Navigating the complexities of tax paperwork is rarely straightforward. Amidst a sea of similar-looking forms, it's easy to get lost, which is why guidance is essential when tackling tax-related documents. This piece focuses on the intricacies of filling out W-9 forms.

The W-9 form is a document distributed by the Internal Revenue Service (IRS) for use by various businesses and working professionals. Specifically, if you are an independent freelancer, self-employed individual, or a business offering services to other companies, you're obliged to fill out this form. The W-9 form calls for essential details like your name, residential address, and taxpayer identification number, which could either be an Employer Identification Number (EIN) or a Social Security Number (SSN).

Given that you may need to submit this form multiple times, it's a good idea to complete it once and save a copy for future submissions. With PDF Reader Pro, this process is streamlined and accessible on various platforms including Mac, Windows, iOS, and Android. In the following sections, we'll explore the steps for efficiently filling out a W-9 form.

- What is a W-9 Form?

- Why You Need to Fill Out a W-9 Form

- Who Might Ask You Form W-9?

- How to Download Form W-9?

- What Are the Components of Form W-9?

- How to Fill Out Form W-9 for Windows

- How to Fill Out Form W-9 for Mac

- Completing the Form Step by Step

- Which Information Is Needed for a W-9 Form?

- Signing the Document

- Submitting the W-9 Form to an Employer/Payer

- Verifying Your Submission is Complete

What is a W-9 Form?

A W-9 form is an essential tax document used by individuals and businesses to request the taxpayer identification number (TIN) of another party, such as an independent contractor or freelancer. This form is typically required when making payments to a person or entity for services rendered.

The purpose of the W-9 form is to provide accurate information to the Internal Revenue Service (IRS) for tax purposes, ensuring that the proper tax obligations are met. Understanding how to fill out a W-9 form correctly is crucial to avoid any potential errors and to ensure compliance with tax regulations.

In this article, we will guide you through the process of completing a W-9 form, highlighting the essential sections and providing useful tips along the way. By following these instructions, you'll be well-equipped to accurately fill out a W-9 form and meet your tax obligations efficiently.

Why You Need to Fill Out a W-9 Form

When it comes to tax forms and tax compliance, accurate recordkeeping is crucial for both individuals and businesses. One important document that plays a significant role in this process is the W-9 form. By filling out a W-9 form, you provide essential information to employers or clients to ensure accurate reporting of payments made to you in your income tax return.

The primary purpose of the W-9 form is to provide the requester with your correct taxpayer identification number (TIN). This is crucial for employers to accurately report payments made to you to the Internal Revenue Service (IRS). By providing the correct TIN, you help prevent any discrepancies that could trigger audits or penalties.

Additionally, the W-9 instructions and W-9 tax form itself help determine if backup withholding is required. Backup withholding is a percentage of payment withheld by the payer and remitted to the IRS. This is typically applicable if the payee fails to provide a correct TIN or fails to certify their exempt status.

For businesses involved in real estate transactions or those who work as independent contractors, filling out a W-9 form is especially important. It ensures accurate reporting of income and helps maintain compliance with tax regulations and when submitting a form online.

In summary, filling out a W-9 form is essential for accurate reporting of payments made to you and helps both you and your employer or client comply with tax regulations. By providing the correct information, you can avoid potential penalties and ensure a smooth tax process.

Managing Taxpayer Information: Form W-9

Complete the essential tax form with ease.

Preparing to Fill Out the Form

Before filling out the W-9 form, it is essential to gather all the necessary information to ensure accuracy and efficiency. Firstly, ensure you have your Social Security Number (SSN) or Employer Identification Number (EIN) readily available. This is the principal taxpayer identification number that will be used on the form.

Next, familiarize yourself with the various fields on the W-9 form, such as your legal name, business name (if applicable), and mailing address. It is crucial to provide the correct information to avoid any issues or delays in processing.

Additionally, be aware of your federal tax classification, whether you are an individual, sole proprietor, partnership, C corporation, S corporation, trust/estate, or LLC. Lastly, if you have any exemptions that apply to you or your business, such as being exempt from backup withholding, make sure you are aware of the corresponding exemption codes.

By gathering all the necessary information beforehand, you can fill out the W-9 form accurately and efficiently, ensuring compliance with tax regulations and avoiding any potential penalties or audits.

Gather Necessary Information

In order to accurately fill out the W-9 form, it is important to gather the necessary information beforehand. The following information is required to complete the form:

- Full Name: Provide your full legal name as it appears on your tax return. This ensures that the form is correctly associated with your tax identification number.

- Business Name (if applicable): If you are completing the W-9 form on behalf of a business entity, such as a sole proprietorship or a limited liability company (LLC), provide the business name as it appears on official documents.

- Federal Tax Classification: Indicate your federal tax classification by selecting the appropriate option from the choices provided on the W-9 form. This identifies the type of taxpayer you are, such as an individual, a corporation, or a partnership.

- Exemptions (if applicable): If you are exempt from backup withholding due to a specific IRS exemption, you must indicate it on the form. Otherwise, leave this section blank.

- Mailing Address: Provide your current mailing address where you would like to receive any correspondence related to the W-9 form.

- City, State, and ZIP Code: Include the city, state, and ZIP code that correspond to your mailing address.

By gathering this necessary information in advance, you can ensure a smooth and accurate completion of the W-9 form. This will help facilitate important transactions, such as real estate transactions or independent contractor work, and ensure compliance with federal tax requirements.

Obtain a Copy of the Form

Obtaining a copy of the W-9 form is an important step in the process of filling out this crucial tax document. Employers typically provide the W-9 form to independent contractors and other individuals to gather necessary taxpayer identification information. However, if you find yourself in need of a copy of the form, it is easy to obtain.

To obtain a copy of the W-9 form, employers often supply it directly to their contractors or request it to be completed online. In some cases, employers may provide a physical copy of the form for you to fill out. If you are unable to obtain the form directly from your employer, don't worry - you can download a free PDF copy of the W-9 form from the official website of the Internal Revenue Service (IRS).

ALWAYS. Businesses should always request their contractors and vendors to fill out a W9 form.

— AC Accounting (@acaccounting_) June 30, 2023

.

.

.#bookkeepingtip #taxtip #businessstrategy #entrepreneur #accountingtips #accountingservices #bookkeepinghelp #virtualbookkeeping #bookkeepingservices #taxes #taxtips pic.twitter.com/TO83oRd0kl

By visiting the IRS website, you can find the W-9 form in PDF format, which can be easily downloaded and printed. This ensures that you have a valid, up-to-date version of the form to complete accurately. Remember, the W-9 form is a legal document, so it is crucial to use the correct and most current version provided by the IRS.

In summary, while employers typically provide the W-9 form, you can easily obtain a copy by downloading a free PDF from the IRS website. Having a copy of the form is essential to correctly provide your taxpayer identification information and ensure the accuracy of your tax returns.

Understand Filing Requirements

Understanding the filing requirements for the W-9 form is essential for both contractors and entities that engage contractors for their services. The W-9 form is typically required to be filled out by individuals or businesses that are classified as contractors, self-employed workers, or freelancers.

The filing requirement for the W-9 form is triggered when the contractor earns a total of $600 or more from a particular entity during the tax year. Once this threshold is met, the contractor is obligated to submit a completed W-9 form to the entity that they provided services for.

This form is necessary for the entity to report the contractor's earnings to the Internal Revenue Service (IRS) on Form 1099-MISC. It enables the entity to accurately prepare and file their tax returns. The W-9 form includes important information such as the contractor's name, address, and taxpayer identification number, which is usually their Social Security Number or Individual Taxpayer Identification Number.

By understanding the filing requirements for the W-9 form, contractors can ensure that they meet their obligations and provide the necessary information to the entities they work with. Entities can also avoid potential penalties by requesting a completed W-9 form from contractors who meet the $600 threshold. Overall, it is important to be aware of and comply with these requirements to maintain accurate tax reporting and proper documentation.

Click here to get your W-9 form!

Who Might Ask You For Form W-9?

Several parties may ask you to fill out a W-9 form. A broker, bank, or lending institution that cancels your debt may ask for a W-9 form. But as an independent contractor, your client or customer will ask you to fill out a W-9 form.

You are obligated to fill out Form W-9 for parties you expect to pay you for a product or service. The goal is to ascertain who they are paying and let the IRS know which party bears the costs and reports the income.

Where to Download Form W-9?

If you are asked to complete a W-9 form, you will likely receive a copy of the form. If you don't get the copy of the form, don't worry because PDF Reader Pro provides the latest version of W-9 forms for you here. You can download and fill out the IRS W-9 form online on any device you have. Or you can directly download the W-9 form from the official IRS website here.

What Are the Components of Form W-9?

Form W-9 is less than one page consisting of seven lines and two sections. Below are things that you need to pay attention to when filling out a W-9 form.

Line 1: Form starts with name. Fill in your full name with the correct spelling. Make sure the spelling is the same as other tax forms you have filled out.

Line 2: The second line is for your business name. This line is filled in if your business name (trade name or entity name) is different from the one shown in line 1.

Line 3: The third line shows your tax status based on the IRS classification. Check the respective box and you can only check one box on this line.

Line 4: This line is for exemptions. It applies if your entity is exempt from backup withholding. Fill in the first line with your code. Fill in the second line if you are exempt from reporting required by Foreign Account Tax Compliance (FACTA). Please note that individuals do not fill out this section.

Line 5: Fill in your address on this line. Make sure you include your street and apartment number in order to receive further information and notifications.

Line 6: Enter your state, city, and zip code.

Line 7: This section is filled in with your account number and is optional.

The second part of the form contains the necessary data that will be used to report payments to you. This section must be filled in as follows:

Part I: Taxpayer Identification Number (TIN).

This section has two options. If you are filling out the form as an individual or LLC member, fill in your Social Security Number (SSN). If you are filling out the form as a corporation or partnership, fill in the Employment Identification Number. You can fill in both numbers if you are the sole owner.

The last part proves your confirmation that your entered data is correct. If you have confirmed everything is correct, sign Form W-9 and insert the current date.

How to Fill Out Form W-9 for Windows

With PDF Reader Pro, filling out a W-9 form is a piece of cake. We provide some simple steps to achieve that.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

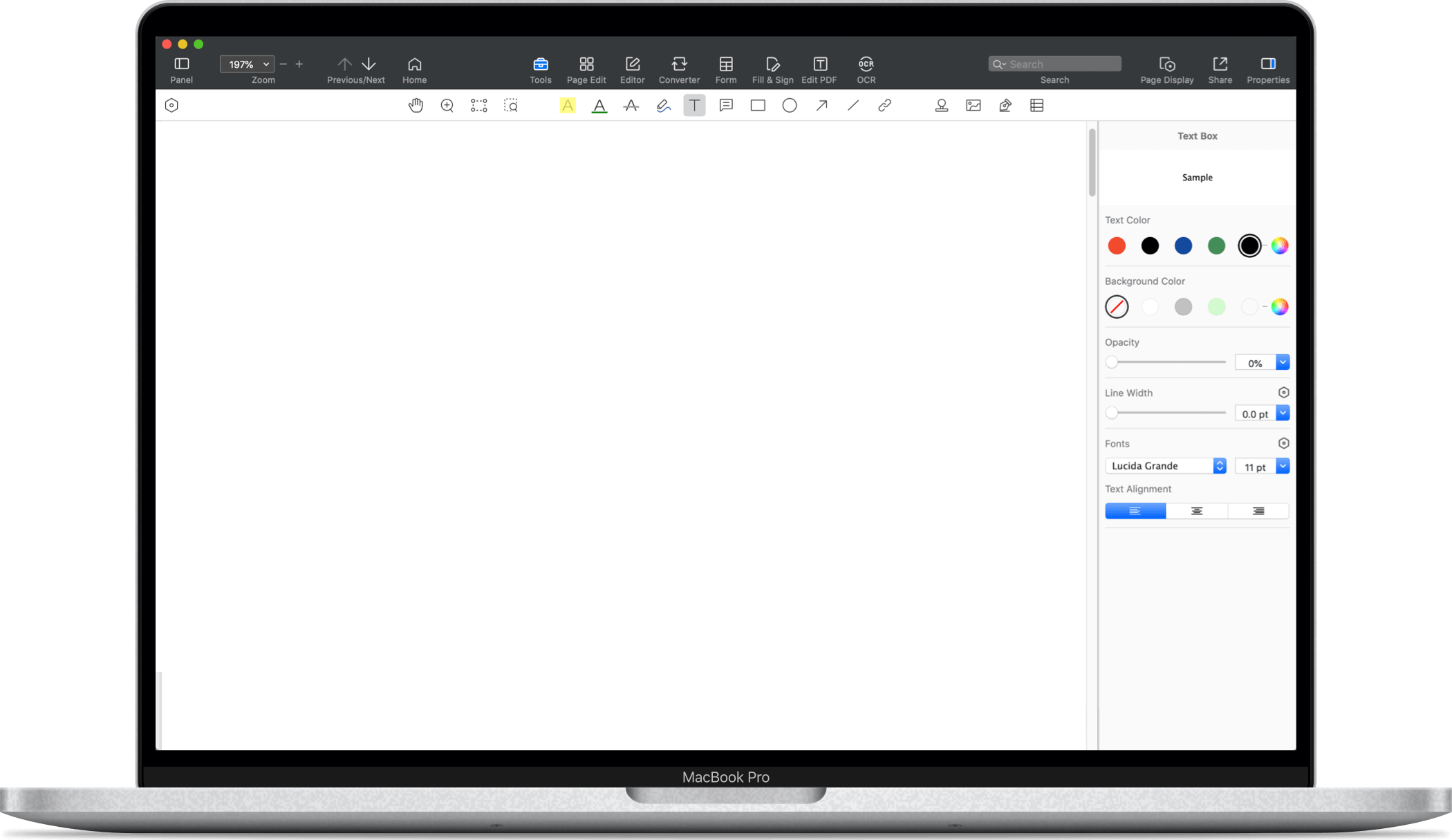

Step 1: Open your W-9 form in PDF Reader Pro

Step 2: Click on any field and start typing your information

Step 3: To sign the form with a digital signature, click Tools -> Signature

Step 4: Save the complete form on your device for future use

Click "File" and then "Save as".

Step 5: Print out the form and send it to your client/customer

Click "File" and then "Print". Adjust your settings in the printing pop-up menu and then click print.

Or click here to fill out the form online.

How to Fill Out Form W-9 for Mac

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Launch PDF Reader Pro and load your W-9 form

Step 2: Select any field to begin entering your details

Step 3: For adding a digital signature, navigate to Tools and then choose 'Signature'

Step 4: Store the finalized form on your device for later reference

Click "File" and then "Save as".

Step 5: Generate a printout of the form to send to your client or customer

Click "File" and then "Print". Adjust your settings in the printing pop-up menu and then click print.

Completing the Form Step by Step

Completing the W-9 form is a straightforward process that requires contractors to provide essential information to the entity they have provided services for. By following a few simple steps, contractors can fulfill their obligations and ensure accurate reporting of their earnings to the IRS. In this guide, we will walk through the process of completing the W-9 form step by step.

Step 1: Download the Form

The first step is to obtain a copy of the W-9 form. This can be done by visiting the official website of the Internal Revenue Service (IRS) or by requesting the form from the entity you are working with. The W-9 form is a one-page document that is relatively easy to understand and complete.

Step 2: Provide Your Name and Business Information

Begin filling out the form by entering your full legal name as it appears on your tax returns. If you are working as a business entity, provide the name of your company or business. Indicate your business address, including the street address, city, state, and zip code.

Step 3: Enter Your Taxpayer Identification Number

Next, provide your taxpayer identification number. For most individuals, this will be their Social Security Number (SSN). However, if you do not have an SSN, you may need to obtain an Individual Taxpayer Identification Number (ITIN) from the IRS. For business entities, the taxpayer identification number will be the Employer Identification Number (EIN).

Step 4: Specify Your Federal Tax Classification

On the form, you will be asked to indicate your federal tax classification. This is typically determined by the type of business entity you operate as. There are several options to choose from, including sole proprietor, partnership, corporation, LLC, and more. Select the appropriate classification based on your business structure.

Step 5: Sign and Date the Form

Once you have filled out all the necessary information, carefully review the form to ensure accuracy. Sign and date the form in the designated spaces provided. By signing the form, you are certifying that the information provided is true and correct.

Step 6: Submit the Form

After completing the form, submit it to the entity you have worked with. This can typically be done by mailing the form to their designated address or by submitting it electronically if they have an online submission process. Keep a copy of the completed and signed form for your records.

Completing the W-9 form is a vital step in ensuring accurate tax reporting and compliance with IRS regulations. By following these simple steps, contractors can fulfill their obligations and provide the necessary information to entities for tax purposes.

You can also check our recommendations on How to Fill Out a W4 Form.

Which Information Is Needed for a W-9 Form?

Image source: the balance

Step 1: Taxpayer Identification Number (TIN) and Business Name

When filling out the W-9 form, it is crucial to provide accurate and correct information in the Taxpayer Identification Number (TIN) and Business Name section. This section requires individuals and businesses to disclose their TIN and the name under which they conduct their business.

The TIN is an essential piece of information that helps the IRS identify taxpayers and track their income for tax purposes. For individuals, the TIN is typically their Social Security number (SSN), while businesses are required to provide their Employer Identification Number (EIN).

It is important to note that individuals should use their SSN unless they are operating a business entity. In that case, they should obtain an EIN from the IRS. The choice between using an SSN or an EIN depends on whether the taxpayer is classified as an individual or a business.

If a taxpayer does not yet have a TIN, they must apply for one before completing the W-9 form. Individuals without an SSN may need to obtain an Individual Taxpayer Identification Number (ITIN), while businesses will need to obtain an EIN.

Providing incorrect TIN information can have serious consequences, including delayed processing of tax returns and even possible penalties. Therefore, it is crucial to ensure that the TIN and Business Name sections of the W-9 form are accurately filled out. Always verify the TIN information with the IRS records to avoid any discrepancies.

By carefully completing the TIN and Business Name section, taxpayers can ensure that their income is properly reported and their tax obligations are met in a timely and accurate manner.

Step 2: Address, Zip Code and Exemption from Backup Withholding

Step 2 of the W-9 form requires individuals and businesses to provide their address, zip code, and indicate whether they are exempt from backup withholding. This information is crucial for the Internal Revenue Service (IRS) to identify and communicate with taxpayers.

The address and zip code fields on the form ask for the taxpayer's current mailing address. It is important to enter this information accurately to ensure that any correspondence from the IRS reaches the taxpayer in a timely manner.

The exemption from backup withholding field is where the taxpayer can indicate if they are exempt from backup withholding. Backup withholding is a tax withholding process in which the payer must withhold 24% of certain payments to the payee, in case the payee fails to provide a correct taxpayer identification number (TIN) or fails to report the income on their tax return. By indicating exemption from backup withholding, the payee is stating that they are not subject to backup withholding.

Providing this information accurately is important to avoid backup withholding and ensure that the payer correctly reports the income to the IRS. It is crucial to understand the criteria for exemption from backup withholding to determine whether or not to mark this field.

To complete Step 2 of the W-9 form, individuals and businesses must enter their current address, zip code, and indicate their exemption from backup withholding if applicable. By accurately providing this information, taxpayers can avoid any potential complications or penalties related to backup withholding.

Step 3: Federal Tax Classification and Real Estate Transactions

When filling out the Form W-9, it is important to accurately indicate your federal tax classification on line 3. This section is crucial as it determines how you will be taxed on the income you receive.

For individual contractors who file their taxes as an individual or sole proprietor, as well as those who have a single-member LLC, you will need to check the box for "Individual/Sole proprietor or single-member LLC." This classification is for those who are self-employed and operate their business as an individual or sole proprietor.

However, if you operate your business as a corporation or partnership, you would select the appropriate option on line 3 that corresponds to your entity type. For example, if you have registered your business as a corporation, you would check the "C Corporation" box. Similarly, if you have formed a partnership, you would select the "Partnership" option.

In the case of trusts, estates, and limited liability companies, there are specific classifications for each. If you fall into one of these categories, you will need to select the appropriate option that aligns with your tax status.

It is worth mentioning that real estate transactions may require a different federal tax classification. In such cases, it is essential to consult a tax professional or refer to IRS guidelines to ensure you select the correct classification for these specific transactions.

By accurately indicating your federal tax classification on line 3 of the Form W-9, you help ensure that the payer correctly reports the income and that you are taxed appropriately based on your business entity type or individual status.

Step 4: Exemptions for Foreign Status or Limited Liability Company (LLC) Status

Step 4 of Form W-9 deals with exemptions for foreign status or limited liability company (LLC) status. This section is important to determine if certain withholding requirements apply to the payee.

If you are a U.S. citizen or U.S. resident alien, you can skip this step. However, if you are not a U.S. citizen or U.S. resident alien, you need to check the box that indicates your foreign status. This will help the payer determine if they need to withhold taxes on your payments.

For LLCs, the requirement depends on how the LLC is structured for tax purposes. If the LLC is considered a corporation, it should not check any boxes in Step 4. On the other hand, if the LLC is classified as a partnership or a disregarded entity, it needs to check the appropriate box that indicates its status.

For those who are exempt from backup withholding, there are exemption codes that can be entered in the space provided. These codes are outlined in the form's instructions, and they provide documentation to the payer that the payee qualifies for exemption from backup withholding.

It's important to carefully review the instructions and consult a tax professional if necessary to ensure the correct exemptions and codes are used in Step 4 of the Form W-9.

Optional Fields – Miscellaneous Income, Cancellation of Debt and Mailing Address

Optional Fields on Form W-9: Miscellaneous Income, Cancellation of Debt, and Mailing Address

In addition to the basic information required on Form W-9, there are optional fields that allow individuals to report additional types of income to the IRS. These optional fields include Miscellaneous Income, Cancellation of Debt, and Mailing Address.

Miscellaneous Income refers to any income that is not reported on Form W-2 or Form 1099. It includes various types of earnings such as dividends, royalties, rental income, and real estate transactions. By providing this information, individuals ensure that all their income is accurately reported to the IRS.

Cancellation of Debt is another optional field on the W-9 form. It is used to report any debt that has been canceled or forgiven. This typically occurs in situations such as loan modifications, foreclosure, or debt settlements. By disclosing this information, individuals fulfill their obligation to report any debt relief that may have tax consequences.

The Mailing Address field is self-explanatory. It is where individuals provide their current mailing address for any correspondence related to tax matters. It is essential to keep this address up to date to ensure that any important tax documents or notifications are received.

Remember, while these fields are optional, providing accurate and complete information is crucial for tax purposes. By utilizing these optional fields on the W-9 form, individuals can ensure that all their income is properly reported to the IRS, and any potential tax consequences are appropriately addressed.

You can also check our recommendations on How to Fill Out Form 1099-A.

Signing the Document

Signing the W-9 form is a crucial step in the process of providing your taxpayer information to the IRS. The form must be signed by the person who is the U.S. person, which can include U.S. citizens, U.S. resident aliens, and certain other individuals.

Image source: PDF Reader Pro

When it comes to signing the W-9 form, there are different methods of creating a legally binding eSignature. One option is to use an electronic signature, which is a digital representation of your handwritten signature. Electronic signatures are legally recognized and can be created using various software or online platforms.

To create an electronic signature, you can use a stylus or a mouse to draw your signature directly on the screen. Alternatively, you can type your name and use a specific font or formatting to indicate that it is your signature.

It's important to note that the electronic signature must be made with the intent to sign the document. By signing the W-9 form electronically, you are affirming that the information provided is true and accurate to the best of your knowledge. Remember to save a copy of the signed form for your records.

By following these instructions, you can complete the signing process for the W-9 form efficiently and accurately.

Submitting the W-9 Form to an Employer/Payer

When filling out the W-9 form, it is crucial to submit it accurately and promptly to the employer or payer. This form is required for independent contractors and entities who receive payments for services rendered. To ensure a smooth process, follow the guidelines below for submitting the W-9 form.

Firstly, provide all the necessary information requested on the form, such as your name, business name, address, and taxpayer identification number (TIN). Double-check that the information is accurate and up to date, as errors or missing details can cause delays or issues.

Next, be sure to sign the W-9 form to confirm that all the information provided is true and correct. You can either physically sign the form using a pen or create an electronic signature, which is legally recognized and accepted. When using an electronic signature, ensure it is made with the intent to sign the document.

Once you have completed and signed the W-9 form, submit it to your employer or payer according to their preferred method. Some employers may require a physical copy of the form, while others may accept electronic submissions. If mailing the form, consider sending it via a method that provides tracking to ensure it reaches the intended recipient.

Lastly, it is essential to keep a copy of the signed W-9 form for your records. This will serve as proof of the information provided and can be useful when filing your tax returns. By following these steps, you can confidently submit the W-9 form to your employer or payer, ensuring the accurate reporting of your income for tax purposes.

Verifying Your Submission is Complete

Once you have filled out the W-9 form, it is crucial to ensure that your submission is complete and error-free. Follow these steps to verify the completion of your W-9 form submission:

- Review all the information: Take the time to carefully review every field on the W-9 form. Verify that you have provided all the necessary information, such as your name, address, and taxpayer identification number (TIN). Ensure that there are no spelling mistakes or missing digits.

- Double-check accuracy: Ensure that the information provided on the W-9 form is accurate and up to date. Mistakes or outdated details can cause delays or issues down the line. Correct any errors before finalizing the form.

- Sign the form: Sign the W-9 form to confirm the accuracy of the information provided. You can either physically sign the form using a pen or create an electronic signature. Make sure your signature is clear and recognizable.

- Submit the form: Once the form is completed and signed, submit it to your employer or payer according to their preferred method. Check if they require a physical copy or accept electronic submissions. If mailing the form, consider using a method with tracking to ensure its safe delivery.

- Confirmation of receipt: Contact your employer or payer to confirm that they have received your W-9 form. This step will provide peace of mind and ensure that your submission is complete.

By following these steps, you can ensure that your W-9 form submission is complete and accurate. This will help avoid any issues or delays in the future.

Support Chat

Support Chat