W8BEN-NonUSIndividuals

FORM W-8BEN is used by a non-United States (non-U.S.) person who is a “beneficial owner” of ADSs in order to avoid United States federal income tax backup withholding on payments made in connection with the Offer. The non-U.S. person must be the beneficial owner of such payments in order for a withholding exemption to apply.

A non-U.S. person includes:

* an individual who is not a citizen or resident of the U.S.; * a non-U.S. corporation; * a non-U.S. partnership; * a non-U.S. branch or office of a U.S. financial institution or U.S. clearing organization if the foreign branch is a qualified intermediary; * a non-U.S. trust or estate; and * any other person who is not a U.S. person. You must give Form W-8BEN to the withholding agent or payer if you are a nonresident alien who is the beneficial owner of an amount subject to withholding, or if you are an account holder of an FFI documenting yourself as a nonresident alien. Submit Form W-8BEN when requested by the withholding agent, payer, or FFI whether or not you are claiming a reduced rate of, or exemption from, withholding. You should also provide Form W-8BEN to a payment settlement entity (PSE) requesting this form if you are a foreign individual receiving payments subject to reporting under section 6050W (payment card transactions and third-party network transactions) as a participating payee. However, if the payments are income which is effectively connected to the conduct of a U.S. trade or business, you should instead provide the PSE with a Form W-8ECI.

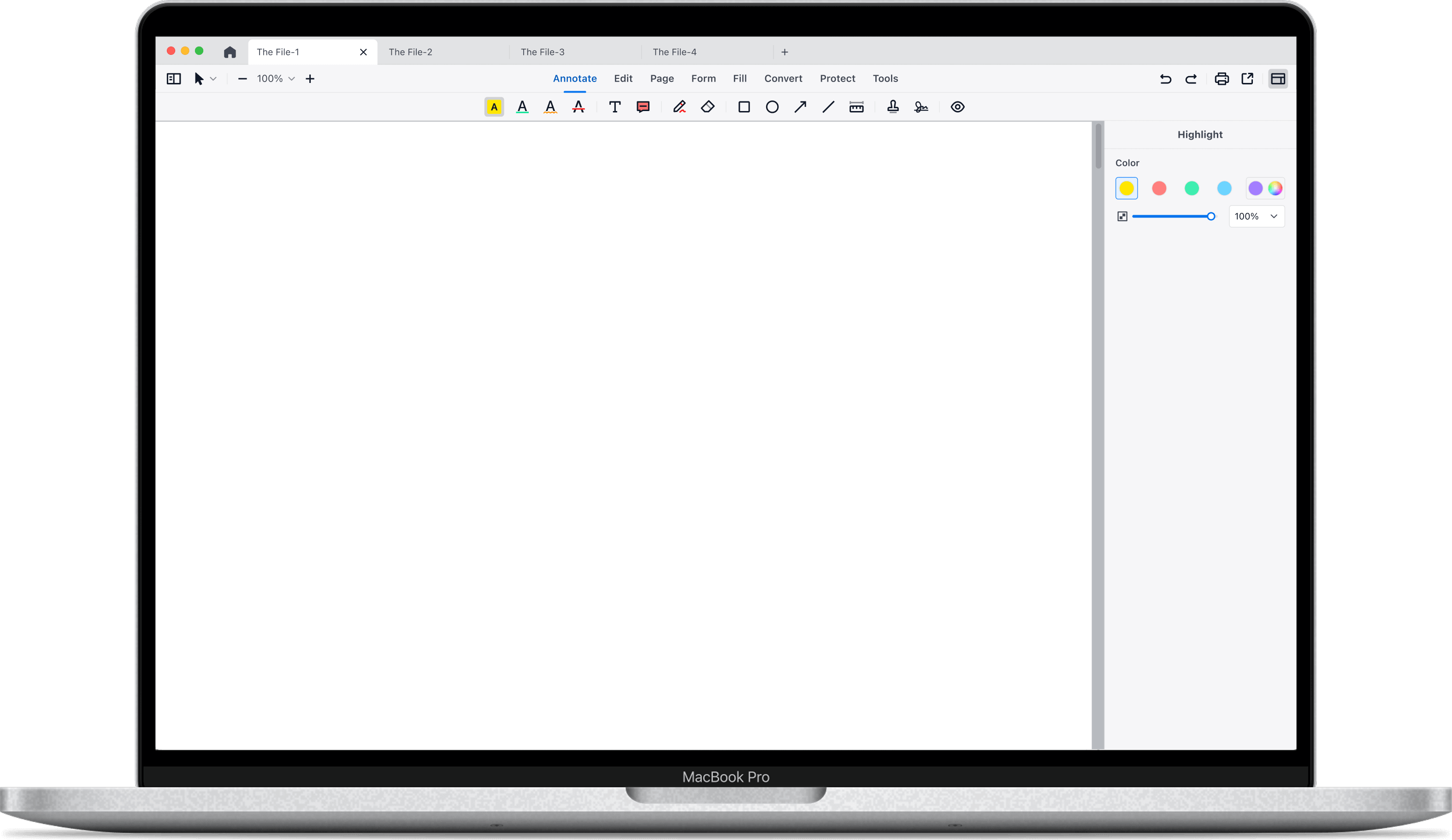

* The free templates above are provided for reference only, for all legal matters, you should always talk to a professional. After downloading the free invoice template, if you need to fill in it or modify the content of invoice on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and use this invoice template design for your own needs, edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "free download" to download the app.

Support Chat

Support Chat