Form 1098

What Is Form 1098?

Form 1098, Mortgage Interest Statement, is an Internal Revenue Service (IRS) form that’s used to report the amount of interest and related expenses paid on a mortgage during the tax year by an individual or a sole proprietor when the amount totals $600 or more. “Related expenses” include points paid on the purchase of the property. Points refer to interest paid in advance or simply prepaid interest made on a home loan to improve the rate on the mortgage offered by the lending institution. Interest payments made by a trust, estate, corporation, or partnership do not need to be filed. In other words, if you paid $600 or more for the previous year in interest and points on a mortgage, your lender is required to send this form to you. If you paid less than $600, you wouldn’t receive a Form 1098. These expenses can be used as deductions on a U.S. income tax form, Schedule A, which reduces taxable income and the overall amount owed to the IRS. Form 1098 is issued and mailed by the lender—or other entity receiving the interest—to you, the borrower.

Who Needs Form 1098?

The mortgage lender is required by the IRS to provide Form 1098 to you if your property is considered real property, which is land and anything that is built on, grown on, or attached to the land. The home for which the mortgage interest payments are made must be qualified by IRS standards, which define a home as a space that has basic living amenities: cooking and bathroom facilities and a sleeping area. Examples include a house, condominium, mobile home, boat, cooperative, and house trailer. Also, the mortgage itself must be qualified. According to the IRS, qualified mortgages include first and second mortgages, home equity loans, and refinanced mortgages. Whether you need Form 1098 depends largely on whether you plan to claim a deduction for mortgage interest paid on your taxes. There are a few rules to know about deducting mortgage interest. 1.You must be the primary borrower and be making payments on the loan. 2.You’re limited to deducting interest on total mortgage debt of $750,000 or less, if the debt originated on or after Dec. 16, 2017. (The limit for older mortgage debt is $1 million.) 3.You must itemize your deductions on Schedule A to claim the deduction. If all of these apply to you, then you would need Form 1098 to deduct the mortgage interest you paid for your home loan for the current tax year. If you have more than one qualified mortgage, then you will receive a separate Form 1098 for each one.

What Is Form 1098 Used For?

Form 1098 serves two purposes. First, it requires lenders to report interest payments in excess of $600 they received for the year. The IRS uses this information to ensure proper financial reporting for lenders and other entities that receive interest payments of $600 or more. Second, this statement is used by homeowners to determine how much interest they paid for the year when figuring their mortgage interest deduction. That’s important for ensuring accuracy in filing your tax return and getting the full tax break you’re allowed when deducting interest paid on your home loan.

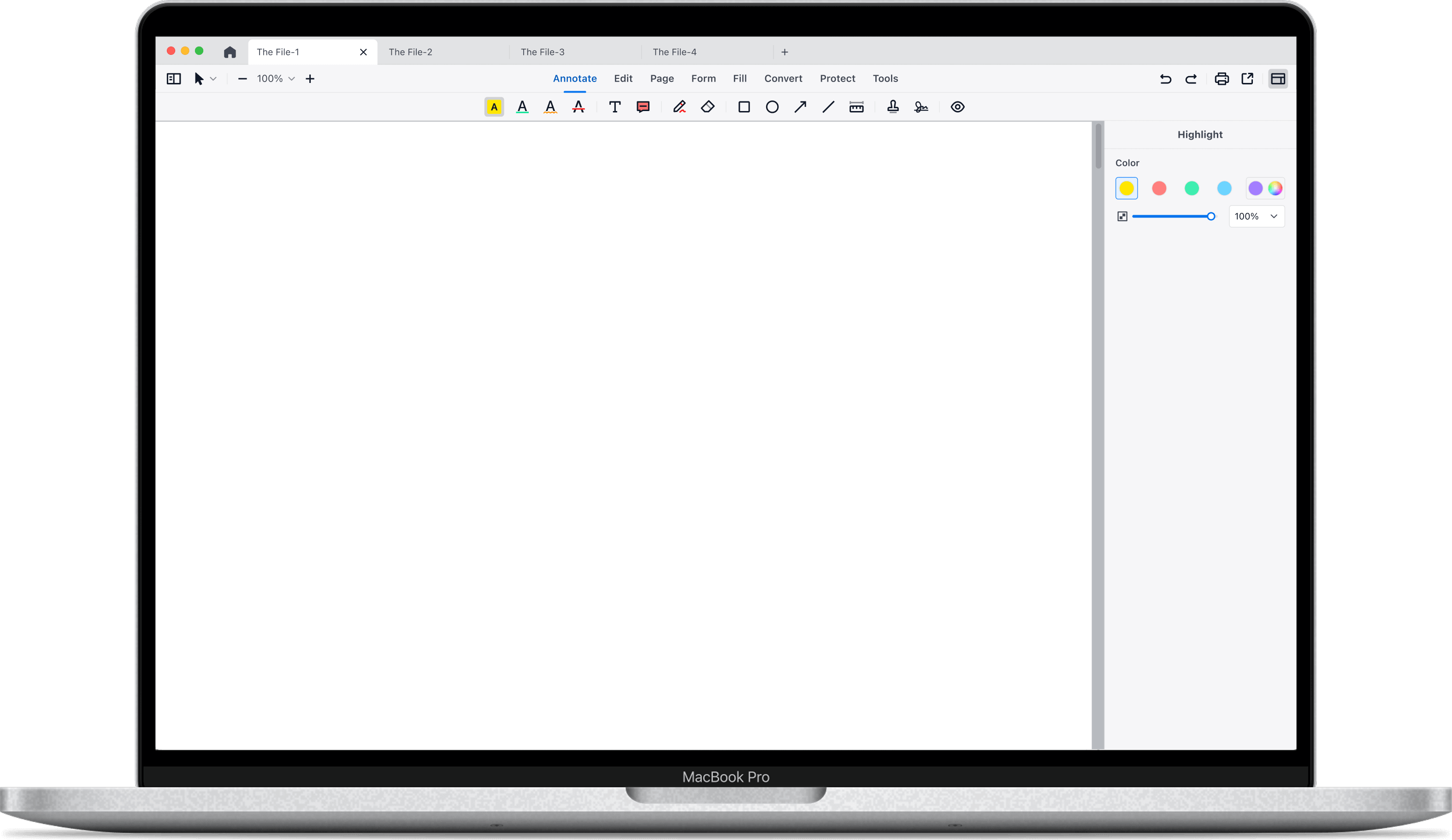

* The free templates above are provided for reference only, for all legal matters, you should always talk to a professional. After downloading the free template, if you need to fill in it or modify the content on your Mac, you may need a powerful PDF editor for Mac. Using PDF Reader Pro, you can add your own details and edit the PDF more conveniently. Download the form and fill it out using PDF Reader Pro. Click the button "Free Download" to download the app.

Support Chat

Support Chat