Form W-2

What Is Form W-2?

A W-2 form, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and to the Internal Revenue Service (IRS) at the end of the year. A W-2 reports the employee's annual wages and the amount of taxes withheld from their paychecks. A W-2 employee is someone whose employer deducts taxes from their paychecks and submits this information to the government.

What Is a W-2 Form Used For?

An employer is legally required to send out a W-2 form to every employee to whom they paid a salary, wage, or another form of compensation. This does not include contracted or self-employed workers, who must file taxes with different forms. The employer must send the employee the W-2 form on or before Jan. 31 each year, so the employee has ample time to file his or her income taxes before the deadline (which is April 15 in most years). Employers must also use W-2 forms to report Federal Insurance Contributions Act (FICA) taxes for their employees throughout the year. By the end of January, employers must file, for the previous year, Form W-2, along with Form W-3, for each employee with the Social Security Administration (SSA). The SSA uses the information on these forms to calculate the Social Security benefits to which each worker is entitled. Tax documents are filed for the previous year. For example, if you receive a W-2 Form in January 2020 it reflects your income for 2019.

What Information Does a W-2 Include?

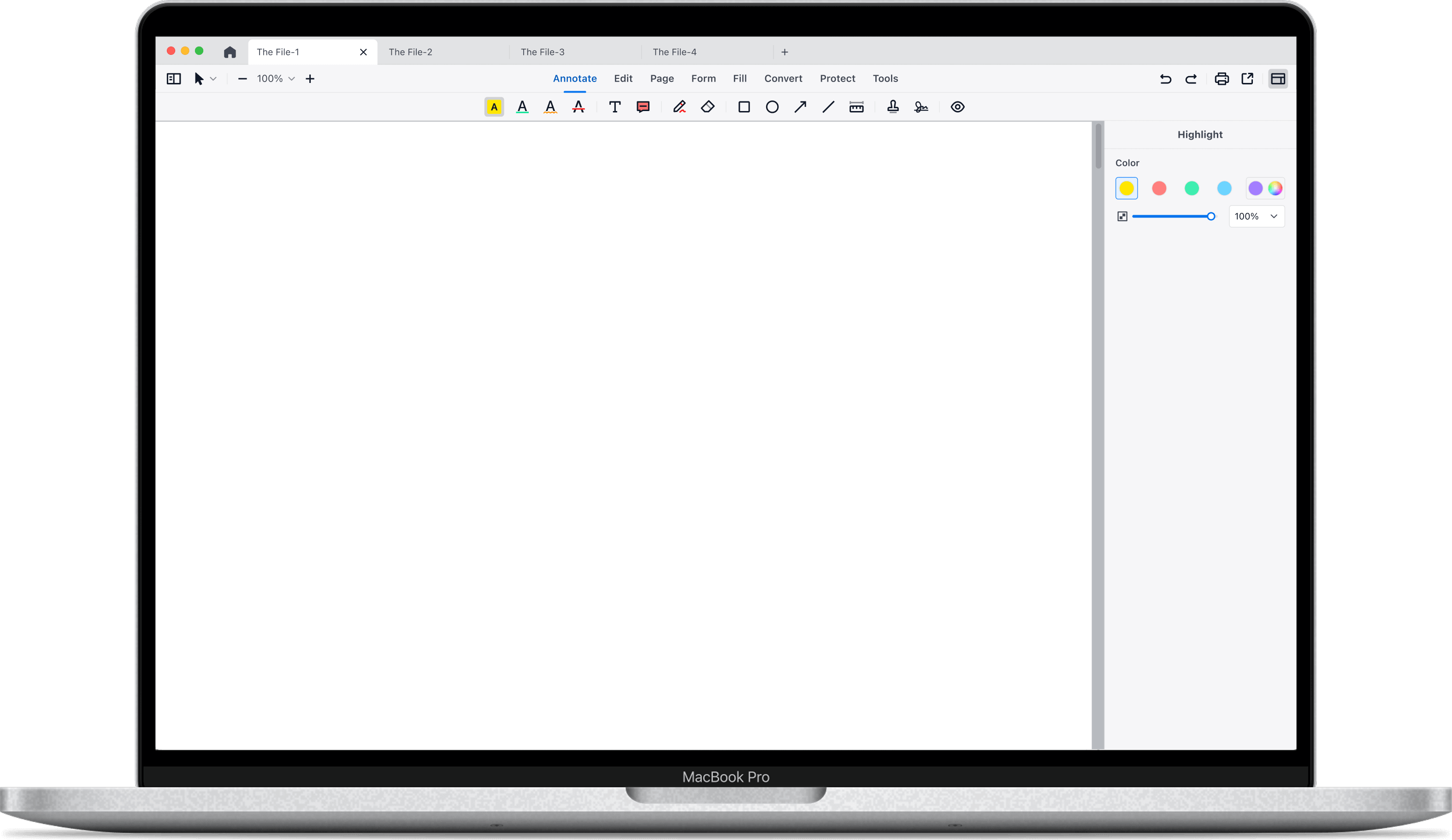

Every W-2 has the same fields, no matter the employer. W-2 forms are divided into state and federal sections since employees must file taxes on both levels. There are fields that provide the employer's information, including the company's Employer Identification Number (EIN) (federal) and the employer's state ID number. The remaining fields mostly focus on the details of the employee's income from the previous year.The employee's total earnings from the employer for the year are included, of course, along with the amount withheld in taxes from the employee's paychecks, separated into the withholding for federal income tax, Social Security tax and more. If the employee also works for tips, a field shows how much money in tips the employee earned for the year. When the employee files taxes, the amount of tax withheld according to the W-2 form is deducted from his or her tax obligation. If more tax was withheld than the employee owes, he or she may receive a refund. The IRS also uses Form W-2 to track an employee’s income and tax liability. If the income reported on an employee’s taxes doesn’t match the income reported on the Form W-2, the IRS may audit the taxpayer. However, taxpayers are required to report all salary, wage, and tip income, even if that income is not reported on a W-2. After downloading the free Form W-2 template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

Support Chat

Support Chat