In the ever-evolving landscape of tax regulations, employees face the challenge of staying updated with the latest changes.

One significant change came in 2020 when the Internal Revenue Service (IRS) overhauled the W-4 form.

This form, essential for determining your tax withholdings from each paycheck, underwent substantial modifications aimed at enhancing transparency and accuracy in the payroll withholding system.

- Understanding the Revised W-4 Form

- Understanding the 5 Steps of the W-4 Form

- When to Consider Revising Your W-4

- Simplifying the W-4 Form for Different Situations

- Special Considerations When Filing Form W-4

- Understanding the Purpose of Form W-4

- How to Fill Out a W-4 Form PDF in 2023: FAQ

Understanding the Revised W-4 Form

For those transitioning to a new job, it's crucial to understand that the W-4 form has evolved.

However, if you're continuing with the same employer and see no need to update your information, the existing W-4 on file remains valid.

Key Changes in the W-4 Form

The revamped W-4 form, effective from December 2020, now comprises five sections as opposed to the previous seven.

This new structure is not just about aesthetics but also functionality:

-

Elimination of Personal and Dependency Exemptions: The current W-4 does not require employees to indicate personal or dependency exemptions, reflecting changes in tax laws where these exemptions are no longer applicable.

-

Focus on Dependents and Withholding Adjustments: The form now inquires about the number of dependents and allows adjustments in withholding based on various factors, such as additional income sources or eligibility for itemized deductions.

-

Simplified Approach: The previous versions included a Personal Allowances Worksheet to determine the number of allowances. With the new W-4, this concept is phased out, simplifying the process for employees. The change aligns with the Tax Cuts and Jobs Act (TCJA), which doubled the standard deduction and eliminated personal and dependent exemptions.

-

Detailed Income Information: For the first time, the form allows you to indicate additional income sources, such as a second job, or if you anticipate claiming itemized deductions on your tax return.

Understanding these changes is crucial for employees to ensure accurate tax withholding.

This not only impacts your monthly paycheck but also your annual tax calculations and returns.

Familiarize yourself with the new form to make informed decisions about your tax withholdings in 2023.

Understanding the 5 Steps of the W-4 Form

Step 1: Personal Information

In this initial step, you'll provide your essential personal information. This includes your name and filing status, which could be single, married, or head of household.

Step 2: Adjusting for Multiple Incomes

This step is relevant if your financial situation suggests a need for different withholding amounts. Factors like a spouse's earnings, income from a second job, or freelance work are considered here.

Step 3: Declaring Dependents

Here, you'll indicate the number of dependents, such as children, under your care.

Step 4: Optional Adjustments

This optional section is where you can specify additional reasons to adjust your withholding. For instance, passive income from investments or potential itemized deductions can influence the amount of tax you owe.

Step 5: Signature

The final step involves signing the form to validate the information provided.

When to Consider Revising Your W-4

Major Changes Since the TCJA

The W-4 form underwent a significant revision in December 2020, marking its first major update since the implementation of the Tax Cuts and Jobs Act (TCJA) in December 2017.

These changes have influenced employee withholdings, providing a strong reason to review your W-4.

Based on Recent Tax Returns

If your recent tax returns showed that you either owed a substantial amount or received a large refund due to overpayment, it's advisable to reassess your W-4.

Life Events and Changes

Significant life changes, such as the birth of a child, marriage or divorce, or starting a freelance job, are key moments to update your W-4 to reflect your current financial situation.

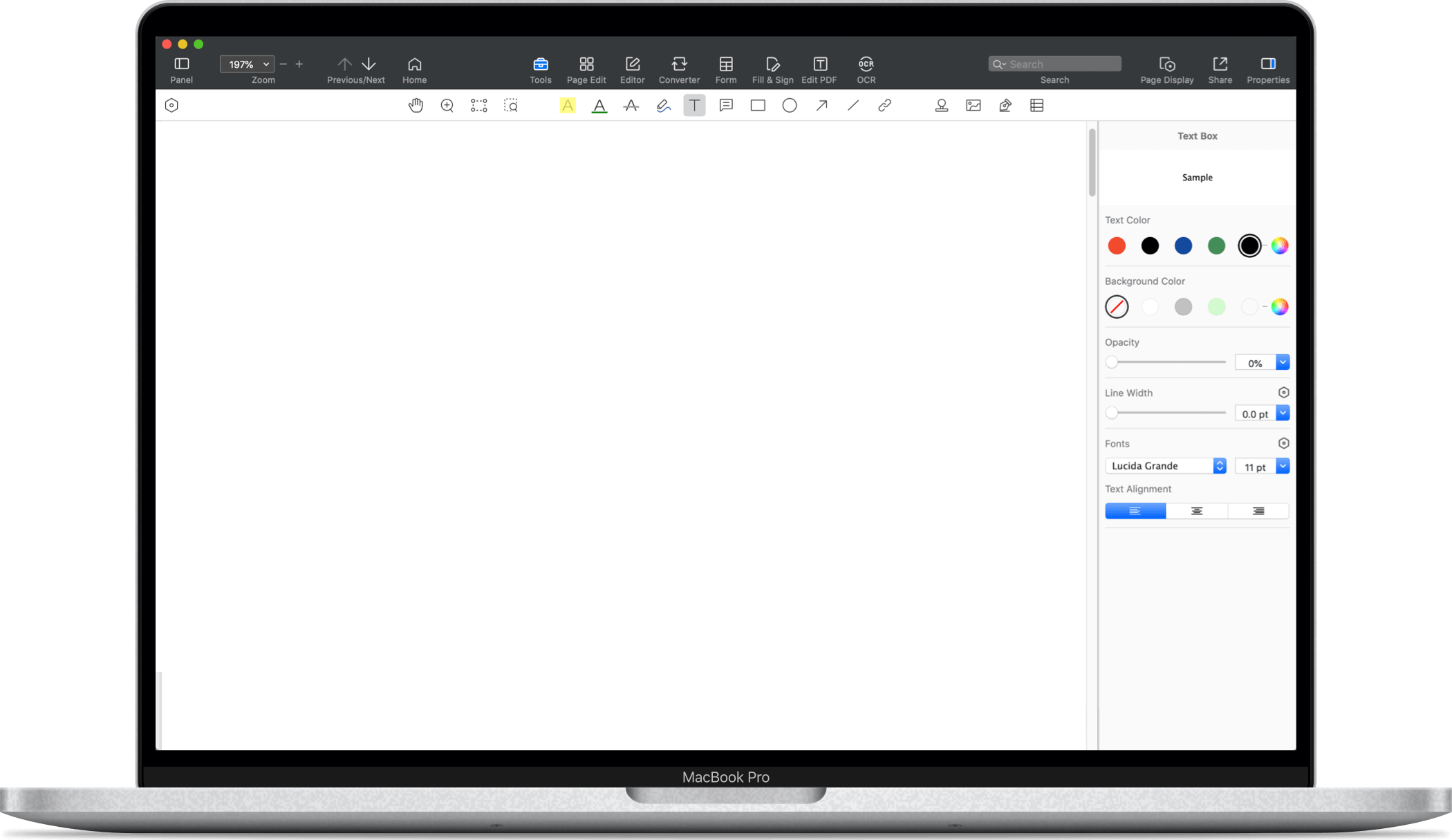

Utilizing PDF Reader Pro's "W-4 Form PDF Template"

For a seamless and error-free process, consider using PDF Reader Pro's "W-4 Form PDF Template."

This template simplifies the process, ensuring you fill out your W-4 accurately and efficiently. It's an invaluable tool, especially for those new to the W-4 form or facing complex tax situations.

Simplifying the W-4 Form for Different Situations

1. Basic Information for Simple Tax Situations (Step 1):

- If you're single or married to a non-working spouse, without dependents, and don’t claim tax credits or deductions (other than the standard deduction), the process is straightforward.

- Just provide your name, address, Social Security number, and filing status. Signing and dating the form completes your part.

2. Additional Information for More Complex Cases:

For those with dependents, a working spouse, or planning to claim tax credits and deductions, more information is required.

Step-by-Step Breakdown

Provide Your Information (Step 1):

- Enter your personal details and Social Security number.

- This information is vital for your employer to correctly apply the withheld taxes to your annual income tax bill.

Indicate Multiple Jobs or a Working Spouse (Step 2):

If you have more than one job, or if you're married filing jointly and your spouse works, proceed to step two. You have three options:

- Option A: Use the IRS’s online Tax Withholding Estimator and include the estimate in step 4.

- Option B: Complete the Multiple Jobs Worksheet on page three of Form W-4, entering the result in step 4(c).

Completing the Multiple Jobs Worksheet:

- Determine if you have two or more jobs. If you and your spouse each have one job, complete line 1. If you have two jobs and your spouse doesn't work, also complete line 1.

- Use the graphs on page four of Form W-4 to find the correct amount to enter. For instance, if one spouse earns $80,000 and the other $50,000, find the intersection of these amounts on the graph and enter this on line 1.

- For three or more jobs, combine the wages from the two highest-paying jobs and use this figure for the "higher paying job" on the graph, while considering the wages from the third job as the "lower paying job." Add lines 2a and 2b together for line 2c.

- Enter the number of pay periods for the highest-paying job on line 3 of the worksheet and divide the annual amount by the number of pay periods. This figure goes on line 4 of the worksheet and line 4c of Form W-4.

Special Considerations When Filing Form W-4

Mid-Year Employment and the Part-Year Method

If you commence a job mid-year without prior employment in the same year, consider a tax-saving approach: the part-year method. Specifically for those working less than 245 days in a year, this method adjusts withholding to better reflect your actual tax liability, preventing excessive withholding.

The Issue with Standard Withholding

The standard withholding formula is based on full-year employment. Without the part-year adjustment, you might find more taxes withheld than necessary, leading to a delayed tax refund.

Understanding the Purpose of Form W-4

Role of Form W-4 in Tax Withholding

Form W-4 is essential for employers to determine the correct amount to withhold from each paycheck for tax payments. It directly influences your annual tax filings and the calculation of any dues or refunds.

Who Needs to Fill Out a W-4 Form? Mandatory for All Employees

Every employee is required to complete a W-4, typically on the first workday. Neglecting to fill it out correctly can lead to incorrect tax withholdings.

Frequency of Filing a W-4 Form - Not an Annual Requirement

Filing a new W-4 isn't an annual obligation. It's generally needed only if you change jobs or experience significant life or financial changes affecting your tax situation.

Meeting IRS Requirements

Filling out a W-4 is mandated because the IRS requires taxes to be paid progressively throughout the year. This approach aligns with how most people earn their income.

Consequences of Incorrect Withholding

- Underwithholding Risks: Having too little tax withheld can result in owing a substantial amount, including potential interest and penalties.

- Overwithholding Drawbacks: Conversely, overwithholding tightens your monthly budget unnecessarily and effectively gives an interest-free loan to the government. Overpaid taxes are only returned after filing your annual tax return.

How to Fill Out a W-4 Form PDF in 2023: FAQ

What is the Purpose of the W-4 Form in Relation to Federal Income Tax?

The W-4 form is used to determine the amount of federal income tax to be withheld from your paycheck. It's a key document for ensuring that you're not over or underpaying your taxes throughout the year.

How Should Married Couples Approach the "Married Filing" Status on the W-4?

If you're married, you can choose the "married filing jointly" or "married filing separately" status on your W-4. This decision should be based on your combined financial situation, as it will affect the amount of tax withheld.

Can I Adjust My W-4 Based on My Financial Situation?

Yes, the W-4 form allows you to tailor your withholdings based on your financial situation. This includes multiple jobs, spousal income, dependents, and additional income sources.

How Do I Account for Additional Deductions on My W-4?

You can indicate additional deductions on your W-4 in Step 4. This is useful if you anticipate itemizing deductions on your tax return, which can lower your taxable income and affect your withholding amount.

What is the Benefit of Using a Form PDF Template for Filling Out a W-4?

Using a form PDF template, such as the one provided by PDF Reader Pro, simplifies the process of filling out your W-4. These templates are usually fillable and guide you through each step, reducing the chances of errors.

Are Electronic Forms and Fillable W-4 Form PDFs Valid for Tax Purposes?

Yes, electronic forms and fillable W-4 form PDFs are valid. They offer a convenient way to complete your tax forms accurately and efficiently. Ensure you use a reliable source like PDF Reader Pro for such forms.

What Should I Know About Blank, Fillable W-4 Forms?

Blank, fillable W-4 forms allow you to enter your information directly on the document using a digital device. This approach is often more accurate and faster than filling out a paper form.

How Do I Fill Out a W-4 Form as a Current W-4 Employee?

As a current W-4 employee, review your existing W-4 form annually or after any significant life or financial changes. Update any information that has changed to ensure accurate withholding.

What is the Importance of Employee Withholding in the W-4 Form?

Employee withholding is crucial as it determines how much federal income tax is deducted from your paycheck. Accurate withholding ensures that you're not overpaying or underpaying your taxes throughout the year.

Support Chat

Support Chat