Filling out tax forms can be a complex task. The IRS issues a range of forms tailored to various income and payroll scenarios, such as the ubiquitous IRS Form W-2. As an employer, if you pay your staff more than $600 in a year, you're obligated to file a W-2 form for each of your employees, as well as submit copies to the Social Security Administration (SSA) and the IRS.

Known officially as the Wage and Tax Statement, the IRS Form W-2 outlines an employee's annual earnings and the taxes that have been withheld from those earnings. Once the employer completes the W-2, it is imperative to distribute a copy to each employee by the end of January each year. Failing to do so, or neglecting to send them to the SSA and IRS on time, could result in financial penalties for the employer.

If you're in a position where you pay your employees over $600 annually, you'll probably find yourself needing to complete this form yearly. PDF Reader Pro can streamline this process for you. With its intuitive interface and robust features, filling out tax forms becomes a swift and straightforward task. Compatible across multiple platforms—Mac, Windows, iOS, and Android—PDF Reader Pro is a versatile tool that simplifies tax paperwork. This guide will walk you through the steps to complete Form W-2 efficiently.

- What Is a Form W-2 Used For?

- Why Do I Need Form W-2?

- How to Download Form W-2?

- What Are the Components of Form W-2?

- How to Fill Out Form W-2 for Windows

- How to Fill Out Form W-2 for Mac

- How to Fill Out Form W-2 Best Practices

- How to Fill Out Form W-2 FAQ

- Making the Most Out of Tax Season

What is a Form W-2 Used For?

Navigating the maze of tax forms can be challenging. The IRS offers a variety of forms tailored to diverse income and payroll conditions, including the well-known IRS Form W-2. If you're an employer who pays your workforce more than $600 annually, it's your responsibility to complete a W-2 form for each employee.

Additionally, copies must be sent to both the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

Formally termed the Wage and Tax Statement, the W-2 form captures an employee's yearly income, as well as any income taxes withheld. It's crucial to distribute employee copies of the completed W-2 by the end of January each year.

Failure to do so or delaying submissions to the SSA and IRS could result in financial penalties.

If you find yourself in the situation of paying your employees over $600 per year, you'll likely need to deal with this form annually. Thanks to PDF Reader Pro, the task of filling out W-2 forms becomes considerably less complicated.

With its user-friendly interface and a wealth of features, this software makes tax form completion quick and efficient. Compatible with Mac, Windows, iOS, and Android, PDF Reader Pro is a versatile solution for simplifying your tax paperwork. This guide aims to walk you through the process of efficiently completing Form W-2.

In this context, it's essential to be aware of various elements that may appear on the W-2, such as:

- Uniform Payments: If your business requires employees to wear uniforms and you offer compensation for it, this should be indicated on the W-2.

- Retirement Plan Contributions: Make sure to accurately report any contributions to retirement plans, as they might have tax implications.

- Compensation Plan: All types of compensation, including bonuses and commissions, should be reported.

- Nonqualified Plans: These should be distinguished from regular retirement plans and reported separately.

- Taxable Fringe Benefits: These include additional advantages like company cars, which should also be reported.

- Dependent Care Expenses: If your business offers a flexible spending account for dependent care, this should be indicated on the W-2.

- Employee Wages: Ensure that all wages are accurately reported, including those for household employees if applicable.

- W-4 and W-3 Forms: Double-check that the information aligns with what’s on your employees' W-4 Forms and the W-3 form that you, the employer, have to submit.

- Income Tax Return: Remember, the W-2 is instrumental for employees when they file their individual income tax returns.

Staying attentive to these elements will make your annual tax form completion process smoother and more accurate.

By law, employers are required to send a W-2 form to every employee to whom they provide a salary, wages, or other form of compensation. Employers must send W-2 forms to their employees by January 31 each year, so that employees have sufficient time to file their income taxes with the Social Security Administration (SSA).

Form W-2 is used to report Federal Insurance Contributions Act (FICA) taxes for their employees. The employer submits for the previous year, at the end of January each year, a copy of the W-2 form to the SSA with the transmittal W-3 form by mail or electronically.

The SSA will use the information on the form to calculate the Social Security benefits to which each worker is entitled. Tax documents filed for the previous year. For example, if you receive a W-2 form in January 2023, it reflects your income for 2022.

You can also check our resume resource on How to Fill Out a W-4 Form.

Why Do I Need to Fill Out Form W-2?

You must fill out a W-2 form and submit it to your employer so that your income and taxes withheld over the past year can be reported to the IRS. Your information confirms to the IRS whether you are paying the correct amount of tax.

Important Note for Independent Freelancers

For contractors or independent freelancers, you do not need the W-2 form. Instead, you need to fill out a W-9 form. Check out our comprehensive guide on how to fill out form W-9.

How to Download Form W-2?

If you are required to complete a W-2 form, you will likely receive a copy from your employer. If you didn't get a copy of the form, know that PDF Reader Pro provides the latest version of the W-2 form. You can download and fill out the form online on any device you have. Or you can directly download the W-2 form from the IRS official website.

What Are the Components of Form W-2?

Click here for the latest version of the W-2 form.

Form W-2 has four parts, each with their own sub-sections. Below are the fields you must pay attention to when filling out a W-2 form.

Part 1. Verify Your Personal Information

The first part of the W-2 form contains your personal information. This section covers sections A through F. When you fill out the W-2 form, make sure this section is filled in correctly and completely.

The following are the subsections of the first section:

- Section A: This section is filled in with your Social Security number so the IRS can identify you.

- Section B: Employer identification number or EIN.

- Section C: Employer's name and complete mailing address.

- Section D: This section contains an employer-given code to identify each employee's form.

- Section E: Employee’s full legal name.

- Section F: Employee's full mailing address.

Part 2. Review tax and payroll information

After personal information, the next sections detail your wages and taxable wages from section one to section six. You should review this section repeatedly to ensure that your salary information is correct. The following is a further explanation of this section:

- Section 1: Total amount of taxable income, tips, and taxable wages received by the employee from the employer in the last one year.

- Section 2: Total federal income tax that the employer withholds from the employee's salary.

- Section 3: Income paid to employees who may be subject to Social Security taxes.

- Section 4: Amount of Social Security tax deposited on the employee's income that the employee reports to the employer.

- Section 5: All compensation reported to the employer where the employee paid Medicare taxes.

- Section 6: Total Medicare tax deducted from the employee's prior year's salary.

Part 3. Assess additional income information

This section is filled with some additional revenue details. For example, if you work in a restaurant and earn tips, your employer might include tips in section 7. You can leave this section blank if you don't collect tips at work.

Section eight aims at more specific cases, such as if you work for a company that collects tips from every employee. Employers will list how many specific tips they give their employees.

Part 4. Check the miscellaneous information

The last section of the W-2 form is generally left blank. If you feel that this section is required, then read and complete it thoroughly to verify that the details are correct.

- Section 9: Contains codes for employers if they participate in the IRS pilot program. This section can be left blank if you are not participating in the program.

- Section 10: Total employee health benefits. If the employee doesn't have one, the employer leaves the box empty.

- Section 11: Contains the amount paid by the employer from a deferred compensation plan that does not qualify. In this way, the Social Security Administration can ensure that the employer distributes the correct amount of benefits.

- Section 12: This section includes a set of codes that employers itemize to the IRS.

- Section 13: Includes checkboxes that contain information about third-party retirement plans and sick pay.

- Section 14: This section is for reporting miscellaneous items that do not appear to be included in the other sections of the form.

How to Fill Out Form W-2 for Windows

With PDF Reader Pro, you can fill out a W-2 form easily within minutes. Here are some simple steps to achieve that for our Windows users.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Launch PDF Reader Pro and load your W-2 form.

Step 2: Select any field and begin typing your details.

Step 3: Save the completed form on your device for later use.

Step 4: Generate a printout of the form and forward it to the Social Security Administration via electronic or postal means.

Or click here to fill out the form online.

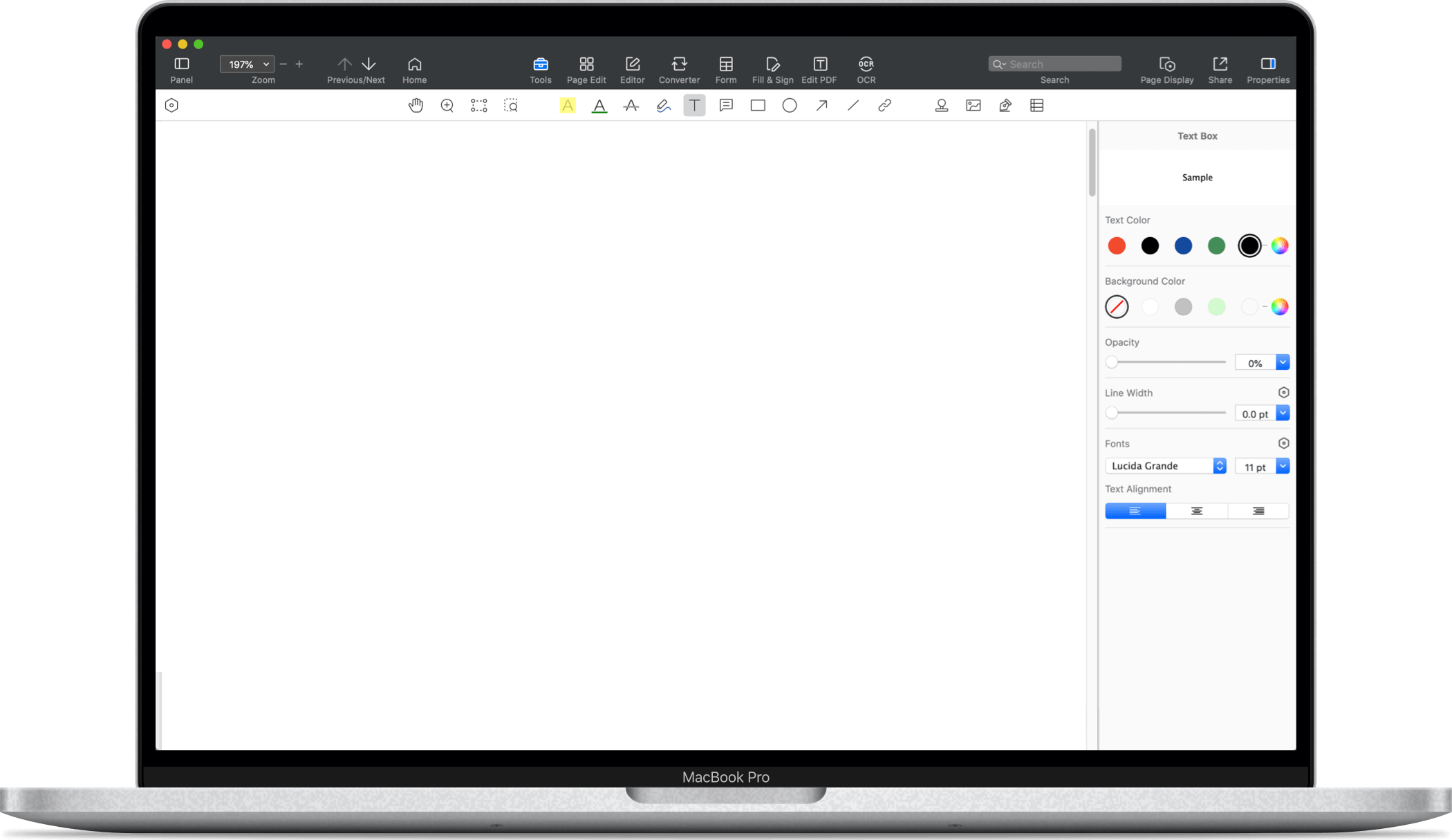

How to Fill Out Form W-2 for Mac

As with our Windows users, filling out your W-2 form for Mac users is equally straightforward. Let's find out how.

Navigate, edit, and

convert PDFs like a Pro

with PDF Reader Pro

Easily customize PDFs: Edit text, images,

pages, and annotations with ease.

Advanced PDF conversion: Supports

multi-format document processing with OCR.

Seamless workflow on Mac,

Windows, iOS, and Android.

Step 1: Open your W-2 form in PDF Reader Pro

Step 2: Click on any field and start typing your information

Step 3: Save the complete form on your device for future use

Step 4: Print out the form and submit it electronically or by mail to the Social Security Administration

Or click here to fill out the form online.

PDF Reader Pro is the best PDF editor with many powerful features. Filling out the form with PDF Reader Pro is like a piece of cake. You can choose whether to fill out the form online here or download and fill it offline with PDF Reader Pro.

How to Fill Out Form W-2 Best Practices

Filling out the IRS Form W-2 can be a daunting process, but with some best practices, you can navigate through it more efficiently. Below are some pointers that should make your experience smoother:

-

Federal Income Tax Withholding: Ensure that the amount of Federal Income Tax withheld from your employee's earnings aligns with their W-4 Form.

-

Statutory Employee: If your worker is a statutory employee, you'll need to mark this on the W-2. This affects how Social Security and Medicare taxes are handled.

-

Taxable Wages and Taxable Income: Clearly differentiate between the gross wages and the taxable wages. Remember, not all forms of compensation are taxable. Contributions to retirement plans, for example, may not be considered taxable income.

-

Independent Contractor or Employee: Make sure to correctly classify your workers. Misclassifying an employee as an independent contractor can lead to penalties.

-

Dependent Care Benefits: These should be clearly mentioned in box 10 of Form W-2. This helps the employee when they claim Dependent Care Expenses on their personal income tax return.

-

Union Dues: If the employee is a union member, don't forget to include any dues they have paid over the year.

-

Disability Insurance Taxes: Account for these, as failing to do so can lead to discrepancies in the W-2 form.

-

Employee Names and Social Security Number: Triple-check the spelling of employee names and their Social Security Numbers to avoid any complications with the IRS.

-

ZIP Code: Always double-check ZIP codes to avoid mailing issues when sending out employee copies of the W-2.

-

Group-Term Life Insurance: This should be stated in box 12 with the appropriate code. This affects both the employee’s and employer's share of Social Security and Medicare taxes.

-

Save with PDF Reader Pro: Once you've entered all the required data, make sure to save the completed form using PDF Reader Pro for future reference. This is also beneficial if you have to issue corrected W-2s.

How to Fill Out Form W-2 FAQ

What happens if I don't file a W-2 on time?

Failing to submit the W-2 forms to the Social Security Administration and your employees by the end of January can result in fines and penalties.

Can I include pre-tax benefits like health insurance premiums?

Yes, these are generally reported in box 12. Such pre-tax benefits reduce the taxable wages subject to Federal Income Taxes.

What's the difference between "Taxable Wages" and "Wages Subject to Federal Income Tax"?

Taxable wages are subject to Social Security, Medicare, and federal unemployment taxes. Wages subject to federal income tax are the gross wages minus any pre-tax deductions like retirement contributions.

Is sick pay included in the W-2?

Yes, sick pay payments should be included in the W-2 unless it was paid by a third-party insurance company.

How do I report Employee Contributions to retirement plans?

These are generally reported in box 12 and reduce the amount of wages subject to federal income tax.

What if an employee has multiple types of compensation, like a compensation plan, bonuses, and regular salary?

All these forms of income should be summed up and reported as one total figure under taxable wages.

Decoding Tax Documentation: Understanding IRS Form W-2

A comprehensive guide to your wage and tax statement - navigating the essentials for tax filing.

Making the Most Out of Tax Season

Before we finish, let's revise the most important sections for W-2 form filling.

Section 1: Introduction to Forms and Applications

In any business setting, submitting a complete application for tax purposes is of the essence. The types of forms required can vary and may include Form W2, Form 1099-MISC, Form W-2c, and Form W-3c. Understanding the right type of form to use for different categories of employees—including alien employees and deceased employees—is crucial.

Section 2: Employee Specifics and Forms

It's important to note that different rules apply to various categories of employees. For instance, "employee by statute" might include individuals in certain professions who would otherwise be considered contractors. This also applies to employee funds and employee stock options.

Section 3: Wage and Payment Details

Knowing the particulars about severance payments, waiver payments, special wage payments, and differential wage payments can make a big difference in how you handle tax implications. This section also covers various codes like Code BB, Code EE, and Code FF that need to be correctly entered on tax forms.

Section 4: Social Security Considerations

Understanding the social security tax, social security tips, and social security wage base is critical. Employers should be thorough in verifying social security cards and numbers.

Section 5: Employer Contributions and Deferrals

For businesses, understanding employer matching contributions, nonexcludable employer contributions, and elective salary deferrals is essential. This also includes knowledge about 409A Non-Qualified Deferred Compensation plans.

Section 6: Address and Payee Information

Getting the correct payee statements is vital for tax purposes. Employers should ensure the correct street address and email address are used to avoid issues like incorrect address entries.

Section 7: Extensions, Penalties, and Errors

Understanding the extensions of time available, the penalty for failure to comply, and the types of errors that can occur (administrative error, inconsequential error) will be covered in this section.

Section 8: Health and Insurance

This part focuses on health insurance coverage, group-term life insurance coverage, and flexible spending arrangements.

Section 9: Special Employment Categories

We'll also explore predecessor employers, employer combinations, and special types of workers like election workers and religious workers.

Section 10: Government and Non-Government Organizations

The role of the Internal Revenue Service, Government Agencies, and 501(C) Non-Governmental Organizations will be discussed here, including guidelines from the Internal Revenue Bulletin.

By keeping these best practices and FAQs in mind, you can make the W-2 form filling process a less stressful one. Remember, always use reliable tools like PDF Reader Pro to ensure the process is error-free and efficient.

By keeping these best practices and FAQs in mind, you can make the W-2 form filling process a less stressful one. Remember, always use reliable tools like PDF Reader Pro to ensure the process is error-free and efficient.

Mastering the ins and outs of Form W-2 is a vital skill for employers, from understanding social security wages to navigating pre-tax deductions. Whether you're dealing with a SIMPLE Plan for your employees, offering a cafeteria plan with a variety of pre-tax benefits, or grappling with noncash payments and employer contributions, every detail matters when it comes to the tax statement. This guide aims to be an invaluable resource, no matter your level of familiarity with the complex world of tax forms and regulations.

Remember, correct address details are pivotal to ensuring that W-2 forms reach their intended recipients without any hiccups. If you find yourself dealing with unique circumstances, such as excess parachute payments or specific employer health reimbursement arrangements, consulting a tax professional is often advised to avoid maximum penalties.

From electronic filing methods to ensuring you understand each line on the W-2, like the 9-digit social security number or the various types of allowable deferrals, this document can be a tool to streamline your year-end processes and make tax season less daunting. Being diligent, understanding the various components, and meeting deadlines can protect you from costly errors and penalties.

Thank you for taking the time to read this guide. May your tax filing be accurate, timely, and free of stress.

As the tax season approaches, make sure you download PDF Reader Pro for better organization of your files. PDF Reader Pro allows you to edit your forms anytime or anywhere you like. Once again, make sure you provide accurate information on your W-2 form.

Download PDF Reader Pro now and experience its spectacular features. If you have any questions, feel free to reach us at [email protected].