Navigating the world of tax reporting can often seem daunting, especially when it comes to understanding the nuances of various forms and their requirements. In this post, we delve into the essentials of handling 1099 forms, crucial for a wide range of tax reporting purposes. We'll cover everything from the basic requirements for each form to the importance of maintaining copies for your records.

Understanding these aspects is not just a matter of compliance; it's about ensuring accuracy and readiness for any tax-related situation that might arise in the course of a business day, month, or year.

Additionally, we'll touch upon the significance of report backups and the organizational strategies needed to manage this vital information efficiently. Whether you're a seasoned professional or new to the realm of tax reporting, this guide is designed to provide you with the miscellaneous information necessary to navigate the process with confidence and ease.

Let's dive into the world of 1099 forms and demystify their complexities.

1099 Form 2023: Important Considerations

As the 1099 filing season approaches, it's crucial to be aware of the updates effective for the 2023 tax year.

Here's what you need to know:

-

Form 1099-NEC Stability: From 2022 onwards, the IRS introduced a standard version of Form 1099-NEC. Good news: there are no changes to this form for 2023.

-

Threshold Adjustment for Form 1099-K: There was a plan to change the reporting requirements for third-party platforms like Venmo and PayPal, setting the threshold at $600 starting January 1, 2023. However, this has been postponed. The reporting criteria remain the same as previous years: over 200 transactions and a total exceeding $20,000. Keep an eye out for a potential $5,000 threshold in 2024.

-

Introducing the IRIS Portal: The IRS has unveiled IRIS, a new online portal for businesses filing 1099 returns for tax years 2022 and later. Note that from January 2024, the FIRE system will no longer accept electronic filings without the legacy transmitter code.

-

Updated Electronic Filing Requirements: Starting January 1, 2024, for returns of the 2023 tax year, electronic filing is mandatory for entities with 10 or more information returns, a significant decrease from the previous 250-return threshold.

-

Combined Federal/State Filing Program Benefits: Many states are part of this program where the IRS automatically forwards 1099 information, eliminating separate state filings. However, it's important to check your state's specific 1099 filing requirements.

Key Sections of the 1099 Form 2023 Guide

-

Form 1099-NEC Reporting: Continue to report payments of $600 or more to non-employees, such as independent contractors, consultants, and legal professionals. This also includes payments to non-corporate entities.

-

Form 1099-MISC Essentials: Use this form for other types of miscellaneous compensation of $600 or more, including rents, prizes, medical payments, and royalties over $10.

-

Electronic Filing Requirement Update: The IRS mandates electronic filing for those with more than 10 returns from January 1, 2024. This includes various forms like W-2s and 1099s.

-

Extensions and Penalties: Although some 1099 forms are eligible for a 30-day extension, options are limited for W-2 and 1099-NEC forms. Non-compliance penalties range from $60-$310 per recipient, with higher penalties for larger businesses.

When will my 1099 forms arrive and when is the best time to file my tax return? Here’s the answer to these and other tax season questions you may have. https://t.co/deYQnXo2vp pic.twitter.com/tkcrbBrYE1

— BGM (@BGM_CPA) January 16, 2024

Employer Obligations for 1099 Forms

Form 1099-NEC Requirements:

- Employers must report any payments of $600 or more to non-employee service providers.

- This category includes independent contractors, consultants, accountants, cleaning and landscaping professionals, and other self-employed individuals.

- It also covers payments to non-incorporated entities such as partnerships, LLCs, limited partnerships (LPs), or estates.

- Remember, fees paid to attorneys, including those in corporate law firms, fall under this form too.

- Additionally, you're responsible for reporting any backup withholding.

Form 1099-MISC Reporting:

Use this form to report miscellaneous compensations of $600 or more that occur in your regular business operations. This encompasses a variety of payments, including rents, prizes and awards, certain medical and healthcare payments, other forms of income, and royalties exceeding $10.

Get guidance on filling out the 1040-NR tax form with our straightforward guide for nonresidents.

Updates in Electronic Filing

The IRS has set new regulations requiring businesses filing more than 10 returns in a year to switch to electronic filing.

This change, effective from January 1, 2024, lowers the threshold significantly from the previous 250 returns.

Paper filing won't be an option anymore. Almost all types of returns, including W-2s, 1099s, and other business returns, count towards this 10-return threshold.

Extension Policies

The IRS permits an automatic 30-day extension for certain 1099 forms.

However, the scope for extensions is limited for W-2 and 1099-NEC forms. For specific queries regarding extensions, it's recommended to consult with your tax advisor or engagement team.

Interesting that they are looking to change 1099 reporting here. 🤔 https://t.co/yMii40pKdf

— Matthew J. Cordes, EA (@cordes_tax) January 16, 2024

Understanding Penalties for Non-Compliance

Non-compliance with filing deadlines and requirements can lead to significant penalties:

-

For Small Businesses (average annual gross receipts ≤ $5 million): Penalties range from $60 to $310 per recipient, depending on the timing of the filing/furnishing. The maximum annual penalty is capped at $1,261,000.

-

For Large Businesses (average annual gross receipts > $5 million): The same per recipient penalty applies, but the maximum cap is increased to $3,783,000 per year.

-

In cases of Intentional Disregard: There's a minimum penalty of $630 per incorrect 1099 or statement, with no upper limit.

Moreover, if you've received non-matching notices for Form 1099, it's crucial to promptly address these with your vendors to avoid maximum penalties.

Streamline Your 1099-NEC Filing with a Template

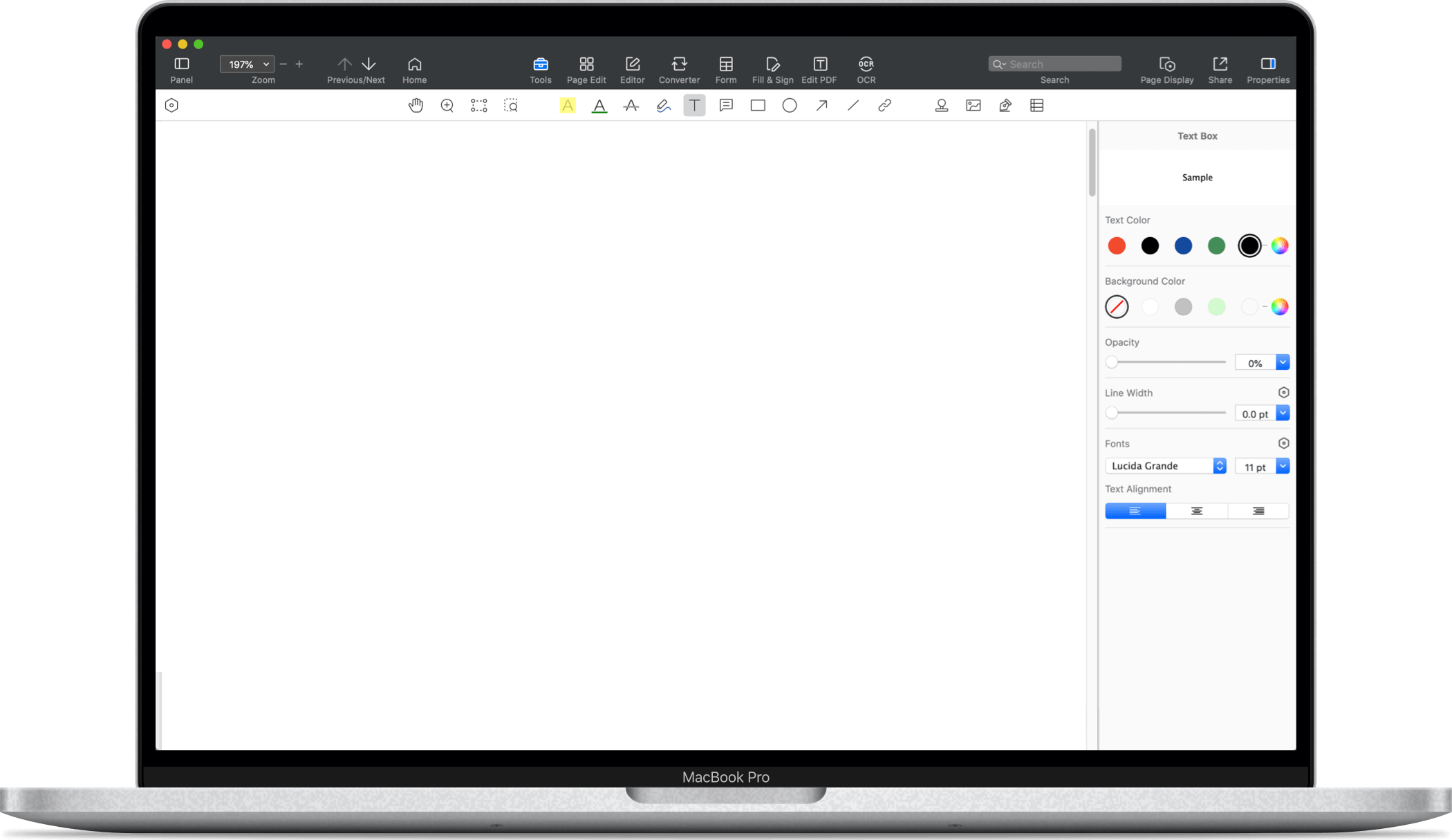

Preparing your Form 1099-NEC has never been easier, thanks to PDF Reader Pro's "Form 1099-NEC PDF Template".

This template is designed to simplify the process of filing and ensure accuracy, which is crucial in meeting IRS requirements.

Why Choose PDF Reader Pro's Template?

-

User-Friendly Design: The template is created with a focus on ease of use. Its intuitive layout means you can fill in details quickly and accurately.

-

Customizable and Editable: With PDF Reader Pro, you can easily customize the template to suit your specific needs. Add, edit, or delete information as necessary.

-

Error-Free Filing: The template helps reduce the likelihood of errors that can occur with manual entry, ensuring a smoother filing process.

More 1099 Forms

Please see our three most vital 1099 PDF templates below:

Discover how to quickly and efficiently fill out PDF forms with our practical tips.

1099 Form 2023: Best Practices

Navigating the intricacies of Form 1099 can be challenging for business owners, tax professionals, and sole proprietors alike.

As we approach the 2023 filing season, it's crucial to understand the best practices for handling various aspects of 1099 forms, particularly the 1099-MISC and other related forms.

Here’s a guide to streamline your filing process:

1. Understanding Form 1099-MISC:

Form 1099-MISC is used to report miscellaneous income. This includes payments for services performed by someone who is not an employee, rents, prizes and awards, medical and healthcare payments, and other forms of miscellaneous income. Keeping accurate records of these transactions throughout the year is vital.

2. For Business Owners:

If you're a business owner, it's important to recognize all reportable payments and understand the filing requirements. This includes payments made in the course of your trade or business to non-employees or for rent, which typically need to be reported on Form 1099-MISC.

3. Real Estate Transactions:

Real estate professionals should be aware of the specific reporting requirements for real estate transactions, which often fall under the purview of Form 1099-S.

4. Managing Third-Party Network and Settlement Transactions:

This relates to payments processed through third-party networks like PayPal or through settlement organizations. The reporting threshold and requirements for these transactions have been a point of frequent updates, so staying informed is key.

5. Sole Proprietors:

As a sole proprietor, it’s essential to report all applicable income accurately on your 1099 forms. This includes income received through business transactions, rent, or services exceeding the reporting threshold.

6. Consulting with Tax Professionals:

Tax advisors play a crucial role in ensuring compliance with 1099 filing requirements. Their expertise can be invaluable, especially when dealing with complex scenarios or when navigating the latest IRS updates and requirements.

7. Choosing the Right Filing Methods:

With the updated electronic filing requirements, it's important to choose a filing method that aligns with your business size and number of returns. The IRS encourages electronic filing for efficiency and accuracy.

8. Meeting Filing Deadlines:

Adhering to the filing deadline is crucial to avoid penalties. The typical deadline for filing 1099 forms is January 31st of the year following the tax year. For 2023, ensure that your forms are filed on time.

9. Leveraging Extensions:

The IRS allows a 30-day extension for certain 1099 forms, including an automatic 30-day extension in some cases. Understanding when and how to apply for these extensions can be crucial in managing your tax filings.

10. Penalties for Non-Compliance:

Failure to comply with filing requirements can result in significant penalties. The maximum penalty varies based on the size of the business and the nature of the non-compliance, so it's important to file accurately and on time.

Conclusion:

The 2023 filing season for Form 1099 presents several challenges, but with the right knowledge and preparation, you can navigate it successfully. Stay informed about the latest reporting requirements, consult with tax professionals as needed, and leverage the appropriate tools and resources to ensure compliance and accuracy in your filings.

Remember, staying ahead of the curve with these best practices not only helps in avoiding penalties but also ensures a smoother, more efficient tax filing experience.

Learn how to create a fillable form without using Acrobat with our guide, using accessible tools to streamline your document workflows.

1099 Form 2023: FAQ

What Are Online Forms for 1099 Reporting?

Online forms for 1099 reporting offer a digital way to prepare and submit various types of 1099 tax forms, including the 1099-K and 1099-MISC. These forms are available on tax software platforms and the IRS website, providing a streamlined, paperless option for tax reporting.

How Does the 1099-K Tax Form Differ from Other Tax Forms?

The 1099-K tax form is specifically used to report payment card and third-party network transactions. It differs from other tax forms in that it's primarily used by businesses processing payments through third-party networks or credit card transactions.

What Are the Filing Thresholds for 1099 Forms?

Filing thresholds for 1099 forms vary depending on the type of return. For instance, the 1099-MISC and 1099-NEC require reporting for payments of $600 or more. The 1099-K has different thresholds, typically based on the number of transactions and the total transaction amount.

Is Paper Filing Still an Option for 1099 Forms?

As of 2023, paper filing for 1099 forms is limited. The IRS encourages electronic filing, especially for businesses with more than 10 returns. Paper filing might still be acceptable under certain circumstances, but electronic filing is becoming the standard.

What Is the Electronic Filing Requirement for 1099 Forms?

The electronic filing requirement mandates that anyone filing more than 10 1099 forms must do so electronically. This change aims to streamline the filing process, improve accuracy, and reduce paper waste.

What Are Correct Payee Statements?

Correct payee statements refer to the accurate and complete 1099 forms that businesses must provide to their payees (e.g., contractors, freelancers) and the IRS. These statements must include all necessary information like the amount paid, the type of income, and taxpayer identification details.

What Constitutes the Original Return for a 1099 Form?

The original return is the first, complete submission of a 1099 form to the IRS. If there are errors discovered after the original submission, an amended return may need to be filed.

How Important Is Filing Correct Information Returns?

Filing correct information returns is crucial for compliance with federal income tax laws. Incorrect or incomplete returns can lead to penalties, audits, and other legal implications.

What Is the Backup Withholding Rule?

The backup withholding rule requires the withholding of a certain percentage of income on certain payments reported on 1099 forms. This rule applies when the payee fails to provide a correct taxpayer identification number or under specific IRS notifications.

What Types of Income Are Reported on 1099 Forms?

1099 forms report various types of income, including non-employee compensation, rents, royalties, barter exchange transactions, and certain types of interest and dividends. Different 1099 forms are used depending on the specific type of income.

How Does the Extension of Time Work for Filing 1099 Forms?

An extension of time to file 1099 forms can be requested if more time is needed to gather information or for other valid reasons. This request must be made before the filing deadline and typically grants an additional 30 days.

What Are the Tax Reporting Requirements for Business Entities?

Business entities are required to report various types of payments made in the course of their business, including non-employee compensation, rents, and other payments made in the course of trade or business activities. The specific reporting requirements depend on the type of business entity and the types of transactions they engage in.

How the 1099 Form Simplifies Taxes

Navigating the complexities of 1099 forms for the 2023 tax season requires a clear understanding of various reporting requirements, especially for miscellaneous income, non-employee compensation, and other specific income types like barter exchange transactions and direct sales. Businesses, including third-party settlement organizations and financial institutions, must be diligent in handling these forms to ensure accurate tax reporting and compliance.

Remember, the IRS provides provisions such as the 30-day extension (including the automatic 30-day extension) to help manage filing deadlines effectively. Utilizing these extensions, particularly when there is a need for gathering additional information or managing unforeseen delays, can be crucial for timely and accurate submissions. However, these should be seen as a last resort rather than a standard practice, as timely filing is always preferable.

Furthermore, it's important to keep abreast of the instructions for forms and specific requirements for each form, including keeping copies for record-keeping purposes. For instance, the 1099-MISC form, used to report miscellaneous income, and the 1099-NEC for nonemployee compensation have distinct requirements that must be followed.

Income tax refunds, unemployment compensation, and report distributions are also critical elements that might be impacted by how these forms are filled out and submitted. Accurate and timely reporting ensures that entities are not only compliant with tax laws but also positioned correctly for any income tax refunds due.

In summary, the key to successfully managing the filing of 1099 forms lies in understanding the intricacies of each type of return, adhering to filing thresholds and deadlines, and making timely extension requests if necessary. Whether you're a business entity or an individual taxpayer, staying informed and prepared throughout the tax reporting process is essential. Remember, when in doubt, consulting a tax professional can provide clarity and guidance tailored to your specific situation.

Free Download

Free Download  Free Download

Free Download