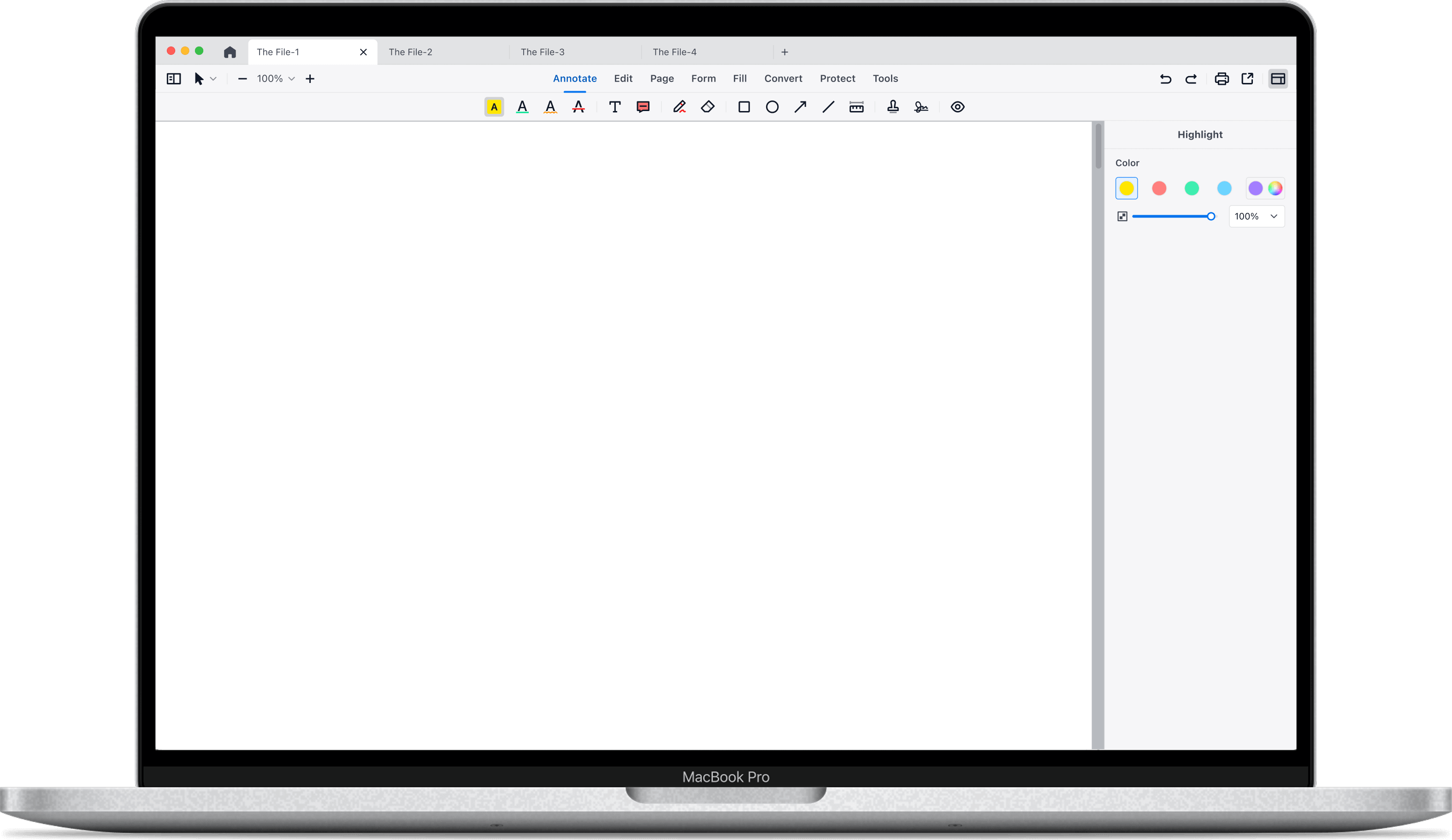

Schedule K-1 Form 1065-B PDF Template

What is a Schedule K-1 Form 1065-B?

A Schedule K-1 (Form 1065-B) is a tax document used to report a partner’s share of income, deductions, credits, and other financial items from an electing large partnership. This form is issued by the partnership to its partners and is crucial for them to accurately report their share of the partnership’s income on their personal tax returns. Electing large partnerships use this form to provide detailed information on each partner’s share of the partnership’s financial activity, ensuring proper tax reporting and compliance.

How to Fill in Our Schedule K-1 Form 1065-B PDF Template

Follow these steps to fill in the Schedule K-1 Form 1065-B template:

Partnership Information

Partnership’s Name and Address: Fill in the partnership’s name, street address, city, state, and ZIP code.

Employer Identification Number: Enter the partnership’s Employer Identification Number (EIN).

Partner Information

Partner’s Identifying Number: Enter the partner’s identifying number (such as SSN or TIN).

Partner’s Name and Address: Provide the partner’s name, street address, city, state, and ZIP code.

Partner’s Share of Liabilities

Nonrecourse Liabilities: Enter the partner’s share of nonrecourse liabilities.

Qualified Nonrecourse Financing: Enter the partner’s share of qualified nonrecourse financing.

Other Liabilities: Enter the partner’s share of other liabilities.

Partner’s Share of Income (Loss) and Other Items

Line 1: Report taxable income (loss) from passive activities.

Line 2: Report taxable income (loss) from other activities.

Line 3: Report qualified dividends.

Line 4a: Report net capital gain (loss) from passive activities.

Line 4b: Report net capital gain (loss) from other activities.

Line 5: Report net passive AMT adjustment.

Line 6: Report net other AMT adjustment.

Line 7: Report general credits.

Line 8: Report low-income housing credit.

Line 9: Report other items.

Support Chat

Support Chat