Are you a taxpayer who's 65 or older? If so, you may be eligible to use Form 1040-SR, a specialized tax form designed with seniors in mind. Filling out tax forms can seem daunting, but with this step-by-step guide, navigating Form 1040-SR will be a breeze.

What is Form 1040-SR?

Form 1040-SR is a specialized tax form designed for taxpayers aged 65 and older. It is a simplified version of the standard Form 1040, with larger print and straightforward instructions, making it easier for older individuals to navigate the tax-filing process. The "SR" stands for "Senior," reflecting its targeted audience.

You can also check our guide on how to fill out a 941 form.

This form incorporates specific features to accommodate the needs of older taxpayers, such as providing spaces for retirement income, Social Security benefits, and deductions that are commonly utilized by seniors.

How to Fill in Your 1040-SR Form

Easily fill in your form this tax season with the help of our step-by-step guide to completing this filing option.

Step 1: Gather Your Documents

Before you start filling out Form 1040-SR, gather all the necessary documents, including:

- W-2 forms showing your wages and salary income.

- 1099 forms for any additional income, such as interest, dividends, or retirement distributions.

- Social Security statements (Form SSA-1099) if applicable.

- Any other relevant tax documents, such as records of deductible expenses.

Step 2: Personal Information

Begin by entering your personal information in the designated sections of Form 1040-SR. This includes your name, address, Social Security number, and filing status. If you're married and filing jointly, provide your spouse's information as well.

Step 3: Income

Next, report all sources of income for the tax year. This may include:

- Wages, salaries, and tips reported on Form W-2.

- Interest and dividends from investments.

- Social Security benefits.

- Pension and annuity payments.

- Rental income.

- Any other income not listed here.

Step 4: Deductions and Credits

After reporting your income, you can deduct certain expenses and claim tax credits to reduce your taxable income or tax liability. Common deductions and credits include:

- Standard deduction or itemized deductions, such as medical expenses, property taxes, and charitable contributions.

- Additional standard deduction for seniors and the blind.

- Credit for the elderly or disabled.

- Retirement savings contributions credit (Saver's Credit).

- Other tax credits for which you qualify.

Step 5: Tax Calculation

Use the tax tables provided in the Form 1040-SR instructions to calculate your tax liability based on your taxable income and filing status. If you're using tax software or e-filing, this step will be automated.

Step 6: Payment or Refund

Finally, determine whether you owe additional taxes or are eligible for a refund. If you owe taxes, you can pay electronically or by check. If you're owed a refund, you can choose to have it directly deposited into your bank account or receive a paper check in the mail.

Step 7: Review and File

Before submitting your tax return, carefully review all the information you've entered on Form 1040-SR to ensure accuracy. Double-check calculations and verify that you've signed and dated the form where required. Once you're confident everything is correct, you can file your return electronically or by mail.

You can also check our recommendations on filling out a schedule 8812 form.

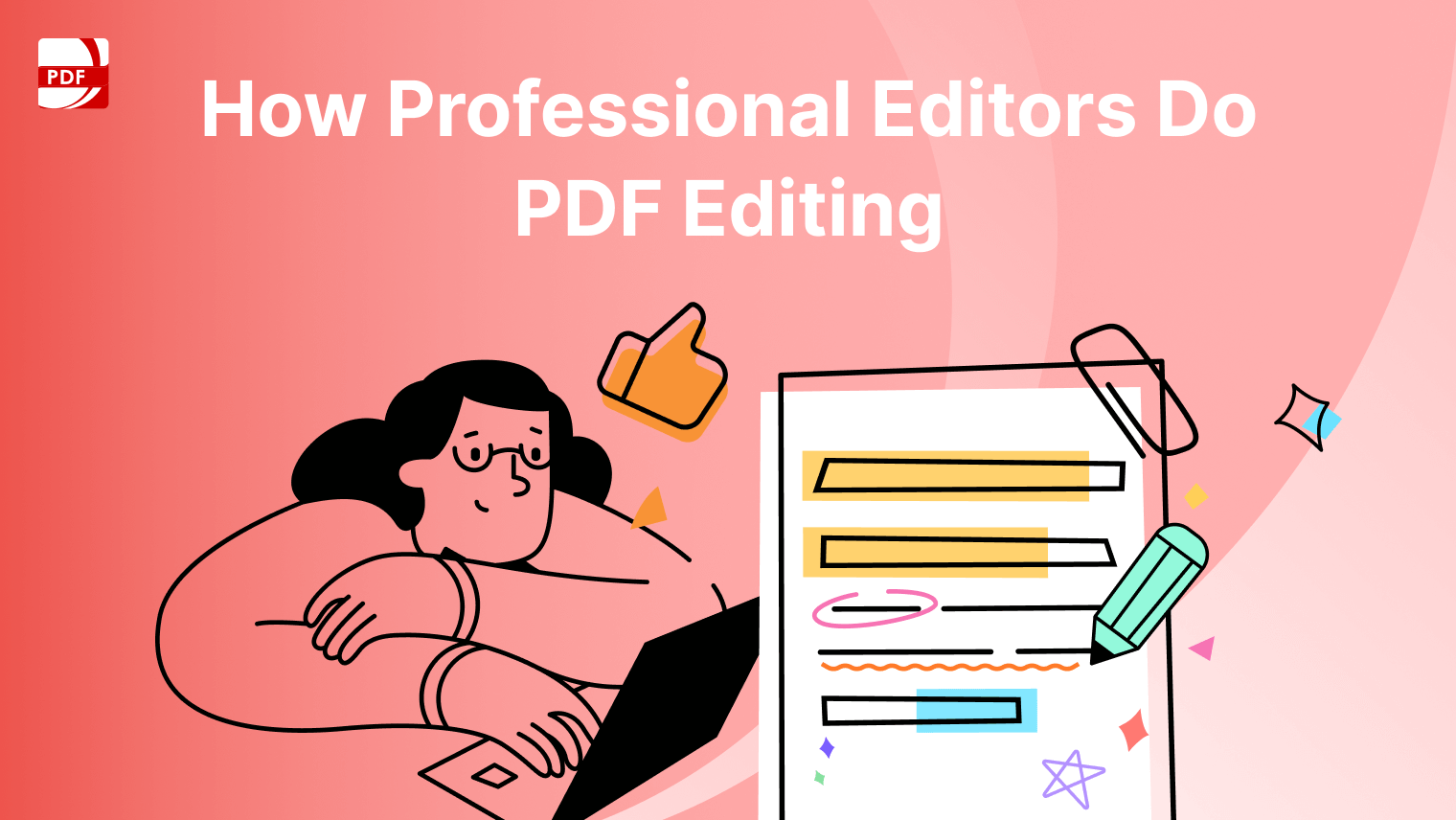

How to Download PDF Reader Pro for Windows

PDF Reader Pro for Windows is a robust and versatile application designed to meet your PDF file viewing, editing, and annotation needs for digital versions. With a user-friendly interface and a range of powerful features, it stands out as a comprehensive solution.

The simplest method to getting PDF Reader Pro is to click the download button below:

How to Download PDF Reader Pro for Mac

PDF Reader Pro for Mac is a powerful and feature-rich application designed to enhance your PDF document management experience for faster filing and more on macOS. Packed with a range of tools, it provides a comprehensive solution for editing, annotating, and organizing templates.

You can also read about filling out a 941 form.

FAQs: Federal Income Tax and Form 1040-SR

Have questions about common tax situations for forms for tax filers? Our FAQs likely have all the answers you need.

1. What is Federal Income Tax?

Federal income tax is a tax imposed by the U.S. federal government on individuals and entities based on their income. It is collected by the Internal Revenue Service (IRS) and is used to fund government activities and services.

2. What is Form 1040-SR?

Form 1040-SR is a specialized tax form designed for taxpayers aged 65 and older. It offers larger print and simpler instructions compared to the standard Form 1040, making it easier for seniors to file their taxes.

3. Who can use Form 1040-SR?

Form 1040-SR is specifically designed for senior taxpayers aged 65 and older. However, any taxpayer can use it if they meet the eligibility criteria.

4. What are the benefits of using Form 1040-SR?

Form 1040-SR offers larger print and straightforward instructions, making it easier for seniors to navigate. It also includes specific lines for retirement income, Social Security benefits, and other deductions commonly used by seniors.

5. How do I file Form 1040-SR?

To file Form 1040-SR, gather all necessary documents, including income statements, deductions, and credits. Fill out the form according to the instructions provided by the IRS, and submit it by the tax filing deadline, usually April 15th.

6. Can I e-file Form 1040-SR?

Yes, you can e-file Form 1040-SR using various tax preparation software or through authorized e-file providers. E-filing is often faster, more convenient, and secure compared to traditional paper filing.

7. What types of income are reported on Form 1040-SR?

Form 1040-SR includes spaces to report various types of income, such as wages, salaries, tips, interest, dividends, retirement income, Social Security benefits, and more.

8. Are there any tax credits available on Form 1040-SR?

Yes, Form 1040-SR allows eligible taxpayers to claim tax credits, such as the Additional Child Tax Credit, Credit for the Elderly or the Disabled, and the Premium Tax Credit, among others.

9. How do I know if I qualify for the standard deduction on Form 1040-SR?

Taxpayers who do not itemize their deductions can claim the standard deduction. The standard deduction amount depends on your filing status, age, and other factors. Consult the IRS guidelines or a tax professional for assistance.

10. Can I have my tax refund directly deposited into my bank account with Form 1040-SR?

Yes, Form 1040-SR allows taxpayers to choose direct deposit for their tax refunds. Simply provide your bank account information on the form, and the IRS will deposit your refund directly into your account.

11. What should I do if I have additional questions about Form 1040-SR or my federal income tax return?

If you have additional questions or need assistance with Form 1040-SR or your federal income tax return, consider consulting a qualified tax professional or contacting the IRS directly for guidance. They can provide personalized assistance based on your specific situation.

By following these step-by-step instructions and organizing your documents beforehand, you'll be well-equipped to tackle your tax return with confidence. If you have any questions or need further assistance, don't hesitate to consult with a tax professional or utilize IRS resources for seniors.

Free Download

Free Download  Free Download

Free Download

Support Chat

Support Chat