payment penalties. While contacting taxpayer assistance centers is never a bad idea, ensuring you meet the deadline for taxpayers requires a strong attention to detail.

We've put together this PDF editing guide so that you can view, edit, and submit your federal return or filing extension in perfectly correct order.

How to Edit Tax Document PDF Files on Windows

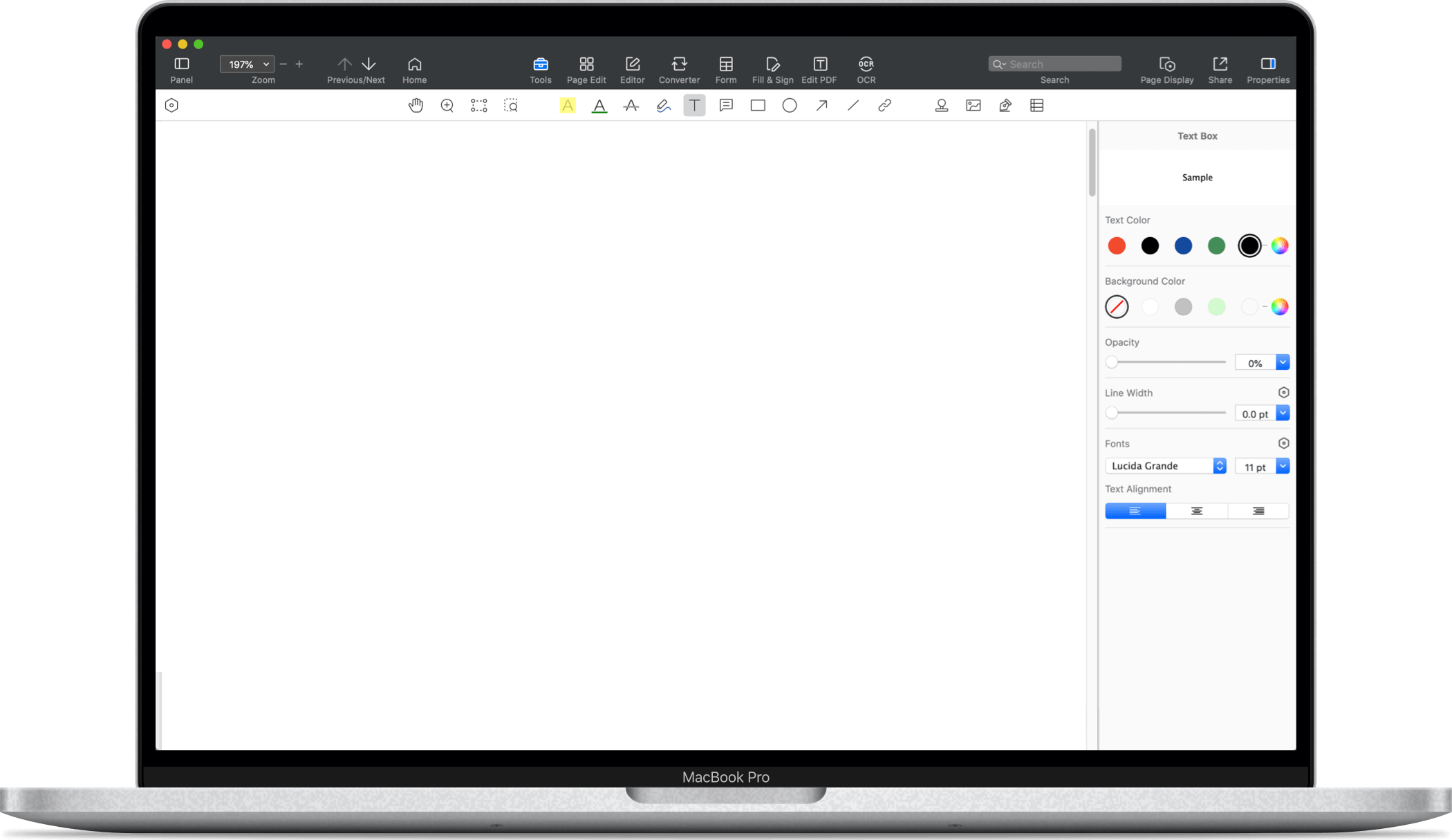

Using the Editing Text features on PDF Reader Pro, you can change your original file entirely or do some basic text editing.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Open Your PDF File

Open your document inside the PDF editor by clicking "Open File" or dragging it into the drop zone.

Step 2: Click Edit PDF tool in the top menu bar

This will open the editing interface, converting the pages to interactive elements.

Image Source: PDF Reader Pro

Step 3: Click on any text box to change the text

Editable blocks will appear, allowing you to select and alter text.

Step 4: Click Add Text on the top menu bar to add your own text.

PDF Reader Pro's built-in application for editing also allows you to add custom text wherever you choose by clicking to open a text box.

Image Source: PDF Reader Pro

Step 5: Head to the "Edit PDF" box on the right-hand side of the screen

Here you can use the tool panel to edit your text's Color, Size, Text Alignment, and Opacity with our advanced features.

Image Source: PDF Reader Pro

Step 6: Once done, click Save.

A pop-up menu will appear to allow you to rename your altered file.

Image Source: PDF Reader Pro

How to Edit Tax Document PDF Files on Mac

You can edit tax-related PDF documents following similar steps on your Mac operating system.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Open your PDF for Editing

Open your document in PDF Reader Pro.

Step 2: Click the Edit PDF tool in the top menu bar

This will open the editing interface, converting the pages to interactive elements.

Image Source: PDF Reader Pro

Step 3: Click on any text box to change the text

Editable blocks will appear, allowing you to select and alter text.

Step 4: Click Add Text on the top menu bar to add your own text.

PDF Reader Pro's built-in application for editing also allows you to add custom text wherever you choose by clicking to open a text box.

Image Source: PDF Reader Pro

Step 5: Opt to Use Our Tools for Editing

By clicking on the tool panel, you can change the color, size, text alignment, and opacity of your document with ease.

Image Source: PDF Reader Pro

Step 6: Once done, click Save.

A pop-up menu will appear to allow you to rename your altered file.

Image Source: PDF Reader Pro

Support Chat

Support Chat