As more and more foreign enterprises and individuals look to the United States for growth opportunities, understanding U.S. taxation becomes imperative. If you're a foreign individual working or conducting business in the U.S., Form W-8BEN is a tax form you'll need to be familiar with.

In this article, we'll explain what Form W-8BEN is, how to fill it out, and what types of income it covers. We'll also provide guides on how to fill out this tax form with PDF Reader Pro for Windows and Mac users.

- What is Form W-8BEN?

- How to Download Form W-8BEN?

- What Does Form W-8BEN Prove?

- Types of Income Covered by Form W-8BEN

- Form W-8BEN Key Terminologies

- Understanding the Structure of Form W-8BEN

- How to Fill Out Form W-8BEN with PDF Reader Pro for Windows Users

- How to Fill Out Form W-8BEN with PDF Reader Pro for Mac Users

- Form W-8BEN Best Practices

- Form W-8BEN FAQ

What is Form W-8BEN?

Form W-8BEN is a document required by the U.S. Internal Revenue Service (IRS) for foreign individuals who earn income in the United States. According to U.S. tax regulations, foreign persons are typically subject to a 30% withholding rate on certain types of U.S.-source income.

However, Form W-8BEN allows foreign individuals to claim a reduction or exemption from U.S. tax withholding if their country of residence has a tax treaty with the United States.

Click here to get your W-8BEN form!

By completing Form W-8BEN, foreign individuals certify their country of permanent residence and can thereby qualify for tax treaty benefits, including lower rates on income. It's crucial to submit Form W-8BEN to your payers or withholding agents rather than directly to the IRS.

How to Download Form W-8BEN?

Simply download Form W-8BEN here from our PDF Reader Pro templates selection.

If you fail to submit your Form W-8BEN on time, you may be subject to a 30% withholding rate on your U.S.-source income. To download a Form W-8BEN template, visit the IRS website or use resources like PDF Reader Pro.

There are many different types of W8 forms, including:

You need to distinguish the difference between each form. In addition, make sure to submit tax forms before the expiration date to avoid paying taxes in different two countries.

What Does Form W-8BEN Prove?

-

Foreign Status: It certifies that you are not a U.S. resident for tax purposes.

-

Beneficial Ownership: It proves that you are the beneficial owner of the income for which a U.S. withholding tax is required.

-

Tax Treaty Benefits: It establishes that your country of citizenship has an income tax treaty with the United States, allowing you to claim reductions or exemptions from U.S. withholding tax.

Types of Income Covered by Form W-8BEN

The form can cover various types of income, including:

-

Personal Services Income: Payments for services rendered, such as consulting or freelancing.

-

Fellowship Income: Stipends, scholarships, or grants usually for educational purposes.

-

Taxable Income: Other forms of income that fall under the U.S. tax code.

-

Non-U.S. Source Income Payments: Payments from sources outside the United States that may still be subject to U.S. tax laws.

-

Original Issue Discount: Income earned from the difference between the redeemed value of a bond and its issue price.

Note: For foreign businesses, there's a different form known as Form W-8BEN-E, which must be filled out to claim benefits under an applicable tax treaty. You can download form W-8BEN-E here.

Form W-8BEN Key Terminologies

-

Withholding Agent: The individual or entity responsible for withholding taxes on payments made to you.

-

Beneficial Owners: These are the true owners of income, not just the recipients but the individuals who have a claim to it.

-

Rate on Income: The percentage at which the IRS will withhold tax on your income, which can be reduced through tax treaties.

-

Electronic Signatures: The IRS currently does not accept electronic signatures on Form W-8BEN. It must be signed manually.

-

Tax Forms: Other forms you may encounter when dealing with U.S. taxation, such as a federal income tax return, may affect how you fill out Form W-8BEN.

Understanding Form W-8BEN is crucial for foreign individuals who work or do business in the U.S. The form serves to certify your foreign status, beneficial ownership of income, and eligibility for tax treaty benefits.

Not submitting this form on time could result in higher withholding taxes, so completing it as early as possible is advisable. For more information or to download Form W-8BEN, you can visit the IRS website or resources like PDF Reader Pro.

If you have further questions, it's always best to consult a tax advisor who specializes in U.S. taxation for foreign individuals.

Understanding the Structure of Form W-8BEN

Form W-8BEN is divided into three main sections:

- Part 1: Identification of Beneficial Owner — This part consists of eight lines.

- Part 2: Claim of Tax Treaty Benefits — This part includes two lines.

- Part 3: Certification — This is where you certify the information by signing and dating the form.

Part 1: Identification of Beneficial Owner

Line 1

Input the full name of the beneficial owner in this field. This is typically the individual who owns the income and is responsible for filing a federal income tax return. Avoid using abbreviations or acronyms.

Line 2

Here, enter your country of citizenship. If you hold dual citizenship, specify the country where you are both a citizen and a resident when filling out this form. If you don't have residency in any of the countries where you hold citizenship, indicate the country where you were most recently a resident.

Line 3

Your permanent residence address goes here. This is the address in your country of residence for income tax purposes. Be as detailed as possible, including city, state or province, and postal code where applicable. This address will indicate to the IRS your country for tax treaty purposes.

Line 4

If your mailing address is different from your permanent residence address, you'll need to complete this line as well.

Line 5

If you possess a Social Security Number (SSN), enter it in this line. If you don't have an SSN and are not eligible to get one, you may apply for an Individual Taxpayer Identification Number (ITIN) by submitting Form W-7 to the IRS. Having an SSN or ITIN is essential for claiming tax treaty benefits.

Line 6

In the 6a field, type your Foreign Tax Identification Number (FTIN) issued by your jurisdiction. If an ITIN is not required, check the box in 6b.

Line 7

This line can be used for any additional referencing information that might assist the withholding agent in fulfilling their obligations concerning income paid to you.

Line 8

Here, you'll enter your date of birth in the format mm-dd-yyyy.

Part 2: Claim of Tax Treaty Benefits

Line 9

Identify the country where you claim to be a resident for income tax treaty benefits. This will determine your eligibility for reduced withholding rates on taxable income, including fellowship income and non-U.S. source income payments.

Line 10

Use this line only if you are claiming treaty benefits requiring additional conditions not covered by Line 9 or Part 3.

Part 3: Certification

After confirming all the information provided is correct, sign and date Form W-8BEN to validate its authenticity.

Some Details to Consider

Form W-8BEN is not a one-size-fits-all form; it is specifically designed for individual beneficial owners of income. If you're a foreign business, you'd be required to fill out Form W-8BEN-E instead.

It's crucial to complete the form accurately to avoid withholding on income paid at higher rates or losing out on treaty benefits. Once you've filled out the form, it's advisable to keep a PDF form for your records and for any future reference.

If you're uncertain about any parts of Form W-8BEN, it's recommended to consult with a tax advisor to ensure you're meeting all the requirements for income subject to U.S. taxation.

How to Fill Out Form W-8BEN with PDF Reader Pro for Windows Users

PDF Reader Pro allows you to fill out any tax form quickly. Check out our Form W-8BEN guide for Windows users!

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Form W-8BEN is a PDF document that contains interactive form fields, so you can directly type on it

Step 2: Or you can tick the checkboxes as needed

Step 3: To sign the Form W-8BEN, click Tools on the toolbar and choose Signature

Click on your signature in the right-side panel and then click on the "Sign Here" field.

Step 4: Click File on the top menu bar to print the form and choose Print

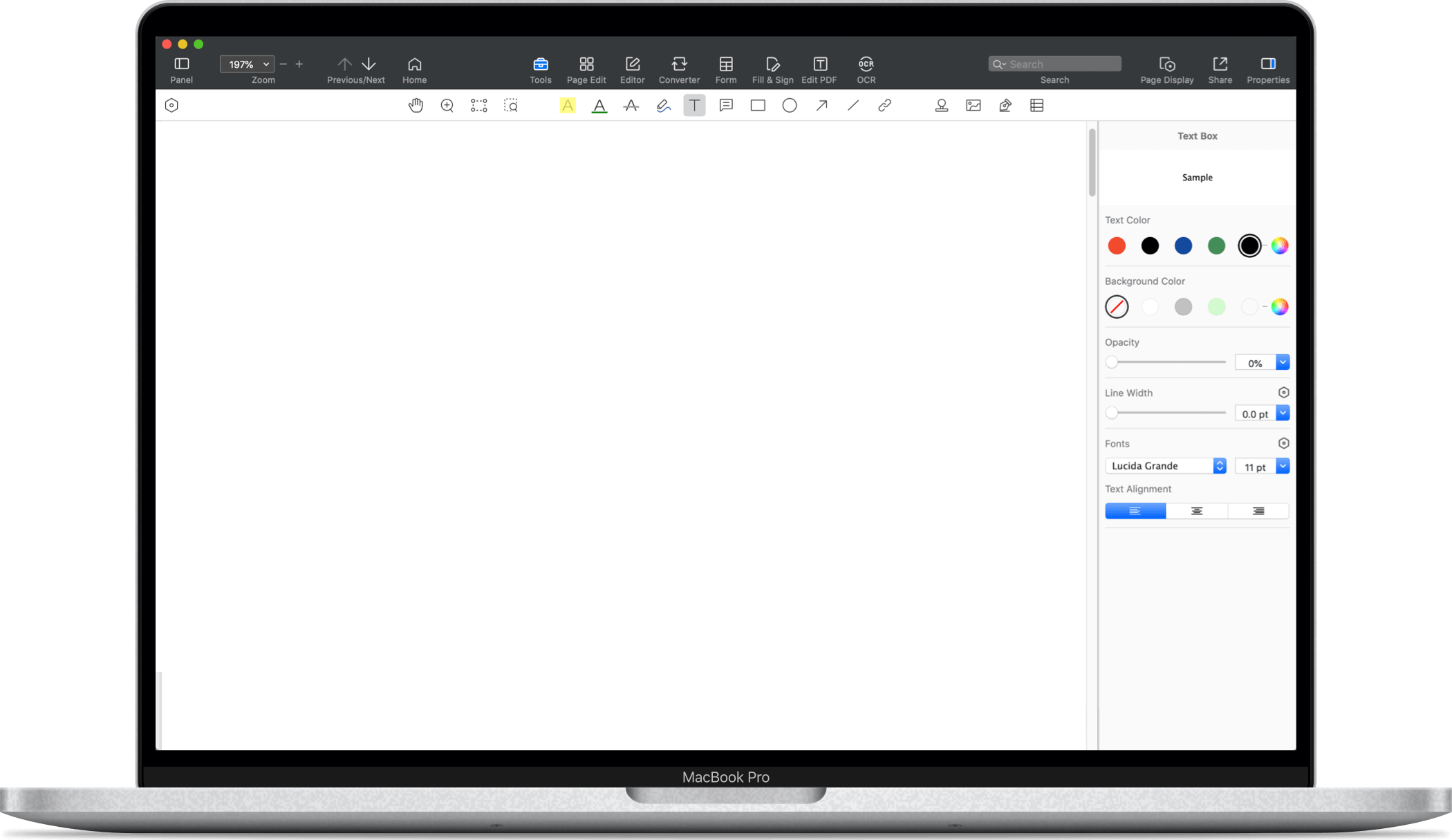

How to Fill Out Form W-8BEN with PDF Reader Pro for Mac Users

PDF Reader Pro offers a seamless experience for completing tax forms, including Form W-8BEN, especially tailored for Mac users. Explore our comprehensive guide to navigate through Form W-8BEN effortlessly!

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Form W-8BEN comes as an interactive PDF with built-in form fields, allowing you to input your information directly into the document.

Step 2: Make sure to click on checkboxes if required

Step 3: To place your signature on Form W-8BEN, navigate to the toolbar, select 'Tools,' and choose the 'Signature' option

In the panel on the right, locate your saved signature and click on it, then proceed to click on the designated "Sign Here" field within the form.

Step 4: Click File on the top menu bar to print the form and choose Print

Form W-8BEN Best Practices

-

Accuracy in Permanent Address: Your permanent address plays a significant role in determining your eligibility for treaty benefits. Ensure it is complete and accurate.

-

Know the Regulations: Being familiar with the requirements of sections related to Form W-8BEN can save you from making costly errors. This will help you better understand alien status, immigration status, and hybrid status.

-

Documentation Requirements: Make sure you gather all required documents beforehand, such as your Foreign Tax Identification Number (FTIN) or Individual Taxpayer Identification Number (ITIN), as the case may be.

-

Filing Requirements: Familiarize yourself with the filing requirements for Form W-8BEN, especially if you are a nonresident alien individual. This includes understanding withholding requirements.

-

Partnership Awareness: If you’re involved in a foreign partnership subject to U.S. tax laws, know how to appropriately fill out Form W-8BEN for partnership purposes.

-

Single Withholding Agent: Where possible, maintain a single withholding agent to simplify your filing process. This agent nominee will be the go-to person for purposes related to Form W-8BEN.

-

Signature Pad: Utilize a signature pad for a more authentic and secure signature, ensuring that the form is legally binding.

-

Review Insurance and Investment Companies: If you're related to insurance or investment companies, make sure to understand how Form W-8BEN applies to you.

-

Understand Exemption from Tax: Know when you're eligible for exemptions from tax, including tax treaty exemptions related to personal services income or annuity contracts.

-

Consult a Qualified Intermediary: For complex financial arrangements, consult a qualified intermediary to guide you through foreign intermediary issues.

Form W-8BEN FAQ

What is the significance of my permanent address?

Your permanent address is vital as it helps to determine your residency for tax treaty benefits.

Navigating Tax Compliance Made Easy: PDF Reader Pro's Support for W-8 Forms

Simplify the process of managing W-8 forms with ease.

What does "Person Under Sections" mean?

"Person Under Sections" refers to the categorization of your tax status under various IRS regulations sections. Understanding this helps to identify your filing and withholding requirements.

What are the purposes of sections?

The "Purposes of Sections" usually spell out what each section of the form is intended to clarify or establish, be it alien status, documentation requirements, or withholding requirements.

Can a foreign partnership file Form W-8BEN?

No, Form W-8BEN is meant for individual beneficial owners of income. A foreign partnership should consult the regulations sections applicable to them and may have to file other forms, such as Form W-8BEN-E.

Do I need to meet specific documentation requirements?

Yes, you will need to provide either an ITIN or an FTIN when filing out Form W-8BEN.

What does the term "nonresident alien individual" imply?

This term refers to an individual who is not a U.S. citizen and does not pass the substantial presence test, which has specific filing and withholding requirements under U.S. tax laws.

What is an "Agent For Purposes" in Form W-8BEN?

An agent for purposes usually refers to a single withholding agent or a qualified intermediary responsible for withholding and remitting taxes on behalf of the nonresident alien individual.

What are the implications of having a hybrid status?

A hybrid status occurs when you have different tax statuses in multiple jurisdictions. Consult a tax advisor to understand the implications on your tax treaty exemption and withholding requirements.

Is a signature pad recommended for electronic filing?

While not mandatory, using a signature pad is considered more secure and can add an extra layer of authentication to the form.

If you have further questions or your case involves complex issues like annuity contracts, it's advised to consult a tax advisor to make sure you meet all the conditions and requirements of the form.