The W-4 form is a crucial document that employees must complete when starting a new job or experiencing significant life changes. This form determines the amount of federal income tax withheld from your paycheck. Filling it out accurately is essential to avoid underpayment or overpayment of taxes. Check out how to fill out our W-2 template using our PDF reader.

- Understanding the Basics

- Key Components of the W-4 Form

- Tips for FIlling Out the W-4 Form

- How to Fill Out the W-4 Form on Windows

- How to Fill Out the W-4 Form on Mac

- Seeking Professional Guidance

- FAQs About Filling Out Tax Forms

Understanding the Basics

We're here to help you understand the basics of social security, tax deductions, and tax liability.

1. W-4 Form Overview

The W-4 form, officially titled "Employee's Withholding Certificate," is issued by the Internal Revenue Service (IRS). It captures important details such as your filing status, number of dependents, and additional withholding preferences.

2. Filing Status

Your filing status (Single, Married filing jointly, Married filing separately, Head of household, etc.) plays a significant role in determining the amount of federal income tax withheld.

3. Withholding Allowances

The form includes a section for claiming withholding allowances, which directly impacts the amount of tax withheld. Understanding how many allowances to claim is crucial for accurate withholding.

Key Components of the W-4 Form

Here we cover some of the key components of the form such as itemized deductions.

4. Personal and Dependent Information

Include personal details such as your name, address, and social security number. If you have dependents, you can also claim allowances for them.

5. Income and Withholding

Provide information about your expected income for the year and any additional withholding amounts you want to include.

6. Deductions and Adjustments

The form considers various deductions and adjustments, such as student loan interest or additional income, which can impact your tax liability.

Tips for Filling Out the W-4 Form

Follow our times for extra withholding and other taxable income components.

7. Use the IRS Tax Withholding Estimator

The IRS provides a user-friendly online tool to help you determine the correct number of allowances. This Tax Withholding Estimator considers your specific financial situation.

8. Consider Additional Withholding

If you have multiple jobs, a working spouse, or other income sources, you may need to adjust your withholding to avoid underpayment.

9. Understand the Impact of Life Changes

Life events like marriage, having a child, or buying a home can affect your tax situation. Update your W-4 whenever you experience significant life changes.

How to Fill in Form W-4 on Windows

Fill in and submit this template tax form using PDF Reader Pro on your Windows operating system.

Step 1: Open Your PDF File

Click "Open File" or drag and drop the document into the home screen.

Step 2: Fill in Form Fields

Click to edit the various fields and checkboxes.

Image Source: PDF Reader Pro

Step 3: Sign the Document

Click the quill button to sign the document.

Image Source: PDF Reader Pro

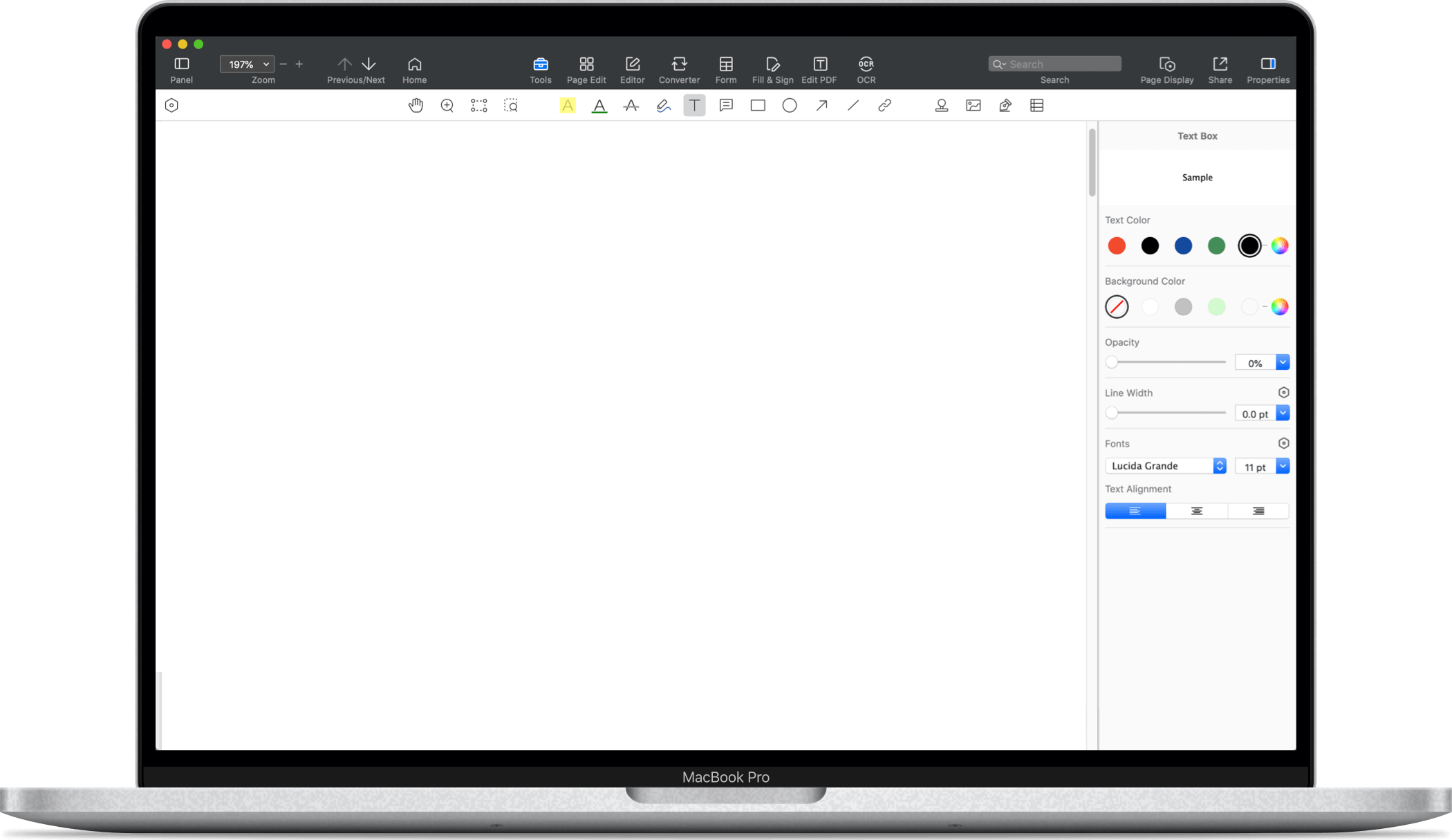

How to Fill in a Form W-4 on Mac

Submit your form to the tax department after editing it with PDF Reader Pro on your Mac operating system.

Step 1: Access Your PDF File

Initiate by selecting "Open File" or effortlessly drag and drop the document onto the home screen.

Step 2: Complete Form Fields

Effortlessly edit the diverse fields and checkboxes by clicking on them.

Image Source: PDF Reader Pro

Step 3: Authenticate the Document

Seal the deal by clicking on the quill button to add your signature to the document.

Image Source: PDF Reader Pro

You can also check our recommendations on How To Fill Out A W9 Form.

Seeking Professional Guidance

When dealing with federal income taxes, it can be useful to involve human resources for guidance.

The Role of a Financial Advisor During Tax Season

Engaging with a financial advisor can provide personalized insights and guidance tailored to your unique financial situation. A financial advisor can help optimize your tax strategy, ensuring you make informed decisions during tax time.

Tax Filing Status, Payments, and Penalties

Understanding your tax filing status, making timely tax payments, and avoiding underpayment penalties are essential aspects covered by a financial advisor. Their expertise can help you navigate tax complexities with confidence.

Internal Revenue Service (IRS) Assistance

For specific inquiries or concerns, reaching out to the IRS can provide clarity on tax-related matters. Familiarizing yourself with IRS guidelines ensures that you stay informed and compliant with federal tax regulations.

FAQs About Filling Out Tax Forms

Have questions about extra income, federal taxes and other sources of income? We'll answer all your questions about the W-4 Tax form below.

What is the significance of W-4 during Tax Season?

The W-4 form is crucial during tax season as it allows individuals to adjust their federal income tax withholding. This ensures that the correct amount of taxes is withheld from paychecks, preventing underpayment or overpayment.

How can I maximize my tax refund during Tax Time?

Maximizing your tax refund involves strategic planning on the W-4 form. Consider updating your filing status, personal exemptions, and leveraging larger refund strategies outlined in the form.

Are there specific considerations for Self-Employment Income?

Yes, individuals with self-employment income must accurately report it on the W-4 form. This ensures proper withholding and compliance with tax obligations.

What role does a Financial Advisor play during Tax Season?

A Financial Advisor can provide personalized guidance on tax strategies, filing status, making timely tax payments, and avoiding underpayment penalties. They offer insights tailored to your unique financial situation.

How does the IRS assist during Tax Season?

The Internal Revenue Service (IRS) is a valuable resource for specific tax-related inquiries. Familiarize yourself with IRS guidelines for staying informed and compliant with federal tax regulations.

What are Personal Exemptions, and how do they impact Income Taxes?

Personal exemptions on the W-4 form relate to your filing status and influence the amount of tax withheld. Understanding and updating these exemptions ensure accurate withholding based on your financial situation.

Can a W-4 Form help with larger refunds?

Yes, by strategically adjusting your W-4 information, you can implement strategies for larger refunds during tax time. Explore the form to optimize your withholding allowances.

What steps can I take to avoid Underpayment Penalties?

To avoid underpayment penalties, it's essential to understand your tax filing status, make timely tax payments, and seek guidance from a financial advisor for comprehensive tax planning.

How does the W-4 Form cater to Retirement Income?

Individuals receiving retirement income can update their W-4 to reflect this income accurately. This ensures that the withholding aligns with their overall financial situation.

Are there resources available for understanding Tax Forms?

Yes, various tax forms impact your financial situation. Familiarize yourself with these forms and seek guidance from a tax professional for a comprehensive understanding of their implications.

Filling out the W-4 form accurately is essential for maintaining financial stability and complying with tax regulations. By understanding the key components and seeking guidance when needed, you can navigate the process confidently. For personalized advice, consider consulting a tax professional to ensure your withholding aligns with your financial goals and obligations.

Free Download

Free Download

Support Chat

Support Chat