IRS Form 9465

What Is Form 9465?

Each year, many Americans file their tax returns and discover that they owe more income tax than they can afford to pay immediately. Additionally, many taxpayers owe back taxes and have no idea how to pay their tax debt. Fortunately, the Internal Revenue Service (IRS) has a program that allows taxpayers to pay taxes in monthly installments instead of in a large, one-time, lump sum. If you find yourself in this position, filing Form 9465: Installment Agreement Request with the IRS will allow you to to implement an installment agreement. But keep in mind that penalties and interest on the overdue balance will still accrue until you pay taxes owed.

Who Can File Form 9465

Taxpayers who can't pay their tax obligation can file Form 9465 to set up a monthly installment payment plan if they meet certain conditions. Any taxpayer owing no more than $10,000 will have their installment payment plan application automatically approved with the following stipulations: 1. The taxpayer must have filed all past tax returns in order to qualify for this agreement. 2. Has not entered into an installment payment agreement within the past five years 3. Is unable to pay taxes in full when they are due 4. Must be able to pay the entire outstanding balance within three years If you owe more than $50,000, you cannot file electronically and need to return a completed IRS Form 9465 on paper with original signatures. You can do this by attaching it to the front of your tax return at the time of filing. The form can also be submitted by itself at any time.If you owe $50,000 or less in taxes, penalties and interest, it's also possible to avoid filing Form 9465 and complete an online payment agreement (OPA) application instead. Any taxpayer owing more than $50,000 must also submit Form 433-F: Collection Information Statement along with Form 9465, something that also can't be done online.

Who Should Not File Form 9465

Individuals who are already making payments under an installment agreement with the IRS are not eligible to use Form 9465 and must contact the IRS at 1-800-829-1040 if they need to make arrangements for payment of additional amounts. Individuals who should also call instead of filing Form 9465 include those who are in bankruptcy and want to make an offer-in-compromise.3 Whether you can use Form 9465 or not, there are actually a variety of solutions you can try If you receive an unexpected bill from the IRS.

Benefits of Installment Plans

The advantage of an installment plan is obvious: It gives taxpayers more time to pay off their federal taxes in an orderly manner. As long as the terms of the agreement are honored and the taxpayer is able to make their payments, any collection efforts by the IRS or private collection agencies will cease. Eligible individuals can also get a six-month extension for filing their tax returns and possibly paying their tax bills if they are under certain financial hardships.

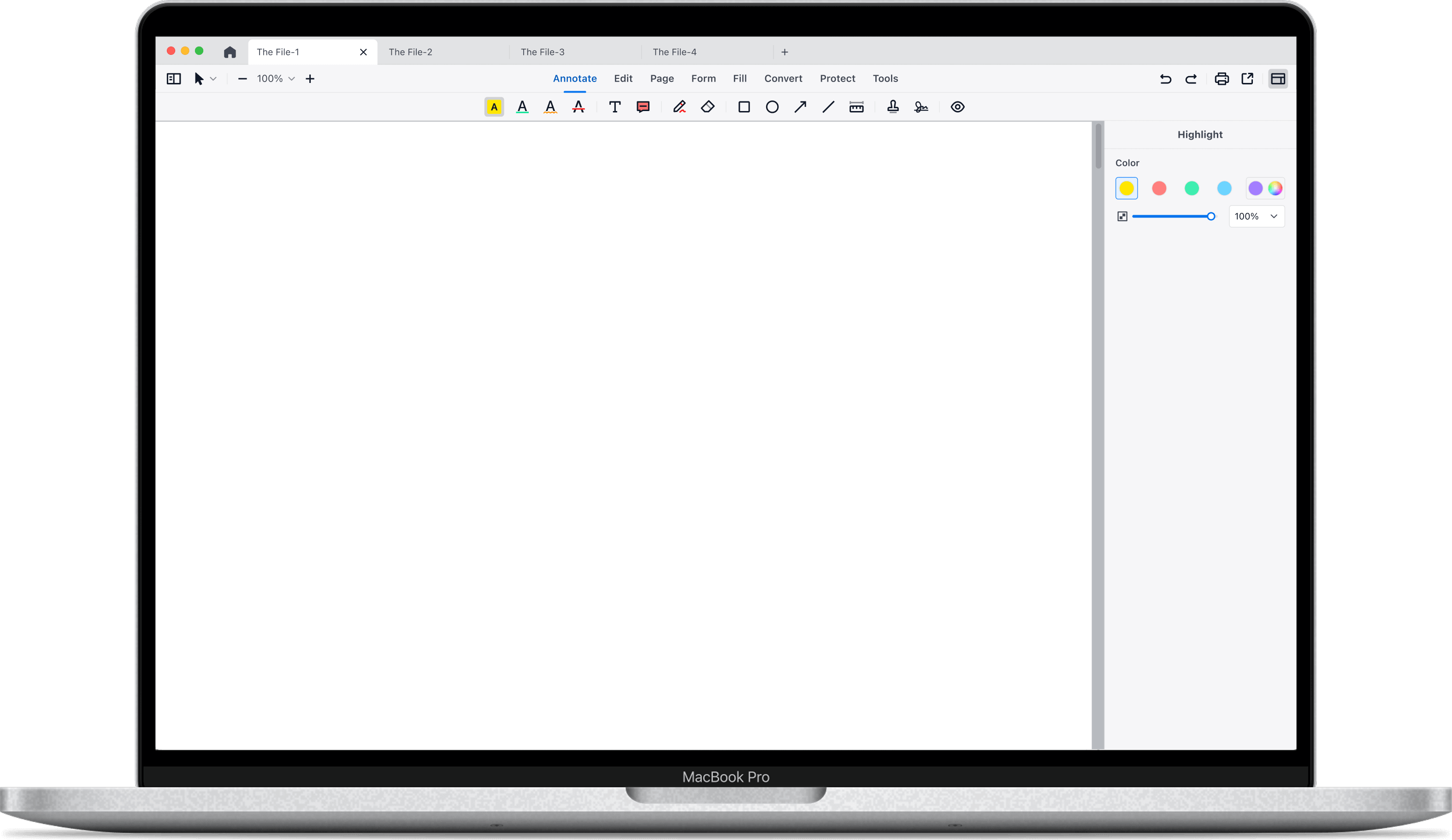

* The free templates above are provided for reference only, for all legal matters, you should always talk to a professional. After downloading the free template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

Support Chat

Support Chat