Loans are a common financial transaction, whether between friends and family or formal lending institutions.

To ensure that both parties involved are on the same page and the terms of the loan are legally binding, it's essential to have a well-drafted loan agreement.

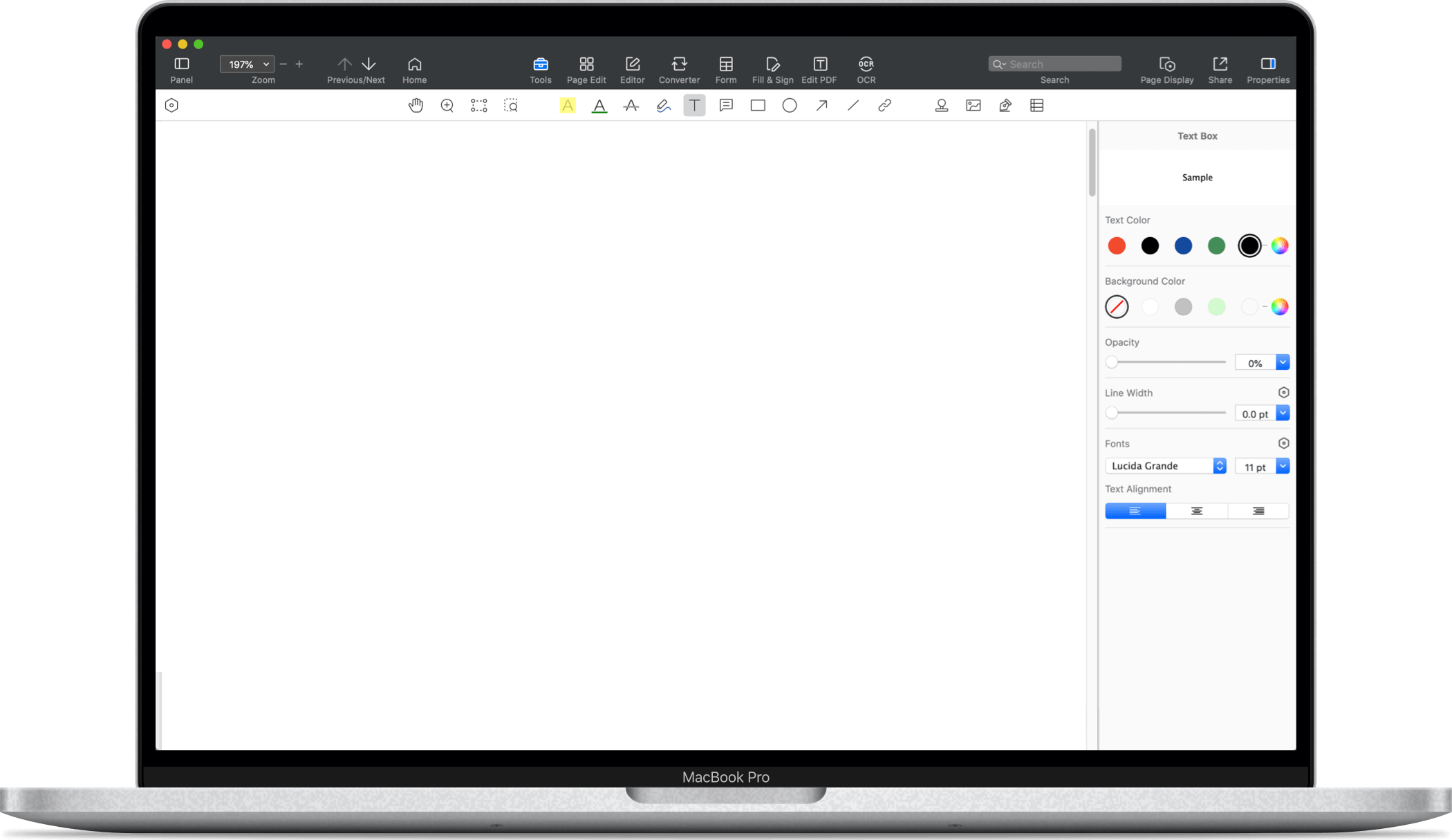

In this blog post, we'll guide you through the process of writing a loan agreement with the help of PDF Reader Pro, and we'll introduce you to their Loan Agreement PDF Template.

What is a Loan Agreement?

A loan agreement is a legally binding contract that outlines the terms and conditions governing a lending arrangement.

It is a crucial document used in various financial transactions, such as personal loans, business loans, and mortgages.

This agreement serves as a written record of the terms agreed upon by the lender and borrower, ensuring that both parties are aware of their obligations and responsibilities throughout the loan's duration.

Key Elements of a Loan Agreement

-

Promissory Note: A loan agreement often includes a promissory note, which is a written promise by the borrower to repay the loan amount, typically with interest, according to the specified terms.

-

Personal Loan: Loan agreements can pertain to various types of loans, including personal loans. These agreements are commonly used when individuals borrow money from friends, family, or financial institutions.

-

Loan Contract: The loan agreement can also be referred to as a loan contract, highlighting its legally binding nature.

-

Loan Terms: This section outlines the specific terms and conditions of the loan, including the loan amount, interest rate (if applicable), repayment term, and any collateral involved.

-

Repayment Schedule: The repayment schedule details the timing and amount of each repayment installment, providing a clear roadmap for the borrower.

-

Credit Unions: In some cases, credit unions may be involved in lending transactions, especially for personal loans. Their policies and terms are typically outlined in the loan agreement.

-

Credit Score: A borrower's credit score may play a role in determining the loan terms, including the interest rate. A good credit score can lead to more favorable loan terms.

-

Secured Loan: If the loan is secured by collateral, such as a vehicle or property, the loan agreement will specify the details of the collateral and the consequences of default.

-

Annual Percentage Rate (APR): The APR is a measure of the cost of borrowing, including both the interest rate and any additional fees. It is often disclosed in the loan agreement.

-

Payment Schedule: This section outlines the payment schedule in detail, specifying due dates, amounts, and the preferred method of payment.

-

Installment Payments: Loan agreements may include provisions for installment payments, allowing borrowers to repay the loan in multiple smaller payments rather than a lump sum.

-

Entire Agreement: The loan agreement may include a clause stating that the written agreement represents the entire agreement between the parties, superseding any previous oral or written agreements.

-

Regular Payments: This section emphasizes the importance of making regular payments as per the agreed-upon schedule to avoid late payment penalties.

-

Legal Documents: Loan agreements are considered legal documents, and they can be used as evidence in case of disputes or legal actions.

Ethiopian Airlines and Citi Sign a USD $450m Loan Agreement for Five New Aircraft

Read More: https://t.co/zLWwBm3az3 pic.twitter.com/WS9j5JYhVm

— Ethiopian Airlines (@flyethiopian) December 19, 2023

Importance of a Loan Agreement

A well-structured loan agreement is essential for several reasons:

- It protects the interests of both parties by clearly defining their rights and obligations.

- It helps prevent misunderstandings and disputes by providing a written record of the loan terms.

- It establishes a legally binding commitment to repay the borrowed funds.

- It may include provisions for addressing late payments or defaults, protecting the lender's investment.

In summary, a loan agreement is a vital document in any lending transaction, whether it involves personal loans, business loans, or mortgages.

It ensures that both the lender and borrower understand and adhere to the agreed-upon terms, promoting transparency and legal protection for all parties involved.

Explore our resume resource on crafting a Bill of Sale for a car, ensuring a smooth and secure transaction.

Why You Need a Loan Agreement

A loan agreement is a legally binding contract that outlines the terms and conditions of a loan.

Whether you are lending money to a friend, family member, or conducting a business transaction, a well-documented loan agreement can help prevent misunderstandings, disputes, and protect your interests.

Here's why you should consider creating one:

-

Clarity: A loan agreement clearly states the terms of the loan, including the amount borrowed, interest rate (if applicable), repayment schedule, and any collateral or guarantees involved.

-

Legal Protection: It provides legal protection for both the lender and borrower by defining their rights and responsibilities.

-

Prevents Misunderstandings: With a loan agreement in place, there is less room for misunderstandings or disagreements about the terms of the loan.

-

Evidence in Court: In the unfortunate event of a dispute, a well-documented loan agreement can serve as valuable evidence in court.

Now that you understand the importance of a loan agreement, let's dive into how to create one using PDF Reader Pro.

How to Write a Loan Agreement

Writing a loan agreement is a crucial step in formalizing a lending arrangement between two parties.

Whether you're lending money to a friend, financing a business loan, or securing a mortgage, a well-drafted loan agreement is essential to protect both the lender and the borrower.

In this step-by-step tutorial, we'll guide you through the process of writing a comprehensive loan agreement that serves as a binding contract.

Step 1: Define the Involved Parties

The first step is to identify the parties involved in the loan agreement clearly. This includes the lender (the person or entity providing the loan) and the borrower (the person or entity receiving the loan). Make sure to include their legal names and contact information.

Step 2: Outline the Key Terms

Specify the key terms of the loan, which are the fundamental details that both parties need to agree upon. These terms should include:

-

Loan Amount: Clearly state the amount of money being lent.

-

Interest Rate (if applicable): If the loan carries an interest rate, specify it along with how it will be calculated.

-

Repayment Schedule: Define the schedule for repaying the loan, including the frequency of payments (e.g., monthly, quarterly) and the due dates.

-

Automatic Payments: If the loan involves automatic payments, mention this and provide details on how these payments will be processed.

Step 3: Include Payment Details

Incorporate specifics about the payment process. Mention whether the payments will be made via check, bank transfer, or any other method. If periodic payments are involved, clearly outline the payment amount for each installment.

Step 4: Address the Term of the Loan

Define the period of time during which the loan will be in effect. Specify the loan's start date and end date, or if it's an open-ended loan, mention the conditions for loan termination.

Step 5: Discuss Repayment Options

Describe the options for repaying the loan. This could include lump-sum payments, installment payments, or any other agreed-upon method. Include details about any pre-payment penalties if applicable.

Pakistan inks $1.2 billion loan agreement with ADB - https://t.co/Ndw7qb3TDz pic.twitter.com/fM7KQXafvT

— Islamabad Insider (@IslooInsider) December 20, 2023

Step 6: Include Additional Clauses

Depending on the nature of the loan, you may need to include additional clauses to cover specific situations. These could involve collateral, late payment penalties, or any other terms that both parties need to agree upon.

Step 7: Consult Legal Experts

To ensure that your loan agreement complies with all relevant laws and regulations and provides the necessary legal protection, it's advisable to consult legal experts or attorneys. They can review the agreement and make any necessary revisions or suggestions.

Step 8: Review and Finalize

Review the loan agreement carefully to ensure that all terms are accurate and agreeable to both parties. Once both the lender and the borrower are satisfied, finalize the agreement.

Step 9: Sign and Date

Both parties should sign and date the loan agreement to make it legally binding. It's a good practice to have the signatures notarized for added authenticity.

Step 10: Keep the Original Agreement

After all parties have signed, retain the original agreement in a safe and accessible location. Provide copies to all involved parties, ensuring that everyone has a record of the agreement.

By following these steps and consulting with legal experts when needed, you can create a well-crafted loan agreement that serves as a binding contract, protecting the interests of both the lender and the borrower.

Dive into our resume resource for a detailed walkthrough on how to write a comprehensive buyout agreement.

Use a Loan Agreement PDF Template

PDF Reader Pro offers a Loan Agreement PDF Template that simplifies the process even further.

This template includes all the essential elements of a loan agreement, and you can easily fill in the details:

-

Download: Access the Loan Agreement PDF Template from PDF Reader Pro's template library.

-

Fill in Details: Open the template and fill in the required information, such as names, loan amount, terms, and more.

-

Customize: Tailor the template to your specific loan agreement requirements.

-

Save and Share: Save the completed agreement and share it with the other party for signatures.

Using PDF Reader Pro's Loan Agreement PDF Template ensures that you have a professionally structured loan agreement in no time.

Creating a loan agreement is a crucial step in any lending transaction, and PDF Reader Pro simplifies the process with its easy-to-use features and templates. With a well-documented loan agreement, you can protect your interests and maintain clarity in your financial transactions. Download PDF Reader Pro today and streamline the process of creating important documents like loan agreements.

How to Write a Loan Agreement: Best Practices

Creating a loan agreement, especially for personal loan agreements, is a critical process that requires careful attention to detail.

🇸🇪🇪🇺A new SEK 1.75bn loan agreement with railway company @SJ_AB will finance the purchase of 25 new trains in Sweden. This financing will support the modernisation & expansion of commercial rail services, thus reducing traffic congestion & carbon emission➡️https://t.co/5jMDbewU6r pic.twitter.com/YzIAzUnEvk

— European Investment Bank (@EIB) December 20, 2023

To ensure that your loan agreement is comprehensive, legally sound, and serves the interests of both parties, here are some best practices to follow:

1. Understand the Type of Loan Agreement

Before drafting your loan agreement, it's essential to determine the specific type of loan agreement you need. Different types of loans, such as personal loans, business loans, or mortgage loans, may have unique requirements and terms. Tailor your agreement to match the type of loan you are facilitating.

2. Specify Loan Terms Clearly

Clearly outline all essential loan terms within the agreement. This includes the loan amount, interest rate (if applicable), repayment period, and the total amount to be repaid. Clarity in these terms is essential to avoid misunderstandings.

3. Address Interest Rates

If your loan involves an interest rate, specify whether it is a fixed rate or variable rate. State the minimum interest rate, and if there is a federal rate applicable, ensure that it complies with legal regulations. Be transparent about how interest is calculated and when it accrues.

4. Define Repayment Period and Schedule

Establish a clear repayment period, specifying the start and end dates. Create a repayment schedule that outlines the due dates and amounts for each installment. You can use an amortization table to provide a breakdown of principal and interest payments over time.

5. Consider Prepayment Penalties

If you wish to impose prepayment penalties for borrowers who pay off the loan before the agreed-upon term, make sure to include this in the agreement. Be transparent about the penalty structure and circumstances under which it applies.

6. Include Penalty Fees

In the event of late payments or defaults, define penalty fees that the borrower will be responsible for. Clearly state the consequences of missing payments and the process for addressing defaults.

7. Protect Lender's Interest

If the loan is secured by collateral, describe the collateral in detail. Address how it will be managed in case of default. Consider involving a notary public to notarize the loan agreement, providing an extra layer of legal validity.

8. Consider Legal Counsel

For more complex loan agreements, involving legal counsel is advisable. Legal professionals can ensure that the agreement complies with all relevant laws and regulations and that it offers adequate protection for both parties.

9. Address Reasonable Expenses

Specify whether the borrower is responsible for any reasonable expenses incurred by the lender in connection with the loan. This might include legal fees or costs related to collecting overdue payments.

10. Review Credit History

Before entering into a loan agreement, review the borrower's credit history. This can help you assess the borrower's creditworthiness and make informed decisions about the loan terms.

11. Include Entire Agreement Clause

To avoid potential disputes, include an "entire agreement" clause, stating that the written agreement represents the complete understanding between the parties, superseding any previous oral or written agreements.

12. Consider Monthly Payments or Single Payment

Determine whether the loan will be repaid in monthly installments or as a single lump sum payment at the end of the loan term. Specify this in the agreement.

13. Seek Mutual Consent

Both the lender and the borrower should fully understand and agree to the terms of the loan agreement. Ensure that both parties have ample time to review the document and ask questions before signing.

By adhering to these best practices, you can create a loan agreement that is legally sound, fair, and provides clarity for all parties involved, ultimately reducing the risk of disputes and protecting the interests of both the lender and the borrower.

How to Write a Loan Agreement: FAQ

How does a Loan Agreement differ from a Legal Contract?

A Loan Agreement is a specific type of legal contract that outlines the terms and conditions of a loan. While both are legally binding agreements, a Loan Agreement is tailored to loans, specifying details like loan amount, interest rates, and repayment schedules.

What is the Principal Balance in a Loan Agreement?

The principal balance in a Loan Agreement refers to the original amount borrowed. It does not include interest or other fees that may have accrued during the loan term.

What is the Outstanding Balance in a Loan Agreement?

The outstanding balance in a Loan Agreement is the remaining amount that the borrower owes to the lender. It considers any principal balance, interest, and fees that have not yet been repaid.

What are the Basic Details to Include in a Loan Agreement?

Basic details in a Loan Agreement include the names and contact information of the parties involved, the loan amount, interest rate (if applicable), repayment schedule, and any collateral or guarantees.

How do Usury Laws Impact Loan Agreements?

Usury laws set limits on the maximum interest rates that can be charged on loans. Loan agreements must adhere to these laws to ensure they are legally valid and enforceable.

Can Financial Institutions Provide Loan Agreements?

Yes, financial institutions such as banks offer standardized loan agreements for various loan types, including bank loans, term loans, and mortgage loans. Borrowers can obtain these agreements from the institution.

What is a Personal Loan Contract?

A personal loan contract is a type of loan agreement specifically used for personal loans between individuals. It outlines the terms and conditions of the loan, including repayment details.

Are Loan Agreements Used for Business Loans?

Yes, business loans also utilize loan agreements. These agreements outline the terms of the loan, including the loan amount, interest rates, repayment schedules, and any collateral.

What are Complex Loans, and How do They Impact Loan Agreements?

Complex loans involve intricate financial structures and terms, often requiring detailed loan agreements to specify the terms comprehensively. These agreements can be more extensive than standard loan agreements.

Are Family Loan Agreements Considered Loan Agreements?

Yes, family loan agreements are a type of loan agreement used when individuals within a family lend money to each other. They define the loan terms and conditions, providing legal protection for both parties.

Can I Use a Loan Agreement Template?

Yes, using a loan agreement template can simplify the process of creating a loan agreement. Templates provide a structured framework where you can fill in the specific details of your loan.

What Should a Loan Document Include?

A loan document, often synonymous with a loan agreement, should include all essential details of the loan, including borrower and lender information, loan amount, interest rates, repayment terms, and any collateral or guarantees.

What is the Loan Process for a Loan Agreement?

The loan process involves applying for a loan, reviewing and negotiating the loan agreement, signing the agreement, disbursing funds, and adhering to the repayment schedule as outlined in the agreement.

What Factors Determine the Loan Type in a Loan Agreement?

The loan type in a loan agreement depends on the purpose of the loan. Common loan types include personal loans, business loans, mortgage loans, and payday loans, each designed for specific financial needs.

Can a Loan Agreement Include Collateral?

Yes, a loan agreement can include provisions for collateral. If the borrower defaults on the loan, the lender can claim the collateral as compensation for the outstanding debt.

What is a Mortgage Loan and How does it Differ in a Loan Agreement?

A mortgage loan is a specific type of loan agreement used to finance the purchase of real estate. It differs from other loan agreements in terms of the collateral involved—the property being purchased.

What are Payday Loans, and How do Their Agreements Work?

Payday loans are short-term, high-interest loans. Loan agreements for payday loans specify the loan amount, due date (typically the borrower's next payday), and associated fees and interest rates.

Writing a loan agreement is a crucial step when entering into any lending arrangement, whether it's a sizable loan for personal or business purposes. The type of loan, maximum usury rate, and credit checks may vary, but the fundamental principles of clarity, transparency, and legal compliance remain consistent.

Whether you choose traditional lenders, online lenders, or consider money from family or unrelated third-party lenders, a well-crafted loan agreement protects the interests of all parties involved. By including elements like pre-payment penalties, amortization schedules, and acceleration clauses, you can ensure that the agreement aligns with your specific needs and provides a clear roadmap for repayment.

While creating a loan agreement, it's advisable to seek the guidance of reasonable attorneys or network attorneys, especially for complex loans or those involving substantial personal property or real property as collateral. These legal professionals can help draft additional clauses to address unique circumstances and ensure that the agreement meets all legal requirements.

Remember that loan agreements are essential documents that can affect your financial well-being over an extended period of time. They can impact your credit history, so it's crucial to understand the terms fully before entering into any agreement. Always consult with legal counsel or financial experts when necessary to make informed decisions and protect your financial interests.

Free Download

Free Download  Free Download

Free Download