Navigating the world of health insurance can be complex, especially when it comes to filing health insurance claims. Health insurance claim forms are essential documents that allow policyholders to request reimbursement for medical expenses covered by their insurance.

In this blog post, we will guide you through the process of filling out a health insurance claim form with ease and efficiency. Plus, we'll introduce you to PDF Reader Pro's "Health Insurance Claim Form PDF Template" to simplify the process even further.

Understanding the Health Insurance Claim Form

Before diving into the details of filling out a health insurance claim form, it's crucial to understand its purpose and components:

- Purpose: A health insurance claim form is used to request reimbursement from your insurance provider for medical expenses covered by your policy. This can include doctor's visits, hospital stays, prescription medications, and more.

- Components: The claim form typically includes sections for personal information, details of the medical provider or facility, a description of the services provided, and any associated costs.

Discover the secrets to filling out PDF forms quickly and efficiently with our expert guide.

How to Fill Out a Health Insurance Claim Form

Step 1: Obtain the Claim Form

First, you need to obtain a copy of the health insurance claim form. You can usually find this form on your insurance company's website or by contacting their customer service.

Step 2: Complete Personal Information

Fill in your personal information accurately. This includes your name, address, date of birth, policy number, and contact information.

Step 3: Provide Details of the Medical Provider

Next, you'll need to provide information about the medical provider or facility where you received treatment. Include their name, address, phone number, and any other requested details.

Dr. Mary Talley Bowden is one of the few direct care specialists in the U.S. who does not contract with any health insurance companies and strives to offer affordable care with clear pricing.

Click on the link to read the full article:https://t.co/AheS9f4wU7 pic.twitter.com/M3BIMWk6AS

— Texas Scorecard (@TexasScorecard) December 21, 2023

Step 4: Describe the Medical Services

In this section, describe the medical services you received. Include the date of service, the name of the healthcare provider, a description of the treatment or service, and any diagnostic codes if applicable.

Step 5: Include Itemized Costs

List the costs associated with each medical service. This may include fees for doctor's visits, procedures, medications, or any other expenses related to your treatment.

Step 6: Attach Supporting Documents

If required, attach supporting documents to your claim form. This might include itemized bills from the healthcare provider, receipts, and any other relevant paperwork.

Step 7: Review and Sign

Before submitting the claim form, carefully review all the information you've provided to ensure accuracy. Once satisfied, sign and date the form.

Step 8: Submit the Claim

Submit the completed claim form to your insurance company through the specified channels. This can typically be done online, by mail, or through a designated portal provided by your insurer.

Explore our resume resource for the Certificate Of Insurance PDF Template, your key to seamless documentation.

Use a Health Insurance Claim Form PDF Template

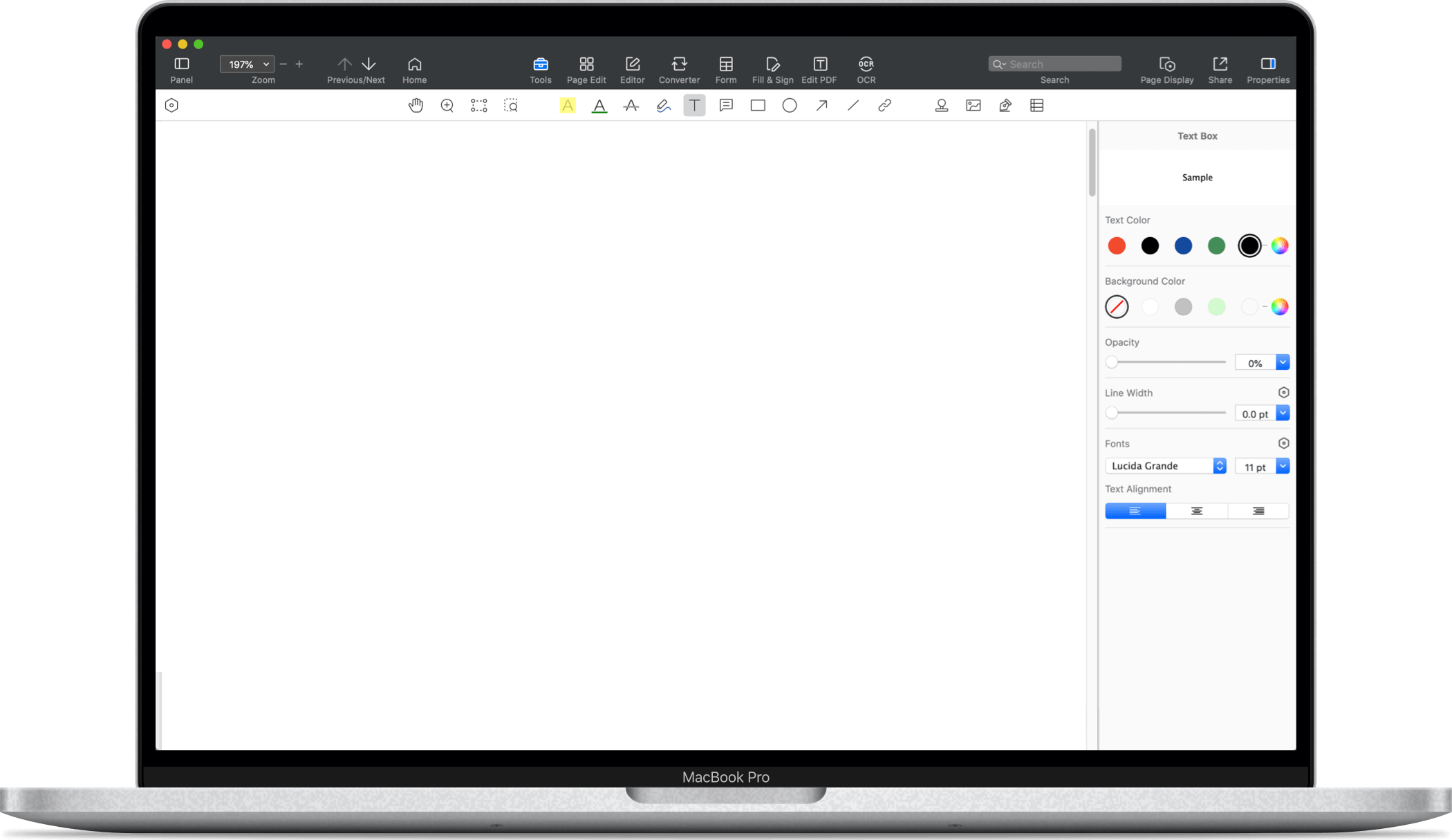

Filling out a health insurance claim form can be a meticulous task, but PDF Reader Pro makes it easier with its "Health Insurance Claim Form PDF Template."

This template offers a structured and user-friendly format for entering your information, ensuring you don't miss any crucial details.

Here's how PDF Reader Pro's template can help:

-

Structured Fields: The template provides organized fields for entering personal information, medical provider details, service descriptions, and costs.

-

Ease of Editing: PDF Reader Pro allows you to easily edit and fill in the template on your computer or mobile device, eliminating the need for manual handwriting.

-

Professional Appearance: Your completed claim form will have a polished and professional appearance, making it easier for insurance companies to process.

-

Digital Storage: PDF Reader Pro enables you to save and store your completed claim form digitally, ensuring you have a backup copy for your records.

Filling out a health insurance claim form doesn't have to be a daunting task. With PDF Reader Pro's Health Insurance Claim Form PDF Template, you can streamline the process, ensuring accuracy and efficiency when submitting your claims. Take advantage of this user-friendly tool to simplify your health insurance claim process today.

Health Insurance Claim Form: Best Practices

Filling out a health insurance claim form is a crucial step in the process of seeking reimbursement for your medical expenses.

To ensure a smooth and successful experience, it's essential to follow best practices when completing the form. Here are some key tips:

1. Use the Correct Health Insurance Claim Form

Start by using the correct health insurance claim form provided by your insurance company. Different insurance companies may have their own specific forms, so make sure you have the right one for your policy.

2. Double-Check Personal Information

Ensure that all personal information, including your name, address, date of birth, and middle initial, is accurate and up to date. Any errors or discrepancies can lead to delays in processing your claim.

3. Include Insurance Policy Details

Provide your insurance policy number and any other relevant policy information as required on the form. This helps insurance companies accurately identify your coverage.

4. Specify Insurance Primary and Secondary

If you have dual coverage or more than one insurance policy, clearly indicate which insurance is primary and which is secondary. This information helps in coordinating benefits correctly.

5. Accurate Diagnosis and Service Information

When describing the medical services received, use accurate diagnosis codes and descriptions. Be as specific as possible, and include any required diagnosis pointer codes.

6. Report Accident Involvement

If your medical expenses are the result of an auto accident, provide details about the accident, including the auto liability insurance information. This is crucial for insurance companies to determine responsibility.

7. Use Postal Codes Correctly

Fill in the postal code or ZIP code accurately for all addresses provided on the form. Errors in postal codes can lead to confusion and delays.

8. Authorization for Payment

If you are not the insured person but are filling out the claim form on their behalf, ensure you are authorized to do so. Include the necessary authorization and contact information for the authorized person.

9. Complete Additional Claim Sections

If your claim involves additional claims or services beyond the initial claim, make sure to complete the sections for additional claim on the form. Provide all the necessary details for each additional claim.

10. Keep Copies and Records

Before submitting your completed claim form, make copies for your records. Retain copies of all supporting documents, including bills and receipts. This documentation is valuable in case of any disputes or follow-ups.

11. Review Your Health Insurance Coverage

Take the time to understand your health insurance coverage, including deductibles, co-pays, and out-of-pocket expenses. This knowledge will help you accurately complete the claim form and manage your expectations regarding reimbursement.

12. Submit the Claim Promptly

Submit your completed claim form and all required documents to your insurance company as soon as possible. Timely submission can expedite the reimbursement process.

13. Keep Communication Open

Maintain open communication with your health care provider and insurance company. Stay informed about the status of your claim and follow up if necessary.

14. Seek Assistance from Experts

If you encounter difficulties or have questions about the claim process, don't hesitate to seek assistance from insurance experts or professionals who specialize in insurance claim forms. They can provide guidance and help you navigate the complexities of the process.

By adhering to these best practices, you can increase the likelihood of a successful health insurance claim submission and ensure that you receive the reimbursement you are entitled to for your medical expenses.

Health Insurance Claim Form: FAQ

What is a Form for Health Insurance?

A form for health insurance is a standardized document used to file a claim for health insurance benefits. It's typically required when seeking reimbursement or direct payment for medical services under your health insurance policy.

How Do Health Insurance Benefits Work?

Health insurance benefits refer to the specific healthcare services and treatments covered under your health insurance policy. These benefits outline what medical procedures and services are financially supported by your insurance.

What is a Health Insurance Benefit Plan?

A health insurance benefit plan is a comprehensive package offered by health insurance providers. It details the scope of coverage, including types of services covered, coverage limits, and guidelines for filing claims.

How Does Health Insurance Claim Reimbursement Work?

Health insurance claim reimbursement involves submitting a claim form to your health insurance company for services received. Upon approval, the insurer reimburses you or pays the healthcare provider directly according to your plan’s coverage.

What is the Role of a Health Insurance Company?

A health insurance company is an organization that provides health insurance policies. They assess healthcare risks, determine coverage details, manage policyholder premiums, and process claims for medical services.

How is the Health Insurance Company Website Useful?

The health insurance company website offers vital information for policyholders, including details about health insurance policies, guidelines for filing claims, a list of network providers, and customer service contact information.

What is a Health Insurance Policy?

A health insurance policy is a legally binding contract between an individual or a group and an insurance provider. It defines the terms of health coverage, including covered services, premiums, deductibles, and out-of-pocket limits.

Who is a Health Insurance Provider?

A health insurance provider can be an insurance company offering health insurance plans or a medical professional/facility that delivers healthcare services covered under a health insurance policy.

What are Health Insurance Steps?

Health insurance steps refer to the sequence of actions involved in acquiring, managing, and utilizing health insurance, from choosing a suitable policy and understanding its coverage, to filing claims and receiving benefits.

Why is an Insurance Card Important?

An insurance card is crucial as it contains key information about your health insurance coverage, such as policy numbers and coverage details. It is often required for identification and verification when accessing healthcare services.

What is an Insurance Carrier?

An insurance carrier is an entity that underwrites and issues insurance policies, including health insurance. They are responsible for determining coverage, setting premiums, and handling claims.

How Does an Insurance Check Work?

An insurance check is a payment method used by insurance carriers to settle claims. It is issued either to the insured party or directly to the healthcare provider for services covered under the insurance policy.

What Does Insurance Coverage Applicable Mean?

Insurance coverage applicable refers to the range of medical services and treatments that are included and financially covered under a health insurance policy.

Why are Insurance Documents Necessary?

Insurance documents, including policy agreements and claim forms, are essential for understanding your coverage, benefits, and responsibilities. They provide the details needed to effectively manage and utilize your health insurance.

What is an Insurance Explanation?

An insurance explanation, often provided as an Explanation of Benefits (EOB), is a document that outlines how a health insurance claim was processed. It details the services billed, the amounts covered by insurance, and any patient responsibility.

How is Insurance for Payment Processed?

Insurance for payment is processed when an insurance company receives and reviews a health insurance claim, then disburses payment based on the terms of the policy, either as a reimbursement to the insured or directly to the healthcare provider.

What are Lots of Reasons Insurance Might Not Cover a Service?

There are various reasons an insurance might not cover a service, including policy exclusions, services deemed non-essential or cosmetic, lack of prior authorization, or services exceeding coverage limits.

What Characterizes a Normal Health Insurance Company?

A normal health insurance company is characterized by its provision of a range of health insurance products, adherence to regulatory standards, processing of claims, and management of policyholder relationships and coverage.

What are Occasions of Service in Health Insurance?

Occasions of service in health insurance refer to the individual instances or visits when healthcare services are provided and are subject to insurance coverage according to the policy terms.

Why Must the Provider of Service be Specified in Claims?

The provider of service must be specified in claims to ensure that the healthcare services rendered are eligible for coverage under the insurance policy and that they were provided by a recognized and authorized healthcare provider.

Who are Providers of Service in Health Insurance?

Providers of service in health insurance are healthcare professionals or facilities that offer medical care and services. These include doctors, hospitals, clinics, and other medical practitioners covered under a health insurance plan.

What is a Service Code in Health Insurance?

A service code in health insurance is a unique identifier used to specify a particular medical procedure or service in billing and claims processing. These codes help standardize and streamline the insurance claim process.

Navigating the world of health insurance can be complex, but understanding key components like primary insurance, the Explanation of Benefits form, and the specifics of care health insurance are crucial. Whether you're dealing with a large insurer like Anthem Insurance Company or exploring options with independent insurance, the process of submitting insurance claim forms and understanding the type of health insurance you have is vital.

Each health insurer, including your health plan insurer, provides unique coverage details and additional instructions that need careful attention. The administrative aspects, such as clerical time and the exact time limit for filing claims and appeals, are as important as understanding your coverage. For families, considerations extend to family head responsibilities and family planning services, all of which are part of comprehensive health insurance planning.

It’s important to remember that each health insurance claim reimbursement form is a step towards ensuring you receive the benefits of your policy. While dealing with paperwork and timelines, like the timeline for filing appeals, can be demanding, it's a necessary part of managing your healthcare finances. In cases of admission of liability or payment liability, being well-informed and proactive is key.

Ultimately, the goal is to ensure that you and your family have the coverage needed for a healthy, secure future. Understanding these various facets of health insurance empowers you to make informed decisions and effectively manage your healthcare needs.

Free Download

Free Download  Free Download

Free Download